Cheap Iowa Auto Insurance for 2026

The average rates for Iowa auto insurance full coverage policies are $67/mo, while Iowa auto insurance minimum requirements are 20/40/15 for bodily injury and property damage. Some coverage options you can choose include comprehensive coverage, collision coverage, and medical payments coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Known as the American Heartland and the home of the Hawkeyes, Iowa is one of the jewels of the Corn Belt and an excellent state for living, working, and enjoying life. Iowa auto insurance allows you to also enjoy peace of mind knowing you’re financially protected from the cost of a car accident.

Understanding auto insurance in Iowa will help you to get the right coverage at the right price. We’ve covered all the information you need to buy Iowa auto insurance with confidence.

To find affordable Iowa auto insurance right now, enter your ZIP code below for fast, free Iowa auto insurance quotes.

Iowa Auto Insurance Laws And Requirements

Iowa’s auto insurance law requires that you carry a certain amount of coverage to make sure you are financially responsible in the event of an accident.

In Iowa, the state liability coverage minimums are:

- Bodily Injury Liability Coverage – $20,000 per person

- Bodily Injury Liability Coverage – $40,000 per accident

- Property Damage Liability Coverage – $15,000 per accident

Take a look at how Iowa’s minimum rates compare with surrounding states.

You can also choose to buy other types of coverage to protect yourself. Optional coverage options in Iowa include:

- Comprehensive Coverage

- Collision Coverage

- Medical Payments Coverage

- Rental Car Reimbursement Coverage

- Roadside Assistance / Towing Coverage

- Uninsured/Underinsured Motorist Bodily Injury

- Loan/Lease Gap Covergae

Iowa follows the tort system for its auto insurance laws, like many other states across the nation. This means that when an accident occurs, the driver who caused the accident will be declared the ‘at fault’ party, and will be subject to insurance claims and lawsuits.

State law requires that drivers protect themselves financially by purchasing a minimum of two different types of Iowa auto insurance: bodily injury liability and property damage liability.

- Iowa Auto Insurance

- Get Affordable Tripoli, IA Auto Insurance Quotes (2026)

- Get Affordable Perry, IA Auto Insurance Quotes (2026)

- Get Affordable Otho, IA Auto Insurance Quotes (2026)

- Get Affordable Ollie, IA Auto Insurance Quotes (2026)

- Get Affordable Hawkeye, IA Auto Insurance Quotes (2026)

- Get Affordable Granville, IA Auto Insurance Quotes (2026)

- Get Affordable Belle Plaine, IA Auto Insurance Quotes (2026)

- Get Affordable Amana, IA Auto Insurance Quotes (2026)

Bodily injury liability insurance covers the costs associated with injuries stemming from a crash that you caused. This insurance doesn’t cover the driver that owns the policy; it is intended to pay out claims to other drivers if you were the one who is at fault for the accident.

For example, if Driver A causes an accident in which Driver B sustains injuries, Driver A’s BIL insurance will kick in to cover some of the medical treatment, rehabilitation, lost wages, pain and suffering, and other costs incurred by Driver B.

The minimum amount of Bodily Injury Liability coverage required by law is $20,000 for a single party, per accident and $40,000 for all parties in a single accident. With today’s high costs for hospitalization and medical treatment, drivers would do well to purchase much higher coverage than this if they can afford it.

The other type of mandatory Iowa auto insurance is known as property damage liability. This insurance covers costs stemming from damages to another automobile, or someone’s property in an accident that you cause. Using the example from above, Driver A’s PDL insurance would pay out a claim to cover the damages to Driver B’s car, including any bodywork or repairs that are needed. Drivers in Iowa must have a minimum of $15,000 in Property Damage Liability coverage.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Iowa Auto Insurance Rates

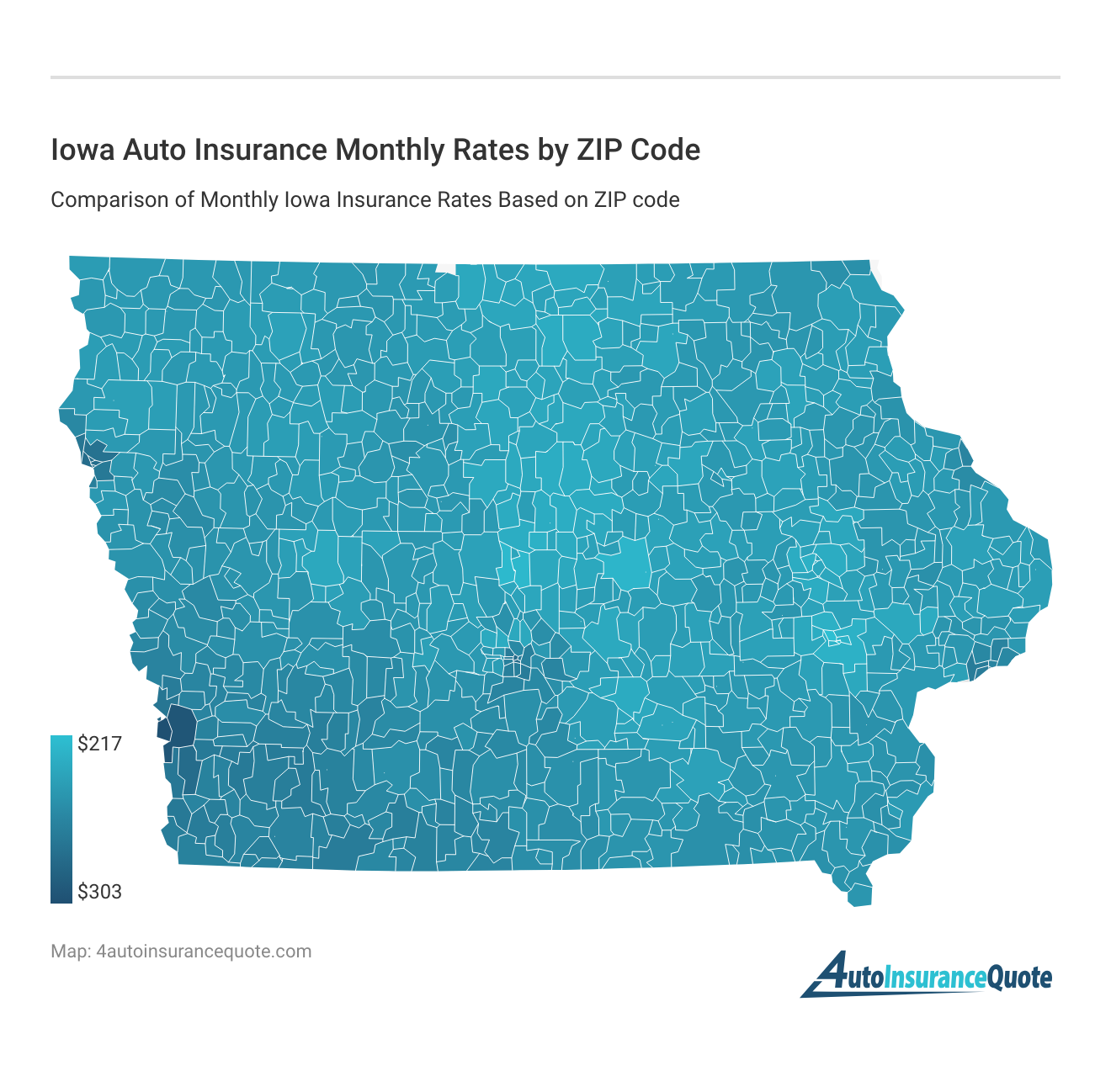

Iowa has very low auto insurance rates compared to other states. On average, a driver in the state pays less than $800 per year for auto insurance, which translates to about $67 per month. When compared to the national average of $1440 per year for auto insurance, there’s no doubt that drivers in Iowa are getting a very good deal on their insurance rates.

As is the case with the rest of the country, those that live in Iowa’s larger cities end up paying a bit more for their auto insurance. Drivers in Cedar Rapids are looking at about $1,000 per year for insurance and those in Des Moines are closer to around $1,200 per year. Let’s see how ZIP code affects your auto insurance rates.

There are a lot of factors that auto insurance companies take into consideration when determining your rates. Take a look at our overview here.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

Iowa Auto Insurance Rates by Company

Though the state boasts very cheap auto insurance rates overall, let’s take a look at how rates vary between some of the largest companies.

But which companies are the largest, holding the most market share percentage in the region?

Driving Statistics In Iowa

In regards to crash statistics, the news is good for Iowa’s driving population. In 2009 (the most recent year in which official numbers are available), the state saw a total of 56,518 vehicle crashes, with 337 of those resulting in a fatality and 14,520 resulting in some form of physical injury.

These numbers are down over the past couple of years, and the 2nd lowest annual total from any year in the last decade. 2008’s totals saw 369 fatalities, more than 16,000 injuries, and 61,500 crashes; the downward trend proves that Iowa’s focus on driver safety, as well as increased law enforcement presence on highways and freeways, is having a positive effect on the number of vehicle crashes that occur.

Things are also going very well for Iowans when it comes to vehicle thefts throughout the state. In 2009, just 3,888 vehicles were stolen, down from 4,376 the year prior and well down from the decade’s peak of 5,823 in 2002. As high numbers of stolen automobiles can have a negative impact on auto insurance rates, this downward trend bodes well for the future. As long as drivers continue to lock up their vehicles and take care to prevent thefts from occurring, Iowa auto insurance rates will continue to remain low.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Auto Insurance Agents In Iowa

Below you will find list of auto insurance agents in Iowa for reference.

Iowa Auto Insurance Agents

- Cheap Iowa Auto Insurance for 2026

- Get Affordable Amana, IA Auto Insurance Quotes (2026)

- Get Affordable Belle Plaine, IA Auto Insurance Quotes (2026)

- Get Affordable Granville, IA Auto Insurance Quotes (2026)

- Get Affordable Hawkeye, IA Auto Insurance Quotes (2026)

- Get Affordable Ollie, IA Auto Insurance Quotes (2026)

- Get Affordable Otho, IA Auto Insurance Quotes (2026)

- Get Affordable Perry, IA Auto Insurance Quotes (2026)

- Get Affordable Tripoli, IA Auto Insurance Quotes (2026)

Additional Iowa Auto Insurance Information

If you need more information, the official resources below can help with insurance and driving-related needs.

- Motor Vehicle Division – Iowa DOT

- IID | Iowa Insurance Division

- Iowa Highway Safety Laws – From the GHSA

Ready to compare Iowa auto insurance rates right now? Enter your ZIP code below for free quotes from top companies.

Frequently Asked Questions

What are the average rates for Iowa auto insurance?

Average rates for Iowa auto insurance are $67/month.

What are the minimum requirements for Iowa auto insurance?

Iowa requires 20/40/15 coverage for bodily injury and property damage.

How can I find cheap Iowa auto insurance rates?

Compare multiple companies for the cheapest rates.

What types of optional coverage can I choose for Iowa auto insurance?

Options include comprehensive, collision, uninsured/underinsured motorist, and medical payments.

How does Iowa’s auto insurance law work?

Iowa follows the tort system, where the at-fault driver is responsible for claims and lawsuits. Minimum required coverage includes bodily injury and property damage liability.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.