Cheap Mississippi Auto Insurance for 2025

Mississippi auto insurance rates average $92.92/mo. Mississippi auto insurance requirements are 25/50/25 for bodily injury and property damage coverage. Drivers looking for the best rate should get Mississippi auto insurance quotes from the best auto insurance companies in Mississippi.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Mississippi auto insurance costs an average of $92/mo

- Mississippi drivers with clean driving records often have cheaper rates

- The best Mississippi auto insurance rates will be found by shopping around

If you drive in Mississippi, you’ll need Mississippi auto insurance. Understanding auto insurance in Mississippi can be complicated, but we can help. Below we’ll explore cheap Mississippi auto insurance rates and everything you need to know to buy the best Mississippi auto insurance with confidence.

To compare Mississippi auto insurance rates right now, enter your ZIP code above.

Mississippi Auto Insurance Requirements

In Mississippi, the state liability coverage minimums are:

- Bodily Injury Liability Coverage – $25,000 per person

- Bodily Injury Liability Coverage – $50,000 per accident

- Property Damage Liability Coverage – $25,000 per accident

Take a look at how Mississippi’s minimum auto insurance rates compare with surrounding states.

You can also purchase optional coverage in Mississippi, such as:

- Comprehensive Coverage

- Collision Coverage

- Medical Payments Coverage

- Rental Car Reimbursement Coverage

- Roadside Assistance / Towing Coverage

- Uninsured/Underinsured Motorist Coverage

- Loan/Lease Gap Coverage

Lawmakers in the State of Mississippi designed the state’s auto insurance laws to be similar to those of most states around the country; this particular system is known as the tort system. Under the tort system, when a crash or accident occurs one of the drivers will be determined to be the party at fault, meaning they caused the crash. This person and their insurance will then be responsible for paying claims, injury costs, and the like.

To ensure that drivers have the financial means to pay these accident-related costs, the state requires that every driver purchase automobile insurance. Mississippi law stipulates that drivers must have minimum coverage for bodily injury liability and property damage liability.

- Mississippi Auto Insurance

- Get Affordable Sunflower, MS Auto Insurance Quotes (2025)

- Get Affordable Pascagoula, MS Auto Insurance Quotes (2025)

- Get Affordable Morton, MS Auto Insurance Quotes (2025)

- Get Affordable Indianola, MS Auto Insurance Quotes (2025)

- Get Affordable Brooksville, MS Auto Insurance Quotes (2025)

- Get Affordable Booneville, MS Auto Insurance Quotes (2025)

Bodily Injury Liability insurance is a type of coverage designed to pay out for injury and medical treatment costs for others that are injured in a crash or accident where you are the at-fault driver.

For example, Driver 1 causes an accident in which Driver 2 sustains injuries that cost $10,000 to treat. Driver 1’s Bodily Injury Liability policy will cover that $10,000 in claims for Driver 2’s medical treatment. It’s important to note that Bodily Injury Liability insurance doesn’t cover the policyholder or any of their passengers; it’s strictly to cover injuries that others sustain.

State law requires that drivers have no less than $25,000 in coverage for a single party, per accident and $50,000 in coverage for all parties in a single accident.

The other type of mandatory auto insurance in Mississippi is known as property damage liability. This coverage pays out to cover any damage that you cause to another person’s property (including their vehicle) when you are at fault for causing an accident.

Again, if Driver 1 causes an accident in which Driver 2 has $3,000 of body damage done to his car, Driver 1’s Property Damage Liability insurance will pay out to cover Driver 2’s repair costs. Drivers are required to have no less than $25,000 in Property Damage Liability insurance coverage.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Mississippi Automobile Insurance Rates

On average, drivers in Mississippi pay a bit less than those across the rest of the country for their Mississippi auto insurance coverage. When looking at statewide data, as of July 2011 it costs about $1,115 per year to insure a car in Mississippi, which is a significant discount from the national median rate of $1,440.

Drivers who live in the more densely populated areas in Mississippi will, of course, end up paying a bit more for auto insurance, thanks to the much higher risk of an accident or stolen vehicle. Those who live in Jackson, MI pay an average of $1,344 for a year’s worth of auto insurance; drivers who live in Gulfport are looking at annual insurance costs of around $1,525.

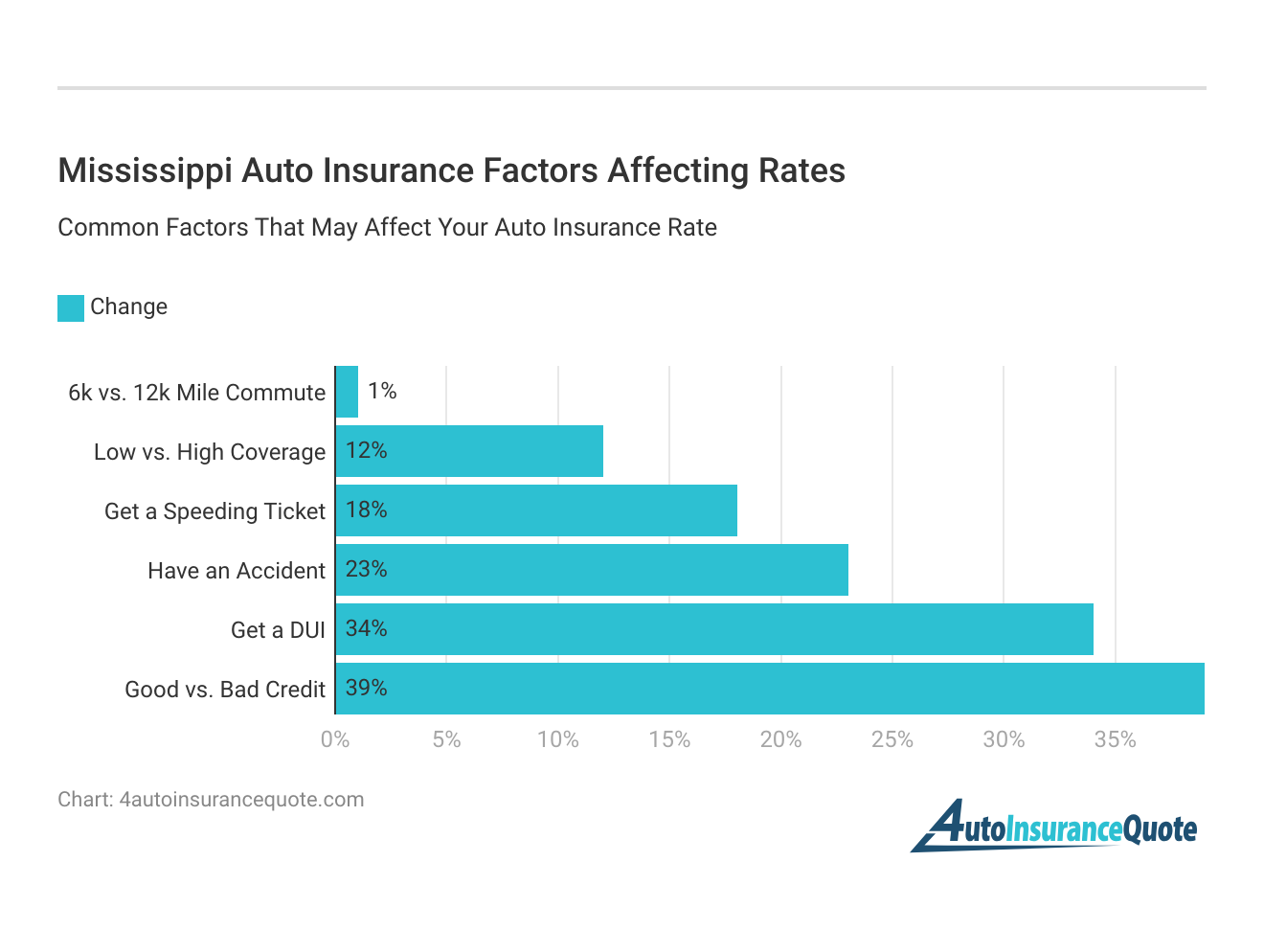

There are a lot of factors that auto insurance companies take into consideration when determining your rates. Take a look at our overview here.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, teenage males typically pay higher auto insurance rates than females. However, as teens approach their 20’s, females end up paying more on average.

Mississippi Auto Insurance Rates by Company

Though the state boasts very cheap auto insurance rates overall, let’s take a look at how rates vary between some of the largest companies.

But which companies are the largest, holding the most market share percentage in the region?

Mississippi Driving Statistics

According to crash statistics supplied by the Mississippi Department of Public Safety, drivers in the state have started to take the risk of an accident far more seriously over the past couple of years. While 2010 saw 69,812 total crashes reported across the state, with 28,476 resulting in injuries and 569 resulting in fatalities, these numbers are down considerably when compared to just a few years before.

In 2007, more than 78,000 crashes were reported, with 33,140 injuries and a total of 830 fatalities! In just three years, drivers, lawmakers, and law enforcement officials throughout the state have made a significant dent in crash rates, and should the trend continue downwards it’s likely that Mississippi insurance costs will decrease as well.

The news is just as good when it comes to reports of vehicle theft in the state. In 2009, there were 5,401 instances of grand theft auto reported in Mississippi; this total is down almost 20% from 2008’s 6,353 stolen vehicles and down nearly 40% from 2006.

The 2009 numbers gave Mississippi an auto crime index rate of 183.0 vehicle thefts per 100,000 citizens, which isn’t terrible but still has room to continue downward. With more and more drivers using Lojack, anti-theft, and other systems to reduce vehicle theft and keep insurance premiums low, and police making use of bait car technology to nab thieves, it’s likely this trend will continue.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Mississippi Auto Insurance Agents

Below you will find a list of Mississippi auto insurance agents.

Mississippi Auto Insurance Agents

- Get Affordable Booneville, MS Auto Insurance Quotes (2025)

- Get Affordable Brooksville, MS Auto Insurance Quotes (2025)

- Get Affordable Indianola, MS Auto Insurance Quotes (2025)

- Get Affordable Morton, MS Auto Insurance Quotes (2025)

- Get Affordable Pascagoula, MS Auto Insurance Quotes (2025)

- Get Affordable Sunflower, MS Auto Insurance Quotes (2025)

Additional Auto Insurance Resources In Mississippi

If you are looking for official sources to answer your questions about driving and insurance laws in Mississippi, take a look at the links below.

- The Mississippi Department of Public Safety

- Mississippi Insurance Department

- MS insurance department auto insurance guide

- Mississippi Highway Safety Laws

Ready to find affordable Mississippi auto insurance rates? Enter your ZIP code now for free Mississippi auto insurance rates from top companies.

Frequently Asked Questions

What are the minimum auto insurance requirements in Mississippi to drive legally?

In Mississippi, the state requires drivers to have minimum coverage for bodily injury liability and property damage liability. The minimum coverage limits are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident.

What optional coverage can I purchase in Mississippi?

In addition to the mandatory liability coverage, you can also purchase optional coverage in Mississippi, such as comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, and medical payments coverage.

What are the average auto insurance rates in Mississippi?

As of July 2021, the average auto insurance rate in Mississippi is $92.92 per month or approximately $1,115 per year. Rates can vary depending on factors such as your location, driving record, and the insurance company you choose.

How can I find the best auto insurance rates in Mississippi?

To find the best auto insurance rates in Mississippi, it’s important to shop around and compare quotes from multiple insurance companies. You can use online comparison tools or contact insurance agents to gather quotes and compare coverage options.

What factors can affect my auto insurance rates in Mississippi?

Several factors can impact your auto insurance rates in Mississippi, including your driving record, age, gender, location, the type of vehicle you drive, and your credit history. Insurance companies also consider factors such as mileage, previous claims, and coverage limits when determining rates.

Is Mississippi a no-fault state?

No, Mississippi is not a no-fault state. All drivers must carry the required Mississippi auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.