Cheap Maryland Auto Insurance for 2026

Drivers can find cheap Maryland auto insurance rates at $158/mo. There are many factors that affect your auto insurance rate, including age and gender. To find the best Maryland auto insurance company and coverage for you, shop around from multiple companies and compare rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Before taking the plunge and buying Maryland auto insurance, there are a few things you should know about the state and its insurance requirements.

A lot of the area in Maryland consists of roads and highways. Maryland has Interstate highways that stretch for well past 100 miles and spread across the state. With so many drivers on the road and so much road space, understanding auto insurance is very important for any Maryland driver to ensure you have the right coverage on those roads.

Before you learn more, see how easy it is to find affordable Maryland auto insurance. Enter your ZIP code above for fast, free Maryland auto insurance quotes.

Maryland Insurance Laws and Requirements

In Maryland, the state liability coverage minimums are:

- Bodily Injury Coverage – $30,000 per person

- Bodily Injury Coverage – $60,000 per accident

- Property Damage Liability Coverage – $15,000 per accident

Take a look at how Maryland’s minimum rates compare with surrounding states.

Uninsured motorist coverage is also required in Maryland, with the following minimums:

- Bodily Injury Coverage – $30,000 per person

- Bodily Injury Coverage – $60,000 per accident

- Property Damage Coverage – $15,000 per accident

Finally, you will need to carry personal injury protection (PIP) at the following minimums:

- $2,500 coverage minimum per person

There are a lot of optional coverage choices in Maryland as well, including:

- Maryland Auto Insurance

- Comprehensive Coverage

- Collision Coverage

- Rental Car Reimbursement Coverage

- Towing and Labor (Roadside Assistance Coverage)

Along with its high insurance rates, Maryland also has some of the highest coverage requirements. The state requires that you have a minimum of $30,000 per person and $60,000 per accident in coverage for bodily injury. This pays for injuries to people in the other car, or pedestrians and cyclists as well, when you are at fault in an accident.

This is only the minimum, however, so you shouldn’t necessarily get only $30,000 worth of insurance per person. Remember that in a serious accident, the cost of medical care can be incredibly high.

The state also requires all drivers with insurance to have a minimum of $15,000 in coverage for property damage liability. This would cover damages to the other person’s car or other property damaged when you are at fault in an accident.

Of course, like with all other things, you should never get just the minimum amount of required coverage. For example, if you damage a sports car or another high-value car, you could find yourself out of pocket in a hurry.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Maryland Auto Insurance Rates

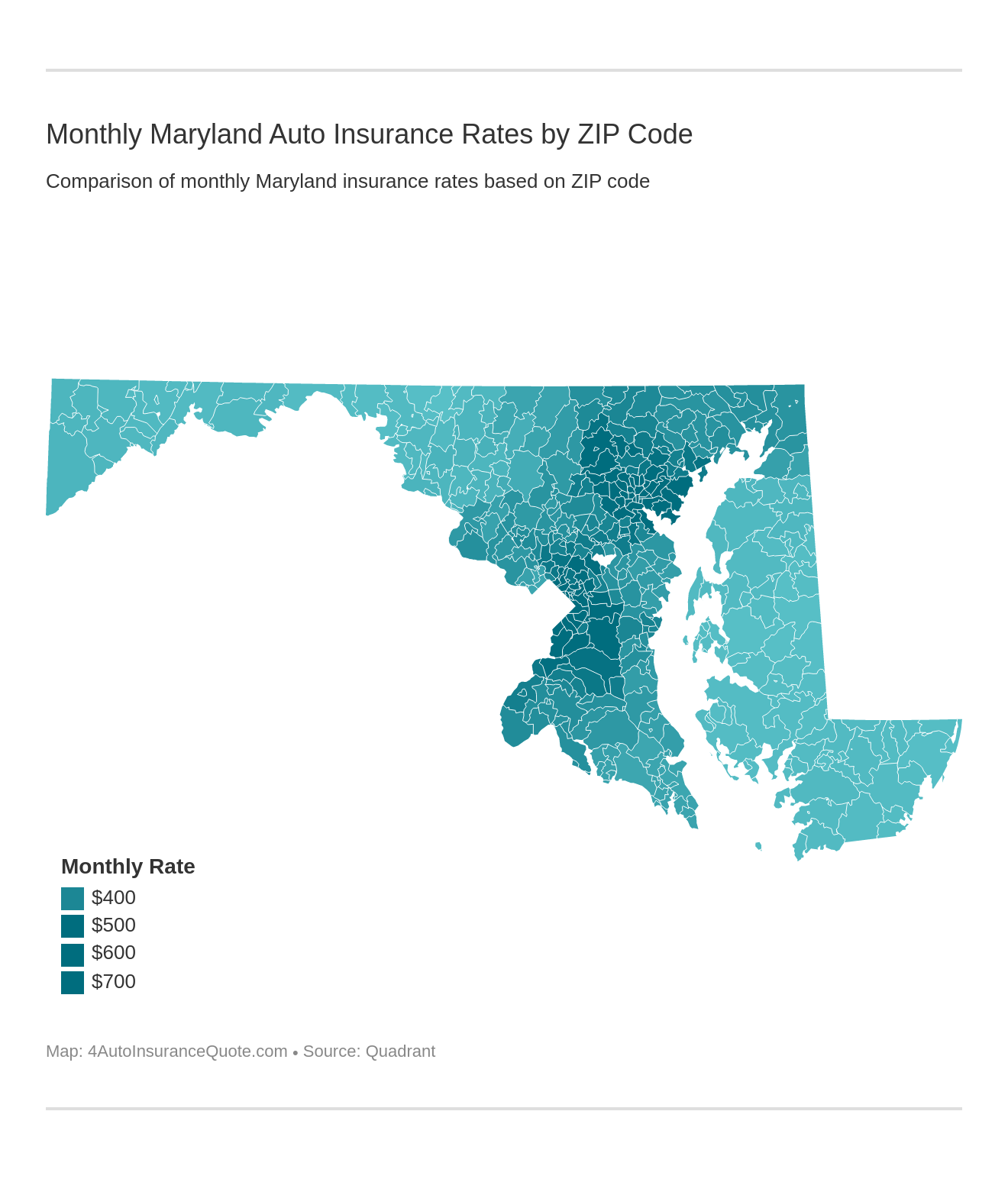

A dense population and a large number of roads may make things more efficient for drivers, but this also puts a different kind of burden on the people of Maryland – a financial burden. Because of this efficiency, insurance rates in Maryland are some of the highest in the nation. In the state of Maryland, the average auto insurance premium is more than $1,900 a year, trumping the national average by almost $500.

This rate is an average, however, and the price for auto insurance in major cities is even more. You will see average prices of about $2,500 in Baltimore and about $2,000 in Columbia.

At such a high price, it’s very important that you know what you’re getting when you purchase auto insurance so that you can get the best bang for your buck.

There are a lot of factors that auto insurance companies take into consideration when determining your rates. Take a look at our overview here.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay significantly higher auto insurance rates than females.

Maryland, like many other states, follows a tort system when settling fault claims after accidents. This means that someone has to be found at fault for causing the accident and the insurance company responsible for that person must pay for the damages in accordance with the details agreed upon in the insurance policy.

Maryland Auto Insurance Rates by Company

With fairly average rates overall, it pays to show around. Let’s take a look at how rates vary between some of the largest companies in Maryland.

But which companies are the largest, holding the most market share percentage in the region?

Maryland Driving Statistics

It’s important to be properly covered when looking at the number of crashes that occur in Maryland every year. Since 2003, the number of accidents has been pretty constant, floating at around 100,000 per year. Fortunately, the number has decreased quite a bit, from 109,130 in 2003 to 100,943 in 2007. Still, this high accident rate is accompanied by many injuries and several fatalities. You can read our article, Most Dangerous Highways by State, to learn which highways in Maryland to be cautious of.

More than half of the people involved in a motor accident in Maryland suffer some kind of injury. Luckily, of these 51,729 people, only 615 fatal accidents occurred in 2007. Still, this is a very unfortunate number and the threat of injury, whether it’s fatal or not, is very high.

Insurance rates also go up if your vehicle is more likely to be stolen than others. In 2005, Maryland came in at 10th for the number of stolen vehicle reports, so the threat of having your car stolen is very real. The county with the most reported thefts in Maryland in Prince George’s County, with 9,743 reported thefts in 2008.

That same year, Baltimore had 2,940 reported thefts and Baltimore City had 5,518. In Baltimore, the most stolen car is the Dodge Caravan, followed by the Honda Accord and Jeep Cherokee, so make sure you always check to see your car is locked before you leave it because the chances of it being stolen are quite high.

Since insurance in Maryland can be quite costly, you should do as much research as possible before purchasing any vehicle.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Maryland Auto Insurance Agents Directory

Looking for a Maryland auto insurance agent? Take a look at the list below.

Maryland Auto Insurance Agents

- Get Affordable Catonsville, MD Auto Insurance Quotes (2026)

- Get Affordable Clear Spring, MD Auto Insurance Quotes (2026)

- Get Affordable District Heights, MD Auto Insurance Quotes (2026)

- Get Affordable Edgewood, MD Auto Insurance Quotes (2026)

- Get Affordable Fallston, MD Auto Insurance Quotes (2026)

Additional Automobile Insurance Resources in the State of Maryland

These official sources can help with any questions or concerns regarding Maryland insurance or driving laws.

- MVA (Motor vehicle administration) in Maryland

- Maryland Insurance Administration

- A Consumer Guide To Auto Insurance (PDF)

- Maryland Highway Safety Laws

Ready to buy Maryland auto insurance? Enter your ZIP code for free Maryland auto insurance rates from top companies today.

Best Auto Insurance Agents in Maryland

Discover the leading auto insurance agents across various Maryland locales, from Catonsville to Fallston, renowned for their exceptional service, competitive rates, and comprehensive coverage options.

| Auto Insurance Agents in Maryland |

|---|

| Catonsville, MD |

| Clear Spring, MD |

| District Heights, MD |

| Edgewood, MD |

| Fallston, MD |

Frequently Asked Questions

What are the auto insurance requirements in Maryland?

Maryland requires minimum liability coverage for bodily injury and property damage, as well as uninsured motorist coverage and personal injury protection (PIP).

Why are insurance rates high in Maryland?

High population density and many roads contribute to higher insurance rates in Maryland.

How can I find affordable auto insurance in Maryland?

Shop around and compare quotes from multiple insurance companies.

What factors affect auto insurance rates in Maryland?

Factors like driving record, age, gender, and vehicle type can impact insurance rates.

Where can I find a Maryland auto insurance agent?

A directory of Maryland auto insurance agents is available.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.