Cheap New York Auto Insurance for 2026

To meet New York auto insurance requirements, drivers must have 25/50/10 of bodily injury and property damage coverage, as well as personal injury protection coverage of $50,000. New York insurance rates vary by driver, but the average New York auto insurance rates for full coverage are $113/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- New York full coverage auto insurance costs an average of $113/mo

- New York drivers must carry liability insurance and personal injury protection insurance

- Comparing New York auto insurance quotes will help most drivers find cheaper rates

New York auto insurance rates vary depending on a driver’s record, age, coverage choices, and more. The best way to determine which New York auto insurance rate is right for you is to compare rates at different New York auto insurance companies.

We’ve simplified it by gathering the basics of how auto insurance works in New York, from New York auto insurance laws to the cheapest companies in New York, as understanding auto insurance doesn’t have to be hard.

To get affordable New York auto insurance right now, enter your ZIP code for free New York auto insurance quotes.

New York Auto Insurance Laws And Requirements

In NY, the state liability coverage minimums are:

- Bodily Injury Liability Coverage – $25,000 per person

- Bodily Injury Liability Coverage – $50,000 per accident

- Property Damage Liability Coverage – $10,000 per accident

Uninsured/underinsured motorist coverage minimums are:

- Bodily Injury Coverage – $25,000 per person

- Bodily Injury Coverage – $50,000 per accident

Aso required is personal injury protection (PIP) at these coverage minimums:

- $50,000 coverage per person

Optional coverage choices in NY include:

- New York Auto Insurance

- Get Affordable Valatie, NY Auto Insurance Quotes (2026)

- Get Affordable Sherburne, NY Auto Insurance Quotes (2026)

- Get Affordable Roscoe, NY Auto Insurance Quotes (2026)

- Get Affordable Otto, NY Auto Insurance Quotes (2026)

- Get Affordable North Valley Stream, NY Auto Insurance Quotes (2026)

- Get Affordable North Babylon, NY Auto Insurance Quotes (2026)

- Get Affordable New Windsor, NY Auto Insurance Quotes (2026)

- Get Affordable Mina, NY Auto Insurance Quotes (2026)

- Get Affordable Milo, NY Auto Insurance Quotes (2026)

- Get Affordable Melville, NY Auto Insurance Quotes (2026)

- Get Affordable Medina, NY Auto Insurance Quotes (2026)

- Get Affordable Lake Mohegan, NY Auto Insurance Quotes (2026)

- Get Affordable Kingston, NY Auto Insurance Quotes (2026)

- Get Affordable Jamaica, NY Auto Insurance Quotes (2026)

- Get Affordable Ithaca, NY Auto Insurance Quotes (2026)

- Get Affordable Glasco, NY Auto Insurance Quotes (2026)

- Get Affordable Fort Drum, NY Auto Insurance Quotes (2026)

- Get Affordable Evans Mills, NY Auto Insurance Quotes (2026)

- Get Affordable Eastport, NY Auto Insurance Quotes (2026)

- Get Affordable Cortlandt Manor, NY Auto Insurance Quotes (2026)

- Get Affordable Bayside, NY Auto Insurance Quotes (2026)

- Get Affordable Bainbridge, NY Auto Insurance Quotes (2026)

- Get Affordable Ashford, NY Auto Insurance Quotes (2026)

- Comprehensive Coverage

- Collision Coverage

- Medical Payments Coverage

- Rental Car Reimbursement Coverage

- Roadside Assistance / Towing Coverage

- Funeral Services Coverage

New York auto insurance requirements are that citizens must purchase three different types of coverage to satisfy New York’s minimum requirements to register a vehicle. Personal injury protection insurance – or “PIP” – is designed to quickly pay for medical expenses and lost wages as a result of an automobile accident. This insurance policy covers the driver, all passengers, and any pedestrians involved in the accident.

Minimum coverage for PIP is $50,000 per person, which includes up to $2,000 per month of work missed, all reasonable medical expenses, a $2,000 death benefit, and a number of other benefits. Of course, there are a number of regulations that can void this policy, such as driving while intoxicated. It’s important to read up on the PIP policy to ensure it’s well understood.

It’s important to note that New York is considered a no-fault insurance state, which means that no matter who is responsible for causing the automobile accident. Every party involved will be required to make insurance claims to their own auto insurance company.

While this does cause some grief if you end up in an accident that you had nothing to do with, overall no-fault insurance does tend to reduce litigation and claims, which makes auto insurance less expensive for everyone. There are some exceptions to the no-fault rules, such as accidents that cause severe economic losses and accidents that result in “serious” injury as designated by state law.

The next mandatory insurance coverage is auto liability insurance. This injury protects the driver from third-party injury or property damage claims that can result from an accident. The minimum coverage in New York is “25/50/10”, which translates to $25,000 for bodily injury, $50,000 for any injury resulting in death, and $10,000 for property damage. Anyone insuring a car in New York would do well to exceed these numbers by as much as they can afford, as medical costs and property values are generally significantly higher than these numbers if the accident is serious.

Finally, New York requires drivers to have uninsured motorists coverage. This policy protects drivers, passengers, and all members of the household in the event that they are injured by someone who doesn’t have insurance coverage.

The mandatory policy only covers bodily injury, and will only stay in effect inside the state boundaries of New York; the policy can be extended with a number of different features, such as inter-state coverage if one so chooses. This policy is one that’s best discussed at length with an auto insurance agent as there are many variables that go into choosing the right amount of coverage.

It probably doesn’t come as a surprise to anyone that auto insurance rates are higher than other states on average.

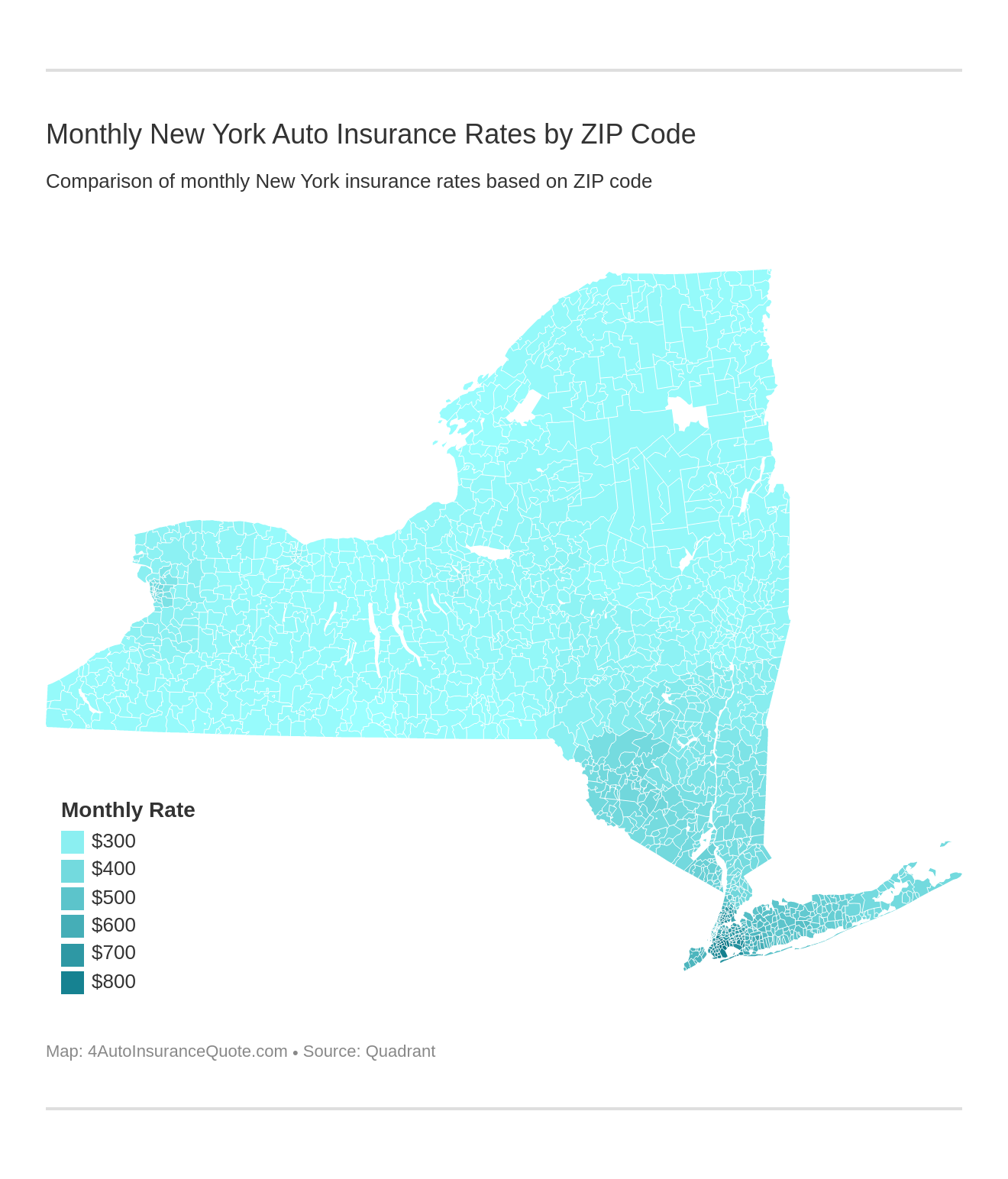

We can also take a closer look at the ZIP codes within the state to see how rates changed based on different areas.

There are a lot of factors that auto insurance companies take into consideration when determining your rates. Take a look at our overview here.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender (learn how age affects auto insurance rates). As with most states, males typically pay higher auto insurance rates than females.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

New York Auto Insurance Rates by Company

Given that rates can be very expensive in New York, it helps to shop around and determine the company that fits your needs and offers cheap New York auto insurance.

But which companies are the largest, holding the most market share percentage in the region?

New York Driving Statistics

As the goal of insurance is to help protect against tragedies such as accidents and theft, it’s important to discuss the actual accident risk while driving in the State of New York.

New Yorkers will be pleased to know that their overall number of accidents and the number of fatalities caused by traffic accidents declined in 2009 (the most recent year for which numbers are available) compared to 2008. 2009 saw 315,000 total accidents throughout the state, a decline of about 1,500 accidents, and fatalities of 1,060, which represented a ten percent decline from 2008. These declines are the result of more stringent law enforcement, and drivers paying more attention and care while they’re driving their car.

New York remained one of the areas that one is least likely to have their automobile stolen throughout the country in 2009. Just 21,800 vehicle thefts were reported, which is incredibly low when compared to other populous states such as California (192,000 thefts), Texas (85,000) and Florida (63,000).

More vehicles were stolen in the city of San Diego than in the entire state of New York in 2008, which is nothing short of incredible (learn about San Diego, CA auto insurance). While 21,800 is still a very high total number, it has been dropping considerably in the past few years, and New York’s annual auto theft count is down by more than 50% since 2004.

New York Auto Insurance By City/Town

Below you will find a breakdown of New York auto insurance by city.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Additional New York Auto Insurance Resources

- New York Department Of Insurance – Automobile insurance information for consumers.

- New York Highway Safety Laws – Learn about the key highway safety laws in New York.

- New York State Department Of Motor Vehicles – Official website of the New York DMV.

New York Auto Insurance Quotes

If you’re in the hunt for the best New York auto insurance – it’s important to do your research before making a decision. Take all of the different companies, levels of coverage, and your budget into account and figure out what’s going to work for you. It doesn’t hurt to chat with an auto insurance agent as well, as they may have a few tips that can save time and money.

To compare auto insurance rates in New York, enter your ZIP code in the quote box below. Whether you live in downtown Manhattan or rural upstate, we can help you buy New York auto insurance for less.

Best Auto Insurance Agents in New York

Embark on a journey through New York’s varied communities with a spotlight on the foremost auto insurance agents, celebrated for their unparalleled service, competitive rates, and extensive coverage offerings.

Frequently Asked Questions

Can I drive in New York without auto insurance?

No, it is illegal to drive in New York without auto insurance. Proof of insurance must be presented when registering a vehicle, and failure to maintain insurance can result in fines, license suspension, and other penalties.

How can I lower my auto insurance premiums in New York?

There are several ways to potentially lower your auto insurance premiums in New York. These include maintaining a clean driving record, opting for a higher deductible, bundling your auto insurance with other policies, and taking advantage of available discounts, such as safe driver discounts or discounts for installing safety features in your vehicle.

What is the average cost of auto insurance in New York per month?

The average cost of auto insurance in New York is approximately $113 per month. However, it’s important to note that individual rates can vary depending on factors such as age, driving history, and the type of vehicle you drive.

How often should I review and update my auto insurance policy?

It is recommended to review and update your auto insurance policy annually or whenever there are significant changes in your circumstances. Examples of changes that may warrant a policy update include purchasing a new vehicle, moving to a different location, or adding or removing drivers from your policy.

Can I use my auto insurance policy to cover rental cars in New York?

In most cases, your auto insurance policy will extend coverage to rental cars within the United States. However, it’s important to check with your insurance provider to confirm the specific details of your coverage and any limitations that may apply.

Can my auto insurance rates be affected by my credit history in New York?

Yes, in New York, insurance companies may consider your credit history as one of the factors when determining your auto insurance rates. Maintaining good credit can help you secure lower insurance premiums.

How much auto insurance do I need in New York?

You will need to carry liability, uninsured motorist, and PIP insurance to meet New York’s auto insurance requirements.

Is New York a no-fault auto insurance state?

Yes, New York is a no-fault auto insurance state.

Do I need full coverage insurance in New York?

No, New York does not legally require you to carry full coverage auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.