Cheap Washington D.C. Auto Insurance for 2026

Washington, D.C. auto insurance laws mandate that drivers carry the 25/50/10 auto insurance requirements for bodily injury and property damage coverage. Average Washington, D.C. car insurance rates are $175.75/mo. Get Washington, D.C. auto insurance quotes from the top Washington, D.C. auto insurance companies to compare before you buy.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

As the nation’s capital and the source of politics, news, and scandals, Washington, D.C. needs little in the way of introduction. Drivers know Washington, D.C. for its infamous Beltway traffic, and if they are unlucky, for its very high auto theft rates. Below we’ll look at Washington, D.C. auto insurance, and how things work for drivers in the District.

Understanding auto insurance doesn’t have to be hard. We’ve broken down what you need to know to buy Washington, D.C. auto insurance with confidence.

Washington, D.C. Auto Insurance Laws And Requirements

In Washington, D.C. the liability coverage minimums are:

- Bodily Injury Liability Coverage – $25,000 per person

- Bodily Injury Liability Coverage – $50,000 per accident

- Property Damage Liability Coverage – $10,000

Take a look at how D.C.’s minimum rates compare with surrounding states.

In D.C. you’ll also need Uninsured/Underinsured Motorist Coverage with the following minimums:

- Property Damage Coverage – $5,000

- Bodily Injury Coverage – $25,000 per person

- Bodily Injury Coverage – $50,000 per accident

Like the majority of states, lawmakers in Washington, D.C. chose to operate the District’s auto insurance laws under the tort system of auto insurance. Essentially what this means for drivers like you is that whenever an accident or collision occurs, one of the drivers involved will be named the at-fault party.

This person and their auto insurance will then be subject to claims and lawsuits for things like injuries, property damage, and more. Washington, D.C. law mandates that drivers must prove they are financially responsible by purchasing three minimum amounts of insurance coverage. These are bodily injury liability, property damage liability, and uninsured motorist bodily injury liability. Let’s take a brief look at each of these policies and what they mean.

Bodily injury liability insurance covers the costs associated with the other party’s injuries when the policyholder is the at-fault party in an accident. For example, Bob is driving down the road and runs a red light, causing a collision with Mary. Mary suffers injuries as a result of the collision, as well as requiring time off from work. Bob’s BIL policy will pay out for Mary’s injury-related cost claims, including medical treatment, rehabilitation, lost wages, and even death benefits up to the maximum amount of coverage he has purchased.

It’s important to know that this coverage does not protect the policyholder in any way – the coverage is only intended to be paid out to other parties after a crash. The minimum amount of bodily injury liability coverage is $25,000 per person, per accident, and $50,000 for all parties in a single accident.

Property damage liability insurance covers the at-fault driver for any damage they do to another person’s property when they cause an accident. Using the above example, Bob’s PDL insurance will pay out claims for damages to Mary’s car, as well as any property inside of it that was damaged in the crash.

Again, PDL does not cover any damage to the policy holder’s property – it is strictly intended to pay out claims for damage to others’ property. The minimum amount of coverage for property damage liability is $10,000.

Uninsured motorist bodily injury liability coverage works a bit different than BIL and PDL. This policy is intended to protect the policyholder and their passengers when they are in an accident caused by someone who doesn’t have auto insurance. Like BIL, the minimum amount of uninsured motorist bodily injury liability coverage is $25,000 per person, per accident, and $50,000 for all parties in a single accident.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Washington, D.C. Auto Insurance Rates

Thanks to some unfortunate statistics that we’ll look at shortly, drivers in Washington, D.C. pay considerably more for their car insurance than those in the rest of the country, on average.

As of August 2011, the median rate for auto insurance in Washington, D.C. is $2,109; those that live in downtown D.C. are looking at a much higher $2,357. This is hundreds of dollars per year more than the national average of $1,436 and is one of the highest average car insurance rates in the nation.

With no real rural areas and crazy traffic all over the district, it shouldn’t come as a surprise that the rates across different ZIP codes do not vary much.

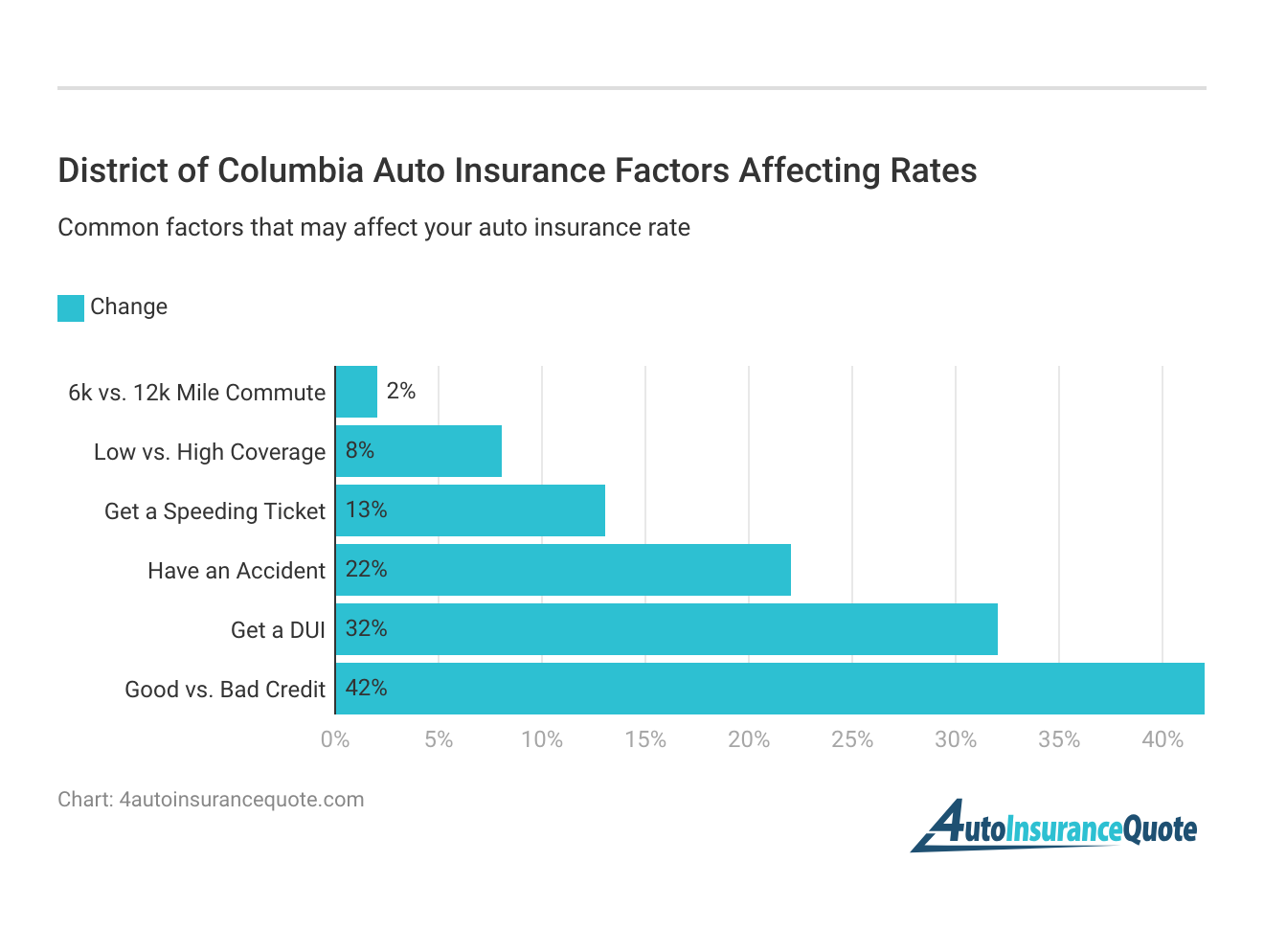

There are a lot of factors that auto insurance companies take into consideration when determining your rates. Take a look at our overview here.

While many of these factors are simply based on your own driving record, two things that affect even the safest of drivers are age and gender. As with most states, males typically pay higher auto insurance rates than females.

Washington, D.C. Auto Insurance Rates by Company

Though the district boasts very cheap auto insurance rates overall, let’s take a look at how rates vary between some of the largest companies.

But which companies are the largest, holding the most market share percentage in the region?

The chance of getting in an accident while driving Washington, D.C. roads are considerably higher than those in the rest of the country, with the District ranking in the top five metropolitan areas for crash rates. In 2008 (the most recent year for which data are available) the District had 16,147 reported collisions, which resulted in 39 fatalities and 6,792 injuries.

Overall crashes are relatively unchanged in the past decade, but thankfully the fatality numbers continue to drop year after year, with 2001 the peak year at 71 fatalities due to automobile accidents. For the sake of comparison, the 2006 numbers were 16,209 crashes and 41 fatalities; these numbers show that if auto crashes are trending downward, the trend rate is statistically insignificant.

Washington, D.C. drivers stand to save quite a bit on their car insurance rates by placing a greater focus on traffic safety, but only time will tell if this occurs.

If you currently live in Washington, D.C., you’re already aware that crime is a serious issue in the District, and although things have gotten slightly better in recent years, the situation still isn’t good when it comes to auto theft. While ranking 50th in total population, Washington, D.C. actually ranks first place for auto theft – a sad reality for drivers that live in the area, and one of the many causes for the District’s high auto insurance rates.

In 2009, a total of 5,532 vehicle thefts were reported throughout Washington, D.C., which represents an incredibly high rate of 922.5 stolen vehicles for every 100,000 citizens. While these numbers are very high, the good news is that they are trending downwards and hopefully the increased pressure from the District’s law enforcement agencies will help to reduce things further.

Comparing the 2009 totals with those from 2003, which saw 9,906 auto thefts and a 1,777 thefts per 100,000 citizens theft rate, shows just how much progress has been made. With hard work and a little luck, these numbers will continue trending down into the future.

Washington, D.C. Auto Insurance Agents

Are you looking for the best auto insurance agents in Washington? If so, check out our list of auto insurance agents below. If you would like to compare auto insurance rates in Washington online, please enter your Washington ZIP code on this page to get the cheapest car insurance quotes in the area.

The Capital Group

1455 Pennsylvania Ave NW Ste 400, Washington, DC 20004

(301) 2147666

AAA Insurance

1405 G St NW, Washington, DC 20005

(202) 4816811

Wells Fargo Insurance Services USA

1401 H St NW Ste 750, Washington, DC 20005

(202) 7835810

Flather & Perkins

888 17th St NW Ste 508, Washington, DC 20006

(202) 4668888

Rust Insurance Agency

910 17th St NW Fl 9, Washington, DC 20006

(202) 7765000

D H Lloyd & Associates

1625 K St NW Ste 400, Washington, DC 20006

(202) 2231506

Everge Insurance Services

1629 K St NW Ste 300, Washington, DC 20006

(202) 6816147

Bryan Scott

1001 Connecticut Ave NW Ste 201, Washington, DC 20036

(202) 2935050

Kevin Hassett

1001 Connecticut Ave NW Ste 201, Washington, DC 20036

(202) 4638407

Newtek Insurance Agency

1627 K St NW Ste 1000, Washington, DC 20006

(866) 3807007

Tom Brown & Company

1425 K St NW Ste 350, Washington, DC 20005

(202) 3937755

Alliance Insurance Services Inc

1660 L St NW Ste 210, Washington, DC 20036

(202) 6381010

Marvin A Address & Associates

1725 Desales St NW Ste 802, Washington, DC 20036

(202) 4290206

Clements & Company

1 Thomas Cir NW Fl 8, Washington, DC 20005

(202) 8720060

Greg Owens

1730 Rhode Island Ave NW, Washington, DC 20036

(202) 4632480

Jay Frye

1211 Connecticut Ave NW Ste 520, Washington, DC 20036

(202) 8610721

Maurice Brown

4900 Mass Ave NW Ste 235, Washington, DC 20016

(202) 7472050

Huntington T Block Insurance Agency

1120 20th St NW Frnt 6, Washington, DC 20036

(800) 4248830

Max James

1713 7th Street NW South Retail, Washington, DC 20001

(202) 3190005

Garry Blunt

955 L’enfant Plaza North No. 1205, Washington, DC 20024

(202) 8632700

Johnson Family Insurance Agency

1534 14th St NW, Washington, DC 20005

(202) 5774622

The Harold Group

702 N St NW Apt 402, Washington, DC 20001

(202) 8981911

Howard W Phillips & Company

2555 Pennsylvania Ave, Washington, DC 20037

(202) 3319200

Pj Hemnani

2141 P St NW Ste 105, Washington, DC 20037

(202) 4638408

Barry Lumsden Insurance Agency

1525 9th St NW, Washington, DC 20001

(202) 3871160

Apex Insurance Group

20 F St NW Fl 7, Washington, DC 20001

(202) 6814150

Gregory Owens

1512 U St NW Fl 2, Washington, DC 20009

(202) 4089451

M Squared Risk & Insurance

1010 Wisconsin Ave NW Ste 200, Washington, DC 20007

(202) 2902490

Chris Miller

1009 U St NW, Washington, DC 20001

(202) 3281210

Elite Insurance & Consulting Services

430 M St SW # 206, Washington, DC 20024

(202) 9055800

JHC Insurance Agency

71 Florida Ave NW Fl 1, Washington, DC 20001

(202) 8323388

Eric Hardiman State Farm Insurance

1540 N Capitol St NW Ste 201, Washington, DC 20002

(202) 6435905

Jimmy Podoley

236 Massachusetts Ave NE Ste 100, Washington, DC 20002

(202) 5462244

Cedar General Insurance Agencies

1730 N Lynn Street Suite A50, Arlington, VA 22209

(703) 8071018

Crystal Insurance Group

1744 Columbia Rd NW Apt 3, Washington, DC 20009

(202) 3879162

Mohammad Y Bajwa

1730 Columbia Rd NW, Washington, DC 20009

(202) 3877932

Angela Rosser

528 H St NE Ste 2, Washington, DC 20002

(202) 5470008

Thacker Insurance & Financial Services

2600 Connecticut Ave NW Ste 200, Washington, DC 20008

(202) 7851966

Tim Lacasse

617 Pennsylvania Ave SE, Washington, DC 20003

(202) 5484229

Waymon L Lynch

3016 14th St NW, Washington, DC 20009

(202) 4629243

Jackie A Walker

420 8th St SE, Washington, DC 20003

(202) 5485240

Countrywide Insurance Company

1377 Kenyon St NW, Washington, DC 20010

(703) 8015062

Mike Jones

522 8th St SE Ste B, Washington, DC 20003

(202) 5463200

Peruvian Insurance Agency

1916 Wilson Blvd Ste 304, Arlington, VA 22201

(703) 2435660

TWFG Insurance Services Rob Robinson

2201 Wisconsin Ave NW Ste C110, Washington, DC 20007

(202) 6849898

Geoff Collins

2233 Wisconsin Ave NW Ste 224, Washington, DC 20007

(202) 3334134

Maurice Brown

1200 G St SE # A, Washington, DC 20003

(202) 5461493

Brad Ryant Sr

1334 H St NE, Washington, DC 20002

(202) 3886411

Analia Ramos Insurance Agency

3537 6th St NW, Washington, DC 20010

(571) 4717130

Tawana Mensah

1332 Pennsylvania Ave SE, Washington, DC 20003

(202) 5063636

Payne Insurance Agency

3600 14th St NW, Washington, DC 20010

(202) 6292233

Lockhart’s Insurance Services

3907 Georgia Ave NW, Washington, DC 20011

(202) 8296222

Johno Steffen

2762 Washington Blvd Apt 1a, Arlington, VA 22201

(703) 2436565

Herbert L Jamison & Company

1220 N Fillmore St Ste 400, Arlington, VA 22201

(703) 2580094

Stephon Scriber

2639 Connecticut Ave NW Ste C110, Washington, DC 20008

(202) 2345555

C M R Insurance Agency

37 N Fillmore St, Arlington, VA 22201

(703) 3519494

Harvey Ostrow

3132 10th St N Ste 2, Arlington, VA 22201

(703) 5277222

Rudy Alston III

2901 12th St NE, Washington, DC 20017

(202) 6350850

Prabakaran Thomas

3408 Wisconsin Ave NW Ste 209, Washington, DC 20016

(202) 5371133

Gloria Perez

4322 Kansas Ave NW, Washington, DC 20011

(703) 7869044

G J Graham

3411 Washington Blvd, Arlington, VA 22201

(703) 5251800

Bill Welsh

933 N Kenmore St Ste 220, Arlington, VA 22201

(703) 5241976

Joli Brown

4818 Macarthur Blvd NW Fl 1, Washington, DC 20007

(202) 7350086

Lloyd Chesley Jr

3500 12th St NE, Washington, DC 20017

(202) 8631400

Pacific Insurance Agency

901 S Highland St Ste 319, Arlington, VA 22204

(703) 9792090

Tsige Paulo

3045 Columbia Pike Ste A, Arlington, VA 22204

(703) 3023770

Mark W Wardlow

3617 12th St NE, Washington, DC 20017

(202) 5268181

Doug Girma

3512 Lee Hwy, Arlington, VA 22207

(703) 6602316

Nationwide Agency

3201 Columbia Pike, Arlington, VA 22204

(571) 4386902

Richard Frick

3201 New Mexico Ave NW Ste 252, Washington, DC 20016

(202) 6865197

Stephen W Papovich

802 S Glebe Rd, Arlington, VA 22204

(703) 5218779

Terry White, Sr

4301 Connecticut Ave NW Ste 143, Washington, DC 20008

(202) 3623535

Howard & Hoffman

3201 New Mexico Ave NW Ste 300, Washington, DC 20016

(202) 9660700

Golden Insurance Agency

3103 13th St S, Arlington, VA 22204

(703) 5382285

David Seidel

413 S Glebe Rd, Arlington, VA 22204

(703) 9205012

Sal Nooristani

200 N Glebe Rd Ste 235, Arlington, VA 22203

(703) 2430700

Kevin Gallagher

4001 9th St N Ste 101, Arlington, VA 22203

(703) 5259500

Adria Brown

2413 26th Rd S, Arlington, VA 22206

(703) 5588200

Georgetown Insurance Group

5125 Macarthur Blvd NW, Washington, DC 20016

(202) 5370064

Howard Eales

5157 Macarthur Blvd NW, Washington, DC 20016

(202) 3634088

M Afarin Rooholamini

4301 Fairfax Dr Ste 190, Arlington, VA 22203

(703) 7601514

Leroy Berkley

723 Kennedy St NW, Washington, DC 20011

(202) 8292771

Atlas Insurance Agency

3305 Mount Vernon Ave, Alexandria, VA 22305

(703) 5490000

Cascade Insurance Group

1100 N Glebe Rd Ste 1010, Arlington, VA 22201

(703) 5512000

Kenya Zambrano

4620 Lee Hwy Ste 208, Arlington, VA 22207

(703) 4652886

Michele Conley

4701 Wisconsin Ave NW, Washington, DC 20016

(202) 9666677

Soltech Insurance Agency Ana Quinteros

944 S Wakefield St Ste 100, Arlington, VA 22204

(703) 2710345

Troka Insurance

210 Riggs Rd NE Ste B, Washington, DC 20011

(202) 6350077

Ernesto Bandini

2605 Mount Vernon Ave Ste B, Alexandria, VA 22301

(703) 5490104

Anchor Insurance

3200 Otis St, Mt Rainier, MD 20712

(301) 6998977

David W Kushner

3200b Otis St, Mt Rainier, MD 20712

(301) 2772535

Donna Carter

2309 Mount Vernon Ave, Alexandria, VA 22301

(703) 5489790

Capital Benefits Corporation

5028 Wisconsin Ave NW Ste 103, Washington, DC 20016

(202) 3624500

Alston & Associates

6234 Georgia Ave NW, Washington, DC 20011

(202) 8292510

Gene Cartwright

2721 Branch Ave SE, Washington, DC 20020

(202) 5846000

J Reed Laughlin

5100 Wisconsin Ave NW Ste 516, Washington, DC 20016

(202) 3648200

Minus & Associates

6230 3rd St NW, Washington, DC 20011

(703) 9208899

Stephen Hoyt

5217 Wisconsin Ave NW Ste 1, Washington, DC 20015

(202) 3643412

Wil Christian

4236 Hildreth St SE, Washington, DC 20019

(202) 5823333

Jon Laskin

5600 Connecticut Ave NW Ste 400, Washington, DC 20015

(202) 3648861

Mouton Insurance Brokerage

7059 Blair Rd NW Ste 202 # 5, Washington, DC 20012

(202) 6677446

Discount Auto Insurance

7321 Georgia Ave NW, Washington, DC 20012

(202) 8829850

Paul Cofer

7414 Georgia Ave NW Ste 2, Washington, DC 20012

(202) 7225100

V. W. Brown Insurance Service

3286 Chestnut St NW, Washington, DC 20015

(202) 9660566

Keith Edwards

7813 Georgia Ave NW, Washington, DC 20012

(202) 7267771

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Washington DC Automobile Insurance Resources

- DC Department of Motor Vehicles

- Department of Insurance, Securities and Banking

- DC Insurance Requirements

- District of Columbia Highway Safety Laws

Cheap Auto Insurance In D.C.

Here at 4AutoInsuranceQuote.com, it’s our goal to make finding the best Washington, D.C. auto insurance rates quick and easy. With around a dozen different insurance carriers offering auto insurance here in the nation’s capital, it can really pay off to check them out and see which has the best rates given your current situation.

We’ve built a tool into this webpage that will help you find the best prices for car insurance in D.C. All you need to do is to enter your ZIP code in the box below for free Washington, D.C. auto insurance rates.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.