Geico Auto Insurance Review (2026)

Geico auto insurance reviews find the company with an impressive "A++" financial rating with A.M. Best and a "B+" rating with the BBB. Geico auto insurance rates average between $250-$285 per month depending on the level of coverage. Drivers can find cheap auto insurance quotes by taking advantage of Geico insurance discounts and programs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: May 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Geico Overview | Statistics |

|---|---|

| Founded | 1936 (now a wholly owned subsidiary of Berkshire Hathaway, Inc.) |

| Slug Executives | Olza M. Nicely, President and Chief Executive Officer – Insurance Operations Louis A. Simpson, President and Chief Executive Officer – Capital Operations Charles R. Davies, Senior Vice President and General Counsel |

| Premiums Written (2018) | $33.07 billion |

| Slug Assets | Over $32 billion |

| Loss Ratio (2018) | 70.65% |

| Headquarters Address | 5260 Western Avenue Chevy Chase, MD 20815 |

| Phone Number | 1-800-841-3000 |

| Website | Geico.com |

| Best For | Affordable Rates and Online Services |

Can a 15-minute phone call save you 15 percent or more on car insurance? Is it so easy that a caveman can do it? What about that cute, green little guy with an accent? Do any of these commercials encourage your decision to purchase insurance?

Insurance companies spend millions of dollars on advertising with the expectation that it will be enough to entice you to purchase insurance coverage from them.

With so many car insurance companies to choose from, making such a critical decision can be difficult.

In this Geico auto insurance review, we are going to provide everything you need to know about Geico, including company history, coverage options, employee ratings, and more. Plus, a whole section on possible discounts available to you.

Would you like to start comparison shopping today? Take advantage of our FREE online tool to start comparing rates in your area.

Let’s get started.

How to Get Cheap Geico Car Insurance Rates

In our next section, we partnered with Quadrant Data to bring you rates based on specific demographic factors. Here are two things to consider when shopping for car insurance:

- Many variables can affect what you pay. Your price may differ from what is listed.

- Geico has discounts and options that may help offset the cost.

Let’s continue on to learn where Geico is available and the average Geico car insurance costs for certain categories like credit history, driving record, and more.

Geico Availability and Rates by State

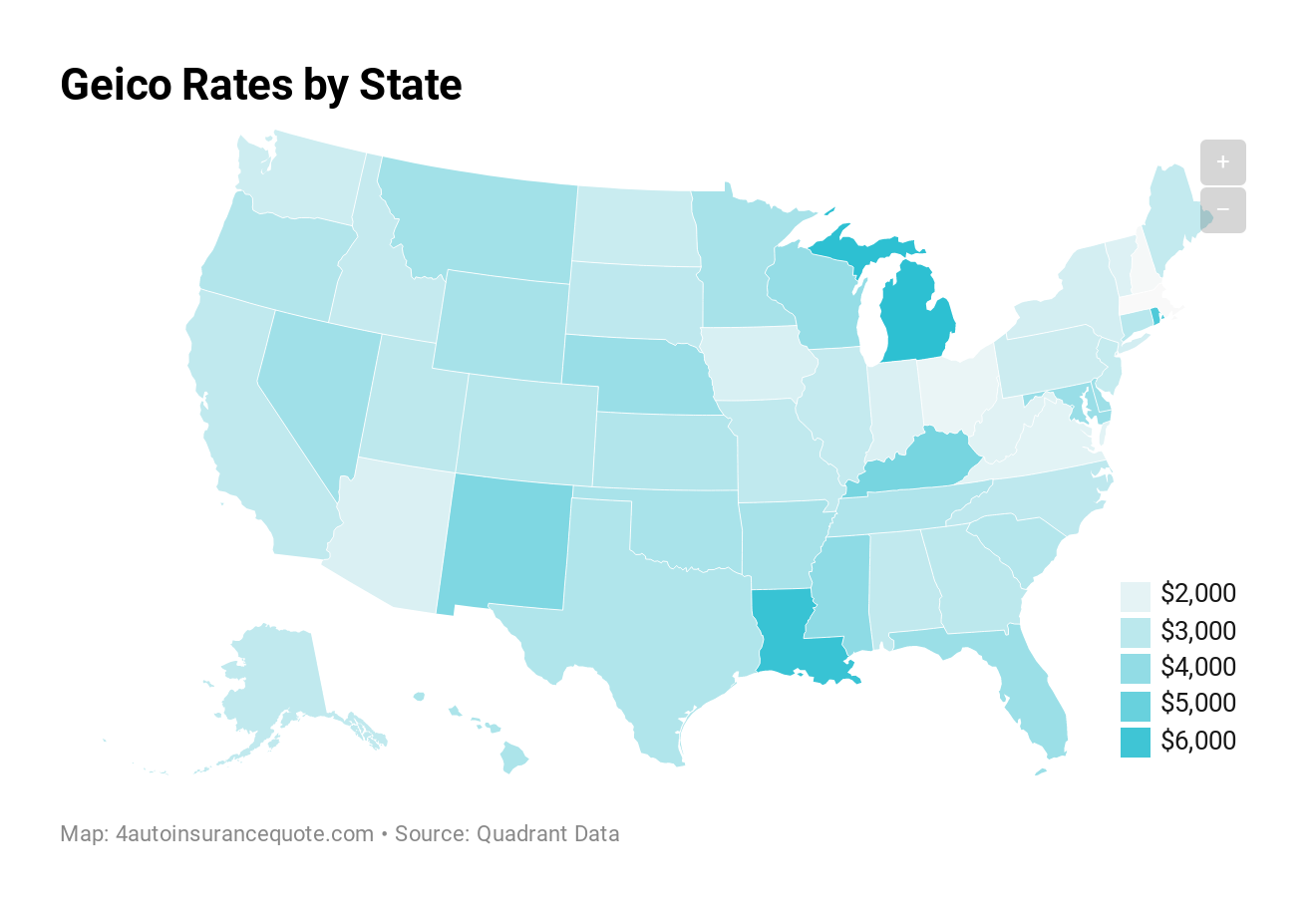

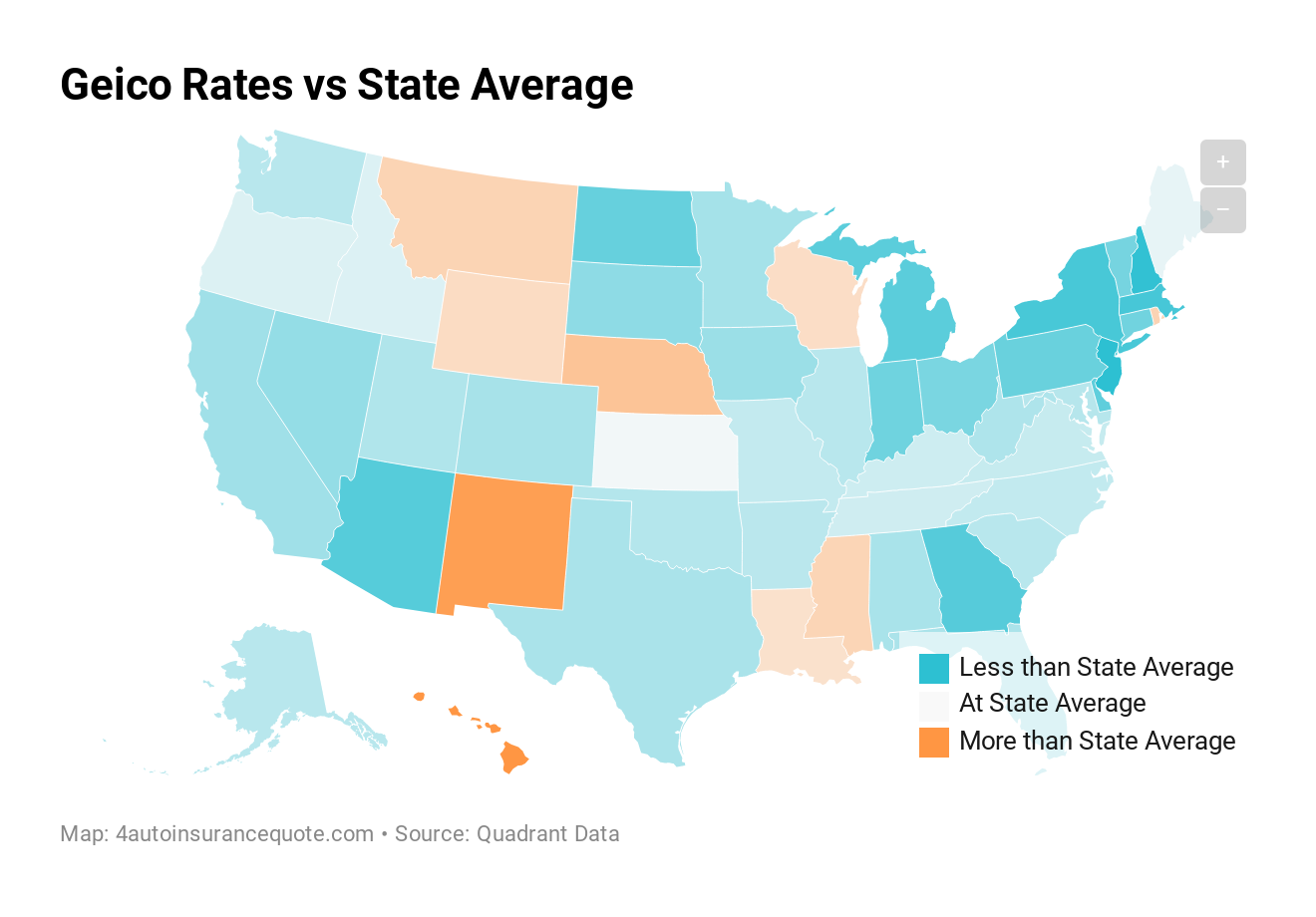

Geico is available in all 50 states. Rates vary, sometimes above and sometimes below average, and can be further affected by factors like driving record, marital status, and credit history.

Louisiana, Michigan, and Kentucky have the highest rates in the country. Geico rates average around $3,000 per policy.

In the table below, are Geico’s rates in all states compared to the state averages.

| State | Annual Premium | Higher/Lower Than State Average | Percent Higher/Lower Than State Average |

|---|---|---|---|

| Median | $3,073.66 | -$587.23 | -0.160405967 |

| Alabama | $2,866.60 | -$700.36 | -0.1963471194 |

| Alaska | $2,879.96 | -$541.56 | -0.1582806078 |

| Arizona | $2,264.71 | -$1,506.26 | -0.3994367163 |

| Arkansas | $3,484.63 | -$640.35 | -0.1552376885 |

| California | $2,885.65 | -$803.28 | -0.2177547305 |

| Colorado | $3,091.69 | -$784.70 | -0.2024307149 |

| Connecticut | $3,073.66 | -$1,545.26 | -0.3345498879 |

| Delaware | $3,727.29 | -$2,259.04 | -0.3773665534 |

| District of Columbia | $3,692.81 | -$746.43 | -0.1681441147 |

| Florida | $3,783.63 | -$896.83 | -0.1916120831 |

| Georgia | $2,977.20 | -$1,989.63 | -0.4005842188 |

| Hawaii | $3,358.86 | $803.22 | 0.3142937358 |

| Idaho | $2,770.68 | -$208.41 | -0.06995787801 |

| Illinois | $2,779.16 | -$526.33 | -0.1592290498 |

| Indiana | $2,261.07 | -$1,153.90 | -0.337894235 |

| Iowa | $2,296.16 | -$685.12 | -0.2298078339 |

| Kansas | $3,220.65 | -$58.98 | -0.01798362728 |

| Kentucky | $4,633.59 | -$561.81 | -0.1081365799 |

| Louisiana | $6,154.60 | $443.25 | 0.07760887805 |

| Maine | $2,823.05 | -$130.23 | -0.04409511475 |

| Maryland | $3,832.63 | -$750.07 | -0.1636739925 |

| Massachusetts | $1,510.17 | -$1,168.68 | -0.4362615281 |

| Michigan | $6,430.11 | -$4,068.53 | -0.3875295561 |

| Minnesota | $3,498.54 | -$904.72 | -0.2054652813 |

| Mississippi | $4,087.21 | $422.64 | 0.1153302289 |

| Missouri | $2,885.33 | -$443.61 | -0.1332575332 |

| Montana | $3,602.35 | $381.50 | 0.1184478288 |

| Nebraska | $3,837.49 | $553.81 | 0.1686542215 |

| Nevada | $3,662.09 | -$1,199.61 | -0.2467470226 |

| New Hampshire | $1,615.02 | -$1,536.76 | -0.4875848701 |

| New Jersey | $2,754.94 | -$2,760.27 | -0.5004835326 |

| New Mexico | $4,458.30 | $994.66 | 0.2871726733 |

| New York | $2,428.24 | -$1,861.64 | -0.4339613515 |

| North Carolina | $2,936.69 | -$456.42 | -0.134514129 |

| North Dakota | $2,668.24 | -$1,497.60 | -0.3594954007 |

| Ohio | $1,867.19 | -$842.53 | -0.3109288002 |

| Oklahoma | $3,437.34 | -$704.99 | -0.1701918609 |

| Oregon | $3,220.12 | -$247.65 | -0.07141452744 |

| Pennsylvania | $2,605.22 | -$1,429.28 | -0.354264908 |

| Rhode Island | $5,602.63 | $599.27 | 0.1197742116 |

| South Carolina | $3,178.01 | -$603.13 | -0.1595094597 |

| South Dakota | $2,940.29 | -$1,041.98 | -0.2616547848 |

| Tennessee | $3,283.42 | -$377.47 | -0.1031083986 |

| Texas | $3,263.28 | -$780.00 | -0.1929134223 |

| Utah | $2,965.57 | -$646.32 | -0.1789416446 |

| Vermont | $2,195.71 | -$1,038.42 | -0.3210815629 |

| Virginia | $2,061.53 | -$296.35 | -0.1256842768 |

| Washington | $2,568.65 | -$490.67 | -0.1603862749 |

| West Virginia | $2,120.80 | -$474.56 | -0.1828510044 |

| Wisconsin | $3,926.20 | $320.13 | 0.08877573998 |

| Wyoming | $3,496.56 | $296.47 | 0.09264590794 |

Comparing the Top 10 Companies by Market Share

Saving money is a great thing, and one way to do that is comparison shopping for car insurance. This helps you get the best rates for you and your family. How does Geico compare to other top insurers in the country on price? The table below compares Geico to nine other top companies on a state-by-state basis.

| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | $2,228.12 | Data Not Available | $2,454.21 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | Data Not Available | $1,189.35 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

Of the top companies available to all consumers (USAA is only available to military-affiliated drivers), Geico has the second-lowest average rates, behind State Farm.

Average Geico Male Versus Female Car Insurance Rates

Who pays more for car insurance? Males? Females? Or is gender a factor at all? Surprisingly, some states allow gender as a factor when determining insurance rates. However, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, California, and parts of Michigan have banned this practice and no longer allow companies to use gender as a factor.

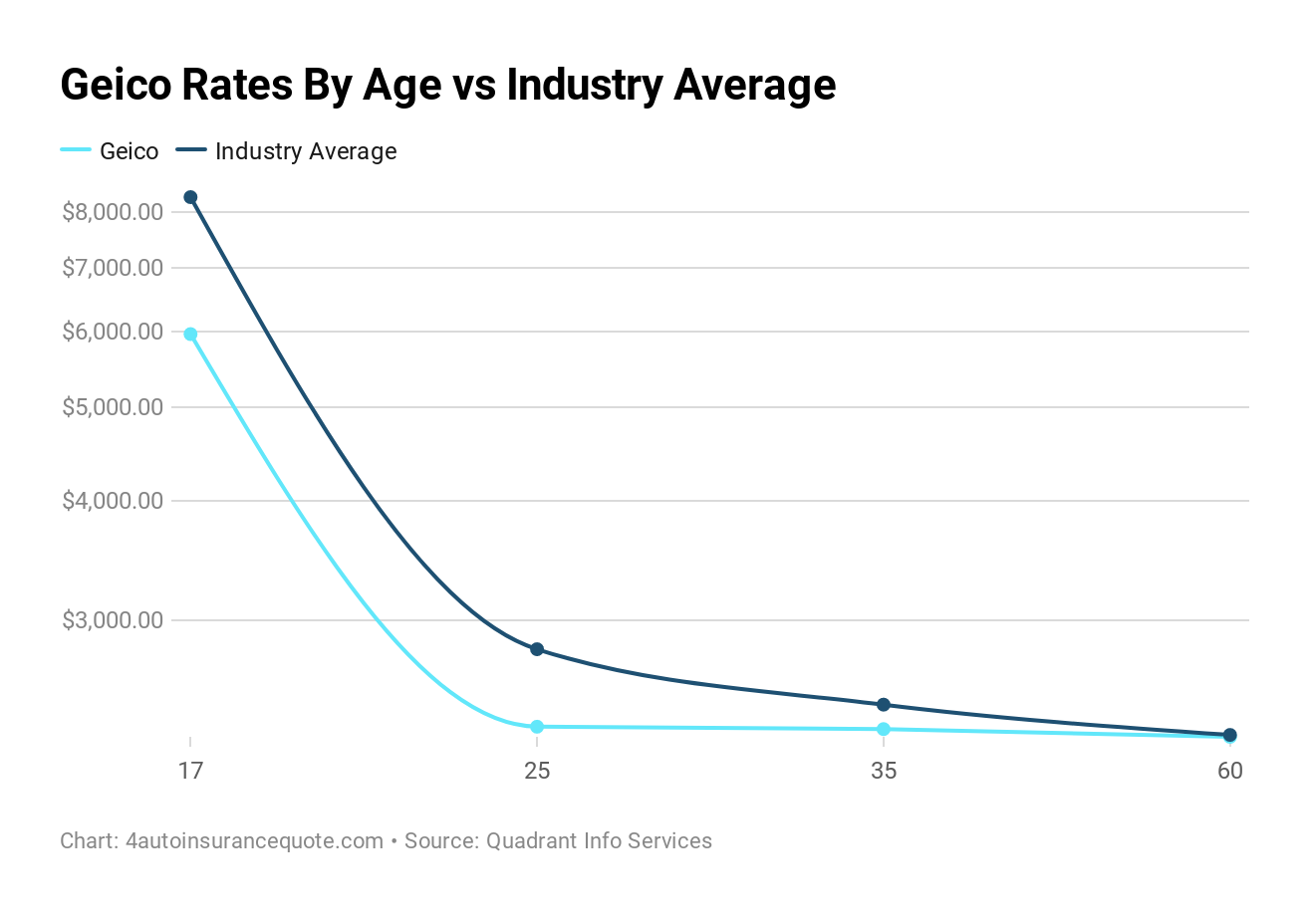

Geico Average Annual Auto Insurance Rates by Age and Gender| Driver Age and Gender | Average Annual Rates |

|---|---|

| Single 17-year-old male | $6,278.96 |

| Single 17-year-old female | $5,653.55 |

| Single 25-year-old male | $2,262.87 |

| Single 25-year-old female | $2,378.89 |

| Married 35-year-old male | $2,312.38 |

| Married 35-year-old female | $2,302.89 |

| Married 60-year-old male | $2,283.45 |

| Married 60-year-old female | $2,247.06 |

Married, female drivers, 60 and over, enjoy the cheapest rates with Geico in this category. Not surprisingly, young male teen drivers have the most expensive rates.

Average Geico Rates by Make and Model

Are you shopping or a new car? One thing to consider when car shopping is the kind of car you drive has a significant impact on the cost of your insurance. In the table below, we showrates for five specific vehicles, see how your rates compare.

| Make and Model | Average of Annual Premium |

|---|---|

| 2018 Honda Civic Sedan – LX with 2.0L 4cyl and CVT | $3,338.87 |

| 2018 Ford F-150 – Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,338.40 |

| 2018 Toyota RAV4 – XLE | $3,337.18 |

| 2015 Honda Civic Sedan – LX with 2.0L 4cyl and CVT | $3,092.58 |

| 2015 Ford F-150 – Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,092.11 |

| 2015 Toyota RAV4 – XLE | $3,090.89 |

It’s good news if you drive a 2015 Ford F-150 pickup truck. Of the vehicles listed, it has the cheapest rate.

Average Geico Commute Rates

How far you drive to work also impacts your car insurance rates. In the table below, we show data from Geico for two commutes based on distance.

| Commute Details | Average of Annual Premium |

|---|---|

| 10-Mile Commute / 6,000 Annual Mileage | $3,162.64 |

| 25-Mile Commute / 12,000 Annual Mileage | $3,267.37 |

Some companies charge hundreds more for a longer commute. The good news for Geico customers, a longer commute will only cost you $100.

Average Geico Coverage Level Rates

You might think that having the lowest minimum coverage in your state is the best way to cover your insurance needs. But that’s not necessarily the case, because the difference in low to high coverage is often less than you think.

Check out how the table below to see coverage level rates from Geico.

| Coverage Level | Average of Annual Premium Rate |

|---|---|

| Low | $3,001.91 |

| Medium | $3,213.97 |

| High | $3,429.14 |

With Geico, the price to upgrade from minimum to full coverage auto insurance is only $425. With some companies, the price stretches to $1,000 and more.

Average Geico Credit History Rates

Missed a payment? Filed for bankruptcy? If so, you may have to pay more for your car insurance. Check out the rates for Geico in the table below.

| Credit Type | Average of Annual Premium Rate |

|---|---|

| Good | $2,434.82 |

| Fair | $2,986.79 |

| Poor | $4,259.50 |

According to Experian, the average credit score in the U.S. is 675. However, if your credit score is lower, you may face increased rates on car insurance. In some states, bad credit can raise your rates by thousands of dollars. On average, with Geico, bad credit can raise your rates by $1,400.

Average Geico Driving Record Rates

Got a leadfoot? Do you see blue lights in your rearview mirror? What about having a few and getting behind the wheel? We hope you never drink and drive, but there are times when you may get a speeding ticketor be involved in an accident. Not surprisingly, these events may cause your car insurance to go up. Find out if Geico covers medical bills resulting from an accident.

The table below reflects what you’ll pay for car insurance based on your credit score.

| Driving Record | Average of Annual Premium Rate |

|---|---|

| Clean Record | $2,145.96 |

| With One Speeding Violation | $2,645.43 |

| With One Accident | $3,192.77 |

| With One DUI | $4,875.87 |

Getting a DUI can not only cost you thousands of dollars, but it can also lead to fines, revocation of your license, and jail time in some states. With Geico, a single DUI will increase your rates by $2,700. We encourage you to never drink and drive because the life you save may be your own.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Coverages Offered

Not all insurance policy decisions should be based on cost. Before choosing a provider, make sure the company you select has the coverages best suited for your situation. In this next section, we’re reviewing Geico’s bundling options, discounts, company programs, and more.

Geico offers a full line of insurance coverages for whatever you need to insure. From motorcycles to windmills, they have it all. Check out the table below.

| Coverage | Purpose | Example of Coverage Use |

|---|---|---|

| Bodily Injury Liability | This coverage pays for another driver's medical bills/loss of income in an accident you caused. | You glance down to check the GPS instructions and rear-end another car, injuring the driver. |

| Classic Car | Covers classic cars for less than regular auto insurance policies. | Vintage cars used just for pleasure -- driving around on a sunny day. |

| Collision | Pays for repairs to your vehicle in accidents with another vehicle or object. | You hydroplane and crash into a tree. |

| Commercial | Covers vehicles used for business. | You own a flower shop and have a delivery van used for your business. |

| Comprehensive | Pays for repairs in accidents not caused by another vehicle. These accidents include theft, natural disasters and animal collisions. | Your car is parked outside when heavy winds knock a tree onto your car. |

| Gap Coverage | Pays the difference between your vehicle's actual value and what you still owe on your loan/lease. | You total your car. Your car is worth $10,000, but you still owe $15,000 on your car loan. |

| Medical Payments | Pays for your and your passenger's medical costs in an accident. | An accident gave you a mild concussion, and you need to be treated at a hospital. |

| Property Damage Liability | Pays for damages to another person's vehicle/property in an accident you caused. | You accidentally scrape another person's car pulling into a tight parking spot. |

| Personal Injury Protection | Pays for your medical bills and other accident costs (such as lost income). | Your concussion from an accident leaves you unable to work for a month, resulting in medical bills and lost income. |

| Rental Reimbursement | Provides access to a rental car if your car is in shop after a covered accident. | Your car will be in the repair shop for at least a few days, so you need another vehicle to get around. |

| Rideshare | Covers rideshare drivers. | You want to work for Uber or Lyft as a rideshare driver. |

| Umbrella | Provides extra liability coverage. | You were in an accident the other parties are suing you. |

| Underinsured Motorist | Helps you if you are in an accident with an underinsured motorist. | A driver hits you, but has such poor insurance that the driver can't cover your medical and property damage bills. |

| Uninsured Motorist | Helps in hit-and-run accidents or an accident with an uninsured motorist. | You come out of the store and someone has run into your car before fleeing the scene. |

Geico offers an excellent selection of coverages and add-ons, so be sure to speak with your agent about which coverages you need.

Geico’s Bundling Options

How can you save money on car insurance? One great way to save money on insurance is by bundling insurance products together. But what is bundling? Bundling is combining more than one product offered by an insurance company to receive a discount. Find out what are the best insurance companies for bundling home and auto insurance.

Here are the products available for bundling from Geico.

- Car insurance

- Homeowners/condo insurance

- Renters insurance

- Commercial auto insurance

- Business insurance

- Motorcycle insurance

- ATV insurance

- Recreational vehicle insurance

- Boat insurance

The more you bundle, the more you can save.

Geico Insurance Discounts

Geico also offers an impressive selection of discounts. Check out the table below to see what options may be available to you.

| Discounts | Percent Saved |

|---|---|

| Anti-Lock Brakes | 5% |

| Anti-Theft | 25% |

| Claim Free | 26% |

| Daytime Running Lights | 1% |

| Emergency Deployment | 25% |

| Federal Employee | 8% |

| Good Student | 15% |

| Military | 15% |

| Multiple Policies | 10% |

| Multiple Vehicles | 25% |

| Passive Restraint | 40% |

| Safe Driver | 15% |

| Seat Belt Use | 15% |

| Vehicle Recovery | 25% |

These discounts vary by state, so be sure to ask your agent if any apply to you.

Geico Insurance Programs

What else does Geico offer customers? Check out the programs below to see if they may be beneficial to you.

- Accident Forgiveness – Geico accident forgiveness is a great way to save money on your premiums. If you have a bad driving record or are a new customer, a monthly fee may apply until you’ve proven you are a good driver. However, accident forgiveness ensures sure your rates don’t increase with your first accident at Geico.

- Auto Repair Express – Geico’s car repair program makes sure you receive priority treatment at repair shops so you can quickly get back on the road after an accident.

- Car Buying Service – This program allows consumers shopping for new vehicles to see what others have paid for similar vehicles

- DriveEasy App – Geico’s usage-based app offers discounts for drivers that have safe driving habits. Save up to 20 percent just for signing up.

- Prime Time Contract – A guaranteed renewal program for drivers over 50.

Geico has a great selection of coverages and discounts available to customers, more than other companies that can provide excellent protection at affordable prices. However, the insurance giant is missing simple discounts like autopay and paperless billing.

Rating Agency

Many companies claim to be better than the competition, and Geico is no exception. Let’s see what multiple independent agencies say about Geico and if they are the right car insurance company for your needs. Check out the scores in the table below.

| Ratings Agency | Rating |

|---|---|

| A.M. Best | A++ (Superior) |

| Better Business Bureau (Northbrook, IL) | B+ |

| Consumer Reports | 89 |

| J.D. Power | 4/5 Overall Satisfaction |

| Moody's | Aa3 (Excellent) |

| NAIC Complaint Index Ratio | .80 (2018) |

| Standard & Poor's | AA+ (Very Good) |

So, who are these agencies and what do their ratings mean? In the next section, we’ll find out.

A.M. Best

An A.M. Best rating measures the financial stability of a company, with A++ being the highest rating possible. Geico earned an impressive A++ rating, which means the company has a stable financial future.

Better Business Bureau (BBB)

This rating looks at multiple aspects of a business, although the most critical element is the company’s complaint history. A complaint history shows how satisfied customers are with the service they receive.

Since A+ is the highest rating the BBB gives, the Better Business Bureau views Geico’s B+ as good and reflects a generally positive relationship with customers.

Moody’s Rating

Moody’s rates companies on purely financial aspects.

Geico earned an Aa3 rating from Moody’s, which is excellent.

This rating means that Geico has a superior ability to repay short-term debts, such as claims.

Standard & Poor’s (S&P)

What does a rating from S&P mean? This video explains more.

Geico has earned an AA+, representing a “very strong capacity to meet financial commitments.”

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) measures the number of complaints a company receives. In 2018, the company’s complaint ratio was 0.71, and below the national average of 1.51.

Let’s look at the complaint ratio for Geico over the last four years in the table below.

| Private Passenger Policies | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total Complaints | 271 | 333 | 272 |

| Complaint Index (better or worse than National Index) | 0.44 (better) | 0.81 (better) | 0.71 (better) |

| National Complaint Index | 0.78 | 1.21 | 1.15 |

| U.S. Market Share | 2.39% | 2.41% | 2.46% |

| Total Premiums | $5,123,336,205 | $5,572,270,812 | $6,055,079,973 |

One thing to consider is that your experience may be better or worse than these ratings based on your insurance needs.

J.D. Power

Another rating to look at when researching an insurance company is customer satisfaction levels. J.D. Power rates companies solely on customer satisfaction levels. Check out the scores for Geico in the table below.

| State or Region | Power Circle Ranking | Numeric Score out of 1,000 | Percentage of Companies With Higher Numeric Score |

|---|---|---|---|

| California | About average | 807 | 65% |

| Central | Better than most | 838 | 14% |

| Florida | Better than most | 832 | 14% |

| Mid-Atlantic | Better than most | 848 | 8% |

| New England | About average | 827 | 20% |

| New York | About average | 813 | 78% |

| North Central | About average | 830 | 33% |

| Northwest | About average | 805 | 55% |

| Southeast | About average | 839 | 13% |

| Southwest | The rest | 798 | 75% |

| Texas | The rest | 816 | 50% |

Geico earned average ratings across most of the U.S., which isn’t bad. The point score is out of 1,000, and Geico consistently scored above 800.

Consumer Reports

Consumer Reports is a non-profit and independent organization that’s working to bring transparency into the marketplace for consumers. The company works to help consumers with purchase decisions, drive fair competition, and improve the products that companies offer.

| Claims Handling | Score |

|---|---|

| Total | 89 out of 100 |

| Ease of Reaching an Agent | Excellent |

| Simplicity of the Process | Very good |

| Promptness of Response – Very Good | Excellent |

| Damage Amount | Very good |

| Agent Courtesy | Excellent |

| Timely Payment | Excellent |

| Freedom to Select Repair Shop | Very good |

| Being Kept Informed of Claim Status | Very good |

Customers had very complimentary things to say about Geico. Two scores that received an “excellent” rating were agent courtesy and simplicity of the process.

Company History

Although the beloved Geico mascot, a green gecko, made its debut only 20 years ago, the Government Employees Insurance Company was founded in 1936 by Lilliam and Leo Goodwin. The company wanted to offer government employees the opportunity to be covered against something as tragic as the Great Depression should the need ever arise.

In 1959, Geico headquarters were established in Chevy Chase, Maryland, where they are still located today. The company has seen steady growth since its inception and now ranks as the second-largest insurer behind State Farm in the United States.

Why should you care about the history of Geico? Because looking at a company’s history provides crucial data about how successful the company is and what its future looks like.

Many factors make up a company, including how well it treats customers, its involvement in the community, and whether it’s financially stable enough to weather volatile disasters and economic situations.

In the following sections, we’re going to discuss everything from Geico’s market share to what employees think about working there.

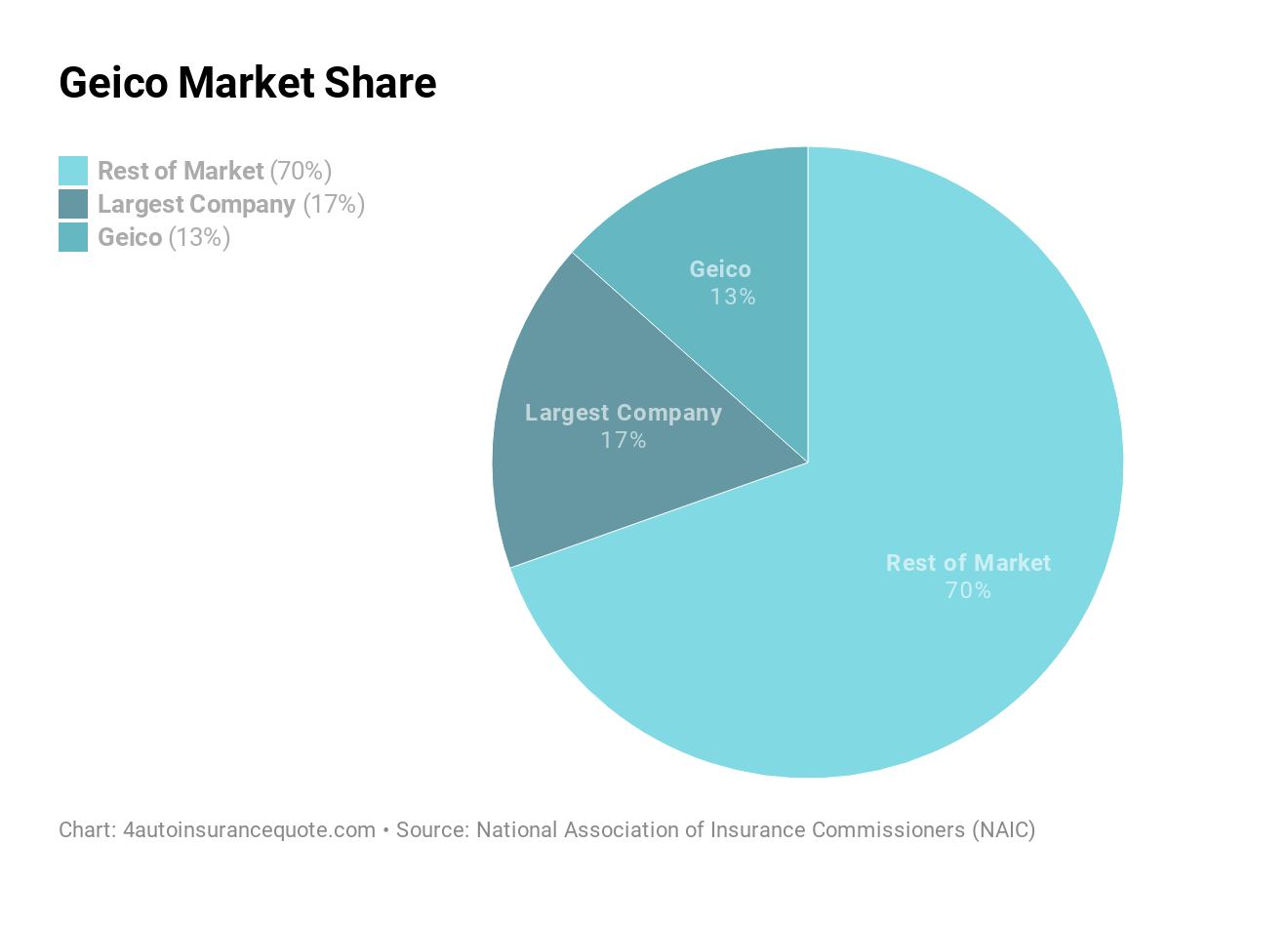

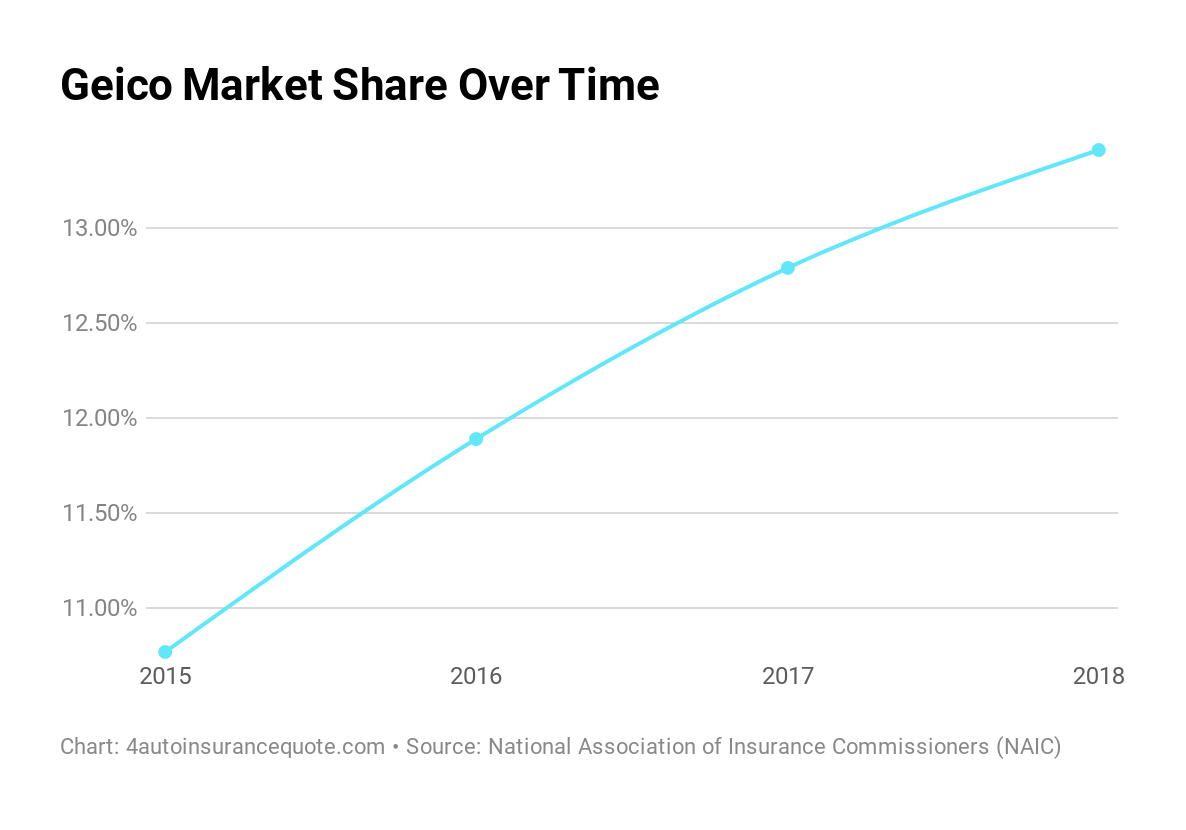

Geico Market Share

The market share of a car insurance company determines how strong the company has become in the industry. A higher market share also means that an insurer is the preferred choice of consumers.

Let’s check out the growth of Geico over the last several years.

| Year | Total Market Share |

|---|---|

| 2013 | 10.24% |

| 2014 | 10.77% |

| 2015 | 11.41% |

| 2016 | 11.89% |

| 2017 | 12.79% |

| 2018 | 13.41% |

Geico has increased its market share by three percentage points in our review period, signaling customers like the company and its rates.

Geico’s Position for the Future

Geico has a good future ahead of it. It has great financial standing (according to multiple different rating sites) and has shown steady growth, surpassing Allstate in market share.

Read more: What happens if I disagree with Allstate’s decision on my auto insurance claim?

Despite customer satisfaction ratings that claim Geico is average and needs to improve in certain areas, the company continues to grow at a steady pace. The company also has affordable rates, which is probably why so many drivers switch to Geico.

With great rates, a clever advertising slogan, and good customer satisfaction scores, Geico should be around for years to come.

Geico’s Online Presence

Geico has multiple options if you want to access information or get in touch with someone about your car insurance needs.

- Online – You can find Geico quotes and more online at the Geico website.

- Agents – You can talk to agents by calling 1-800-207-7847.

- Apps – Geico offers a mobile app through which you can access your policy information and contact agents.

No matter your preferred mode of communication, Geico makes it easy to connect.

Geico’s Commercials

We all know the little green gecko. Let’s revisit some of the company’s best commercials.

What about a 15-minute telephone call?

And, lest we forget the caveman commercials:

Clever advertising is undoubtedly not the only reason the company continues to grow. In the next sections, we’re going to show you what the company is doing in the community and what employees think about working there.

Geico in the Community

Community outreach shows a company cares, and Geico has several programs where the company and employees can give back to the community.

Check out Geico Cares in the following video:

Another program Geico supports is the National Children’s Hospital in Washington, D.C., where it has raised 3.4 million dollars for the hospital to help pay for pediatric care for children.

Geico’s Keepin’ it Green program provides these benefits:

- Introducing recycling programs as well as energy and water-saving efforts in Geico insurance offices

- Saving energy, fuel, and paper through Geico’s paperless options

- Continuing to seek better ways to eliminate waste and improve efficiency in our offices

Geico also hosts blood drives every year to encourage employees to get involved and donate.

Geico’s Employees

What’s it like working at Geico? Let’s see what employees think. Let’s begin by looking at employees’ experience ratings according to A Great Place to Work.

- 86 percent say people are treated fairly regardless of sex.

- 86 percent say Geico is a friendly place to work.

- 85 percent say employees are given a lot of responsibility.

- 85 percent say they feel good about the ways the company contributes to the community.

- 85 percent say that when you join the company, you are made to feel welcome.

Another company we’re going to look at is Glassdoor. According to Glassdoor, the average age of employees who work at Geico is 28 years of age. Salaries at Geico range from $26,000 to over $100,000 per year, depending on your job title.

What else did employees say?

- The average employee review for Geico is 3.2 out of 5

- Employees get great benefits

- Employees have a “poor work-life balance”

Here’s what reviews at Payscale said:

- Geico employees gave the company an average rating of 3.2 out of 5 in Overall Satisfaction

- Geico employees gave the company the highest rated reviews in company outlook (4.4 out of 5), manager relationship (4.1 out of 5), and manager communication (3.8 out of 5)

- Geico employees rated the pay at the company as a three out of five

Geico has also won numerous awards and accolades:

- 2018 The Des Moines Register ranked Geico’s Coralville office as a Top Workplace

- 2018 BestCompaniesAZ nominated Geico’s Tucson office as one of the 100 Best Companies in AZ

- 2018 Employer Support of the Guard and Reserve (ESGR) Patriot Award

- 2018 Michael J. Harris Spirit of Tucson Award (Tucson office)

- 2018 Virginia Values Veterans (V3) recognized Geico for its commitment to hiring veterans

Are you interested in learning more about a career with Geico? Click here to learn more about possible opportunities.

Free Auto Insurance Comparison

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Canceling Your Geico Insurance Policy

On occasion, you may find yourself wanting to cancel your auto insurance policy. Here are examples which may apply to you:

- Selling a car and not replacing it

- Storing a classic or antique vehicle

- A teen is heading to college and will no longer be driving the vehicle

- A vehicle has been paid off and no longer requires comprehensive auto insurance coverage

- Dissatisfied customer

- Rates too high

- Moving abroad

In this next section, we’re going to show you the steps involved with canceling an insurance policy with Geico.

Cancellation Fee

Unlike some of the other top 10 insurance providers, Geico doesn’t assess a cancellation fee if you decide to cancel Geico auto insurance.

Is there a refund?

For customers who cancel Geico insurance policy, a prorated portion of their policy will be refunded if cancellation is before the start of the next billing cycle.

How to Cancel

If you want to cancel your policy with Geico, you’ll have to pick up the phone and call 1-800-841-1587 to speak with an agent. If switching providers, you’ll need to have proof of insurance from a new carrier, or Geico may not cancel your policy. A lapse in coverage can result in penalties and fines and is against the law.

You may be asked to say your Geico policy number, so be sure you have it handy.

Keep in mind that Geico only allows cancellation by phone, and the agent may offer incentives to keep you as a customer. The phone line to cancel is available 24 hours a day, seven days a week.

Can I cancel my auto insurance with Geico at any time?

You can cancel at any time, even if it’s before a renewal cycle ends. Some insurers penalize customers who cancel before a renewal cycle ends, but Geico doesn’t have a penalty fee.

Can i cancel Geico online?

To be sure your policy is canceled, call Geico or sign onto your online account. If automatic payments are being utilized, check to make sure you still aren’t being charged.

How to Make a Claim with Geico

What information do I need to file an auto insurance claim with Geico? Accidents can and do happen, and unfortunately, you may need to file a claim with your insurance company. We know in times of stress, you want a provider that is fast and reliable and can help you through the process.

In the next section, we’re going to discuss how the claims process works and how many claims were paid out by Geico.

Let’s get started.

Read more: What happens if I disagree with Geico’s decision on my auto insurance claim?

Ease of Making a Claim

Geico makes it easy to file a claim with them in the following ways:

- By phone, calling 1-800-841-3000

- Contacting your local agent

- Using the Geico app

- Online claim form through Geico’s site

Once you’ve filed a claim, you can track the claim’s progress in your online account with, or call and talk to a representative with any additional questions. Find out how long does it typically take for Geico to process an auto insurance claim?

Up next, we review how Geico pays out claims to its customers.

Premiums Written

How do premiums written relate to claims? The answer to that question is the higher the number of premiums written, the less customers have to pay. A company with lower written premiums will have to charge policyholders more to cover the cost of accident claims.

Let’s take a look at the NAIC’s data on Geico’s written premiums.

| Year | Premiums Written | Market Share |

|---|---|---|

| 2015 | $20,520,188,000 | 10.77% |

| 2016 | $25,531,762,000 | 11.89% |

| 2017 | $29,596,404,000 | 12.79% |

| 2018 | $33,075,434,000 | 13.41% |

The company has seen a nearly seven-billion-dollar increase in premiums written from 2015–2018.

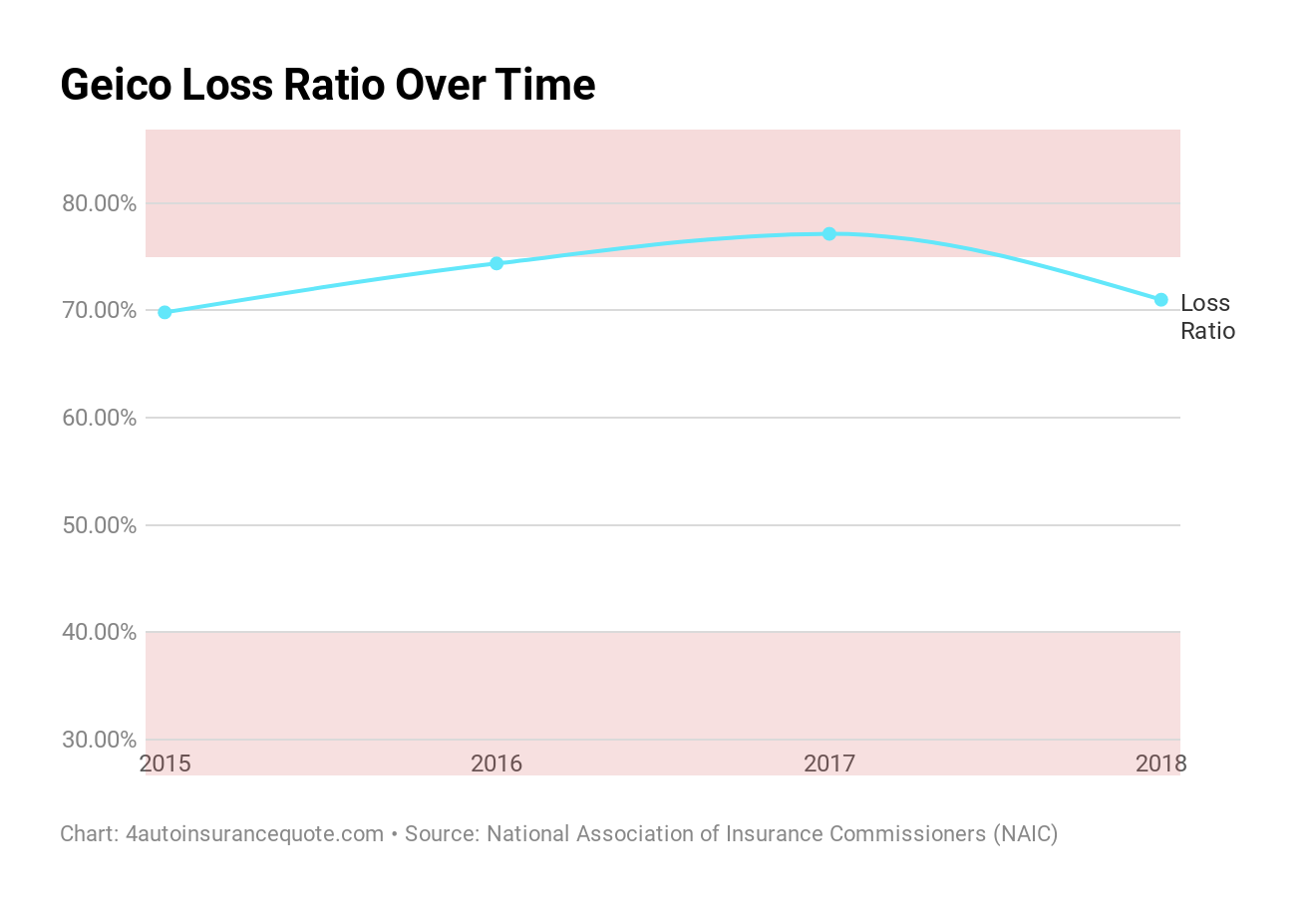

Loss Ratio

What exactly is a loss ratio?

A loss ratio calculates the number of written premiums compared to the number of claims. A company with a 65 percent loss ratio is paying $65 on claims for every $100 earned from written premiums.

A high loss ratio may seem reasonable, but anything over 100 percent means a company is risking bankruptcy. Conversely, a low loss ratio means a company isn’t paying out a large number of claims.

| Year | Loss Ratio |

|---|---|

| 2015 | 69.82% |

| 2016 | 74.38% |

| 2017 | 77.14% |

| 2018 | 71% |

In each year for which loss ratio was measured, the numbers were all within the acceptable range.

Can you get Geico insurance online?

Ready to get a quote? In the next section, we show you the steps needed to find auto insurance quotes online. Before you get started, be ready to provide the following items:

- Date of birth

- Contact information (name, phone number, address)

- Social Security number

- Vehicle information

This information is needed to secure an accurate quote.

Step One – Go to the Geico Website

The Geico website is www.geico.com which is easy to remember and find online.

Select the type of insurance you need, enter your ZIP code, and click start quote.

Step Two – Enter Contact Information

The first set of information you will be asked to enter is personal information. Geico will request your name, address, and contact information.

Geico also offers the opportunity to sign in with your Facebook account, but if you don’t want to combine information, it’s best to avoid it.

Step Three – Enter Vehicle Information

On this screen, Geico will ask you to enter information about your vehicle(s).

Enter what you know about your vehicles, such as make and model and distance driven.

It’s a good idea to take a few minutes and think about how far you drive because as we covered earlier, a longer commute may make your rates higher.

Step Four – Driver Information

Geico will also ask questions dealing with driver histories, such as past accidents and driving violations.

Geico will also ask questions about driving courses and affiliations to determine any applicable discounts.

On the last page, Geico gives you an option to customize coverage. If you skip this step, Geico will provide you a quote for the minimum coverage required in your state.

Step Five – Enter Your Contact Information

Enter a contact number and email address so that Geico can send you your quote.

If you’re not ready to continue with the quote process, inputting your contact information will allow you to come back to your quote for up to 90 days.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Design of Website/App

While other car insurance company websites and apps may be difficult to navigate, Geico’s website is sleekly designed and easy to use. On the website, it’s easy to find whatever information you’re searching for. Just click from any of the categories on the drop-down menu and go.

Below is an example of what appears when you click on the insurance drop-down menu.

Accessing any part of the website is quick and easy. Just click on a tab and go.

Geico, like most insurance providers, has an app that customers can utilize to connect quickly with the company. The app has scored well with customers, receiving 4.8 stars (from over 1.4 million reviews) in the Apple store.

The majority of reviews are positive. Most of the complaints are about simple bugs, which are usually fixed with updates.

So, what can you do with Geico’s mobile app? Check out the list below.

- View/share ID cards

- Pay/manage bills

- Roadside Assistance

- Submit claims/view claims process

- Submit pictures of an accident

- Talk to Geico representative

- Get a new quote

- Use Geico Explore

The app is so useful that you can do everything from pay bills to submit a claim on your phone.

Geico’s DriveEasy app has also done well, although reviews are limited.

Geico’s usage-based app has avoided common bugs that other driving apps have, such as incorrect recording of hard-braking. However, users say that the app drains their smartphone’s battery.

Geico Pros and Cons

Now that we have covered everything you need to know about Geico let’s check out the biggest takeaways in terms of pros and cons.

| Pros | Cons |

|---|---|

| Consistently low rates | Higher than usual rates for having bad credit or driving violations |

| Award-winning mobile services | Just recently (2019) made available a safe driving app for usage-based insurance |

| Ease of getting a quote online | Higher than usual rates for residents of Hawaii, Nebraska, New Mexico, and Rhode Island |

| Available in all 50 states | May have increased rates if you move |

Generally, Geico has rates as competitive or better than other top providers. However, if you have a low credit score or a bad driving record, any savings may be negated.

Geico Car Insurance: The Bottom Line

Researching an insurance company is a great way to make sure you and your family are covered whenever an accident occurs, and you need to file a claim. We’ve shown you everything you need to know about Geico, so you can decide for yourself whether they are the best company to suit your needs.

Did we miss anything? What did you find most useful?

Geico is the second-largest insurance company in the country, and customers give them mostly favorable reviews. One thing to consider is that everyone’s insurance needs are different.

As comprehensive as this guide is, your rates will vary and depend on the information you provide.

Get quotes today to find out how much you could save on car insurance with Geico. Get started by entering your ZIP code in our FREE comparison tool.

Frequently Asked Questions

What do you need to obtain a Geico quote?

To get a quote online, you’ll need to provide your name, date of birth, address, phone, and email. Also needed to complete an online quote are your vehicle information and any citations or accidents.

How much liability car insurance should I get with Geico?

The minimum amount of liability auto insurance coverage you’re legally required to have varies by state. The agent who handles your policy will advise you on your state’s minimum requirements and offer further coverages to keep you fully protected.

Does Geico cover windshield repairs or replacements?

Geico will cover windshield repair and replacement only if you have comprehensive coverage. Call your local agent or go online to learn more.

Is Geico car insurance expensive?

The cost of coverage with Geico will vary depending on many of the factors mentioned above. To get the best protection at an affordable price, we encourage you to look at all discounts options available from Geico.

Geico SuckIT

Geico review

Tomer Ravid

GEICO review

Volodymyr_Korolevych

Adjuster stopped responding

Sergei_K

Can't get rid of them

vscore16

BAIT AND SWITCH

Trinidad2_

geico is the best

Jotwox

Not recommend

Waycross43_

Helpful

Babanana

Geico is amazing

Justin_Kim

Filing a claim at geico