How COVID-19 Could Lower Auto Insurance Rates (2026)

Because of COVID-19's impact on driving and traffic, auto insurance companies are refunding billions of dollars to drivers with traffic down over 90% across the US. Refunds are ranging between 15-25% on policies.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Dec 17, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 17, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Overview

- Traffic is much lighter due to the fallout from the coronavirus

- See which car insurance companies are issuing refunds because of this trend with COVID-19

- Most insurers are pausing late fees and non-pay cutoffs

- Some companies are extending personal car insurance coverage for delivery drivers

This is a scary time, as the novel coronavirus makes its way around the world, disrupting everyone’s normal routine. Many states have issued stay-at-home and shelter-in-place orders. A record number of unemployment claims have been filed, and a large portion of the workforce is now working from home. That means fewer cars on the road, fewer accidents, and less need to have top-tier auto insurance for many people.

When it comes to coronavirus and car insurance there are numerous variables. What should you do about saving money on your car insurance if you’re at home and driving less or not at all? How could COVID-19 lower auto insurance rates?

We’ll go over that, including which insurers are giving refunds due to COVID-19 and some ways you can save money on your policy. You can also use our free tool to get a free quote, as that may be one way to start saving right now.

Will you be getting a refund for driving less during the COVID-19 pandemic?

Several major insurers are following the recommendation by the CFA.

COVID-19 Refunds from Auto Insurance Companies| COMPANY | AMOUNT REFUNDED | METHOD OF REFUND |

|---|---|---|

| Allstate (including Esurance, and Encompass) | 15% of April and May premiums ($600 million total) | Option of either credit or cash refund |

| American Family (AmFam) | $50 per vehicle ($200 million total) | Paper check |

| Farmers | 25% of April premiums | Credit |

| Geico | 15% at renewal, an average of $150 per auto policy ($2.5 billion total) | Credit |

| Liberty Mutual & Safeco | 15% for two months of premiums ($250 million total) | Option of either credit or cash refund |

| Nationwide | $50 per policy | Cash |

| Progressive | 20% for April and May premiums | Credit |

| State Farm | 25% of premium between March 20 and May 31 ($2 billion total) | Credit |

| Travelers | 15% for April and May's premiums | Credit |

| USAA | 20% for two months of premiums ($520 million total) | Credit |

Many companies have pledged to give paybacks to their customers, as car accidents are decreasing with fewer drivers on the road.

- Allstate — along with its subsidiaries Esurance and Ecompass — will be returning $600 million, which will be an average of 15 percent of each driver’s policy. This payment will get credited to your account or it will go through through the most recently used payment method, such as your debit card.

- American Family will return $200 million to its customers, which will break down to a one-time payment of $50 for each vehicle. Physical checks will be mailed to each customer.

- Farmers insurance is giving a 25 percent discount on premiums for the month of April.

- Geico insurance will return an average of $150 per auto insurance policy, though there is no cash option and the refund will be in credit towards a future bill. That’ll be around $2.5 billion for the nation’s second-largest insurer by market share.

- Liberty Mutual and its subsidiary Safeco will be returning a total of about $250 million. That’ll work out to about a 15 percent refund over two months for each customer. You can choose a check or can receive the payment through the most recently used payment method.

- Nationwide is returning per personal auto insurance policy, to the most recently used method of payment on the account. Read our Nationwide auto insurance review to learn more..

- State Farm will be giving back a 25 percent credit to your policy between March 20th and May 31st.

- Travelers insurance will be applying a 15 percent credit for all of their drivers on their April and May premiums. This will be automatic, so you won’t need to take any extra steps to get it.

- USAA will be returning a total of $520 million to its customers. That’s around 20 percent of the premiums over two months for each USAA member, and this credit is automatically applied.

Many more companies will probably follow suit, but insurers will likely still have record-breaking profits during this time.

Read more: What do I need to do to cancel my auto insurance policy with Safeco Insurance?

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

What are some ways to change your existing auto insurance policy to save money during the coronavirus pandemic?

First off, the number of miles you put on your vehicle can be a significant contributor to how high your auto insurance rates are, though it varies based on which insurer you choose and whether you are using your vehicle for pleasure or commute driving.

If you have a long commute, many insurers charge you more because your risk of getting into a car accident goes up. Now is a good time to call your auto insurance company and update your average commute length to see if that can lower your bill.

Another thing you may be able to lower would be your coverage limits. If you have a high level of coverage, you might want to consider changing it to a lower or medium level. Granted, this isn’t normally a great idea, and it usually doesn’t even save a lot of money. But it varies and may be different for some drivers. Plus, if you have an older vehicle, it might just make sense anyway, COVID-19 aside.

How can you make a payment during the COVID-19 pandemic?

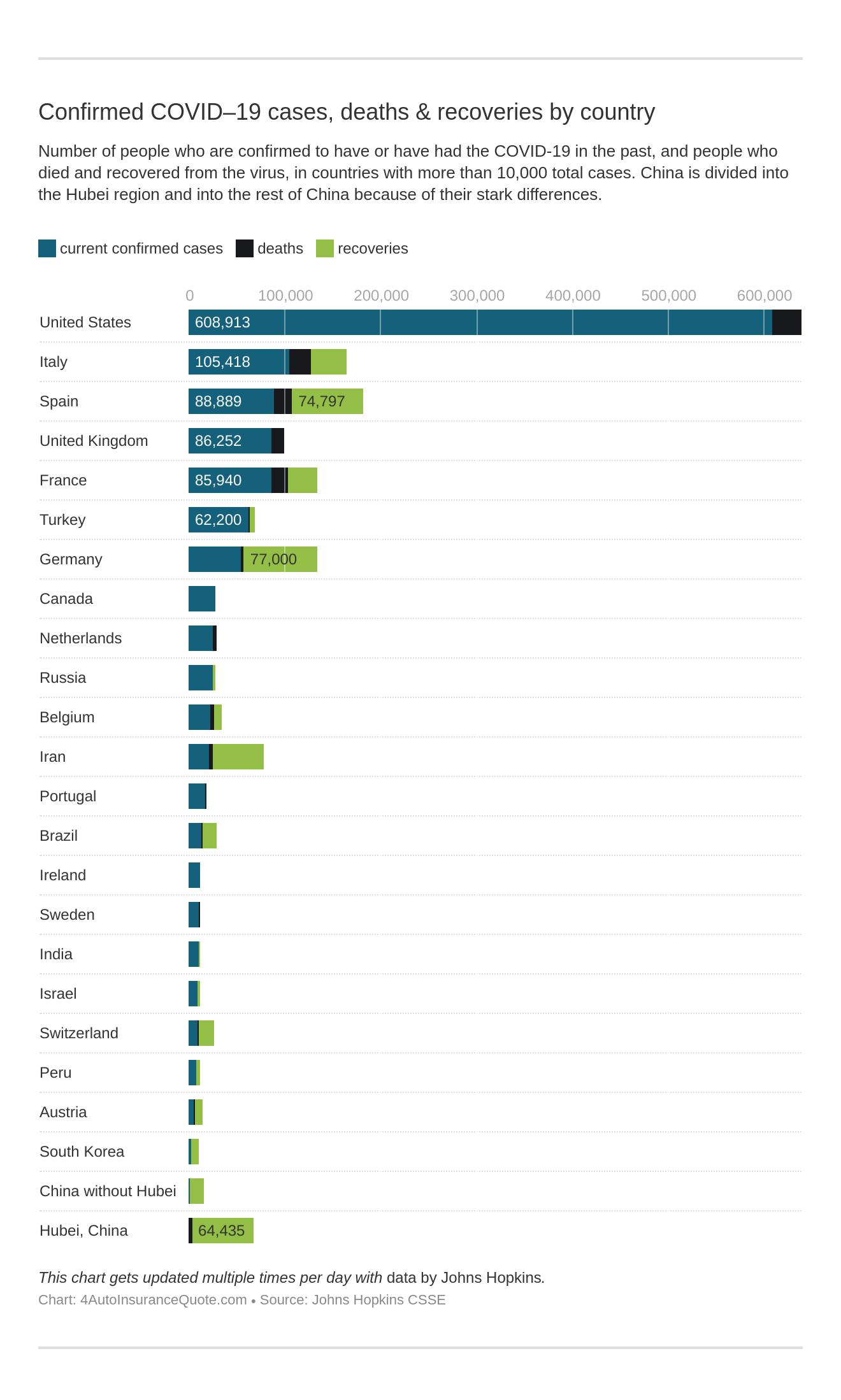

There’s no denying that COVID-19 has changed our “normal.” The numbers keep growing, with John Hopkins University estimating deaths are doubling every three days. You can see how the coronavirus is covering the country right now below.

One thing that’s changed is the unprecedented number of people who are working from home. That includes most employees at the major auto insurance companies.

If you do end up getting into a car accident, you’ll still be able to contact your representative and file a claim. A lot of them are working from home now, but they’re still there to help. Most large insurers also have mobile apps that can help you make a payment or even file a claim.

Some car insurance companies are relying more heavily on virtual inspection tools and video chats to assess damages. Insurers will still be there to help if you need them.

What if you can’t afford to make a payment during the COVID-19 crisis?

So many people’s lives have been altered by the coronavirus already, and many have felt the change most significantly in their wallets.

Luckily, nearly all of the major insurers have at this point announced they will not be disconnecting customers for non-payment nor applying late fees for the time being.

It’s worth noting that this is only for a specified duration, which may change as we get deeper into the coronavirus crisis. Most insurers say that their pausing of late fees and cut-offs will be temporary, and all premiums that are owed will be due at the end of this time frame.

Should you cancel or pause your auto insurance during the coronavirus pandemic?

The short answer here is no.

There are different types of coverage for the various scenarios you may face.

Each type covers specific scenarios, and each is still going to be pretty important as we all navigate current events.

Most states require minimum liability auto insurance. Liability covers damage done to another vehicle or vehicle occupant in the event that you cause an accident.

While you might live in one of the states, like New Hampshire or Virginia, where there are other options, you’ll still have to pay out for that time when you’re uninsured.

If you have to leave home for any reason, like picking up food or going to a medical appointment, you’ll need liability insurance on your vehicle. Considering that most people don’t have the option to stay at home for months without leaving for supplies, it’s just not worth the risk of being uninsured. Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Should you drop coverage that isn’t required by law during the COVID-19 pandemic?

You also may have comprehensive and collision insurance. If you’re financing your car, you’re probably required by the lender to have full coverage auto insurance for the duration of your loan. But, even if you don’t, comprehensive is there to cover more situations that you might not have considered.

It’s springtime, and that means the weather is changing. Spring brings hail storms and heavy winds, which can cause a tree branch to fall onto your car that’s sitting in the driveway. If you don’t have comprehensive, you’ll be out of luck and will have to cover those damages out-of-pocket.

Crime isn’t sheltering in place either, so you’ll want to keep comprehensive insurance in case your vehicle gets stolen or broken into.

Most people don’t have enough supplies to last for months on hand, so there will be times you’ll have to go out to get groceries, even if you are working or staying at home during this time. If you drop collision insurance and get into an accident with an uninsured driver, you could end up with a huge bill that you won’t have help with.

There are other things that you can do to save money on your auto insurance, but it’s not a good idea to drop any part of your coverage right now.

Should you change to pay-per-mile auto insurance during the COVID-19 pandemic?

It depends, and it may be more of a headache than it’s worth if you never used it as an option before. Pay-per-mile auto insurance is mostly purchased for back-up vehicles that aren’t used on a daily basis or by people who work really close to home and rarely travel (read our “Can you pause auto insurance while traveling” for more information).

The thing is: we don’t yet know how long COVID-19 will be disrupting our everyday lives, and most policies are written for six months at a time. You’ll be subject to a cancellation fee if you decide to cancel the pay-per-mile and reinstate a traditional policy.

That said, you can still look into usage-based auto insurance and see if it might be worth it if these criteria fit your everyday life. It varies for each driver and is not available in each state.

How has traffic congestion decreased due to coronavirus?

If you’ve been out and about, you probably noticed that traffic has been very light recently. Streetlight Data has compiled a map that shows how much traffic has declined across the country. Two of the hardest-hit cities are New York City and Los Angeles, where traffic has decreased 92 percent and 73 percent, respectively. Because of this, the number of road accidents has also declined, and the need for insurance doesn’t seem to be as high.

The Consumer Federation of America (CFA) has urged all insurers to provide paybacks to their drivers, as fewer people on the roads are resulting in fewer accidents.

The Consumer Federation of California Education Foundation(CFC) is also petitioning for insurers to refund a portion of paid premiums, stating that insurers stand to make a huge profit from the virus because fewer road accidents will occur, meaning fewer claims getting paid out.

Insurers can certainly expect a large profit increase if things continue without some paybacks. With fewer claims but the same amount of money in premiums being collected, the equilibrium of payment is being offset in favor of the large insurance company.

How do you keep your vehicle covered if you rideshare or deliver supplies during COVID-19?

Normally, your personal policy does not cover you when you’re making food deliveries — you may need business car insurance for food delivery. This may be something you’ve never thought of if you’re a new delivery driver, but a company will probably deny your claim if an accident occurred while you were making a delivery.

This is because you’re using your vehicle much more frequently while you’re working, so you need to purchase separate commercial insurance that takes over when you start that delivery and drops when you complete it.

However, some companies are now taking special considerations with COVID-19 and covering your vehicle for accidents that may occur while working.

Allstate is covering their customers who use their personal vehicles to deliver medicine, food, and other goods professionally. This additional protection is automatically added to all policies right now if an emergency order is in place where you live.

Nationwide has pledged to provide coverage for most restaurants and retailers who are now doing business by delivery due to COVID-19 restrictions.

American Family is also extending personal auto insurance coverage to delivery drivers who are out there risking exposure to bring essential supplies to people.

How can delivery drivers keep their vehicles sanitized against the coronavirus?

If you’re making money with deliveries right now, it’s important to keep your vehicle clean and sanitized to prevent the spread of the novel coronavirus. You should also follow the recommended practices from the Center for Disease Control (CDC).

According to the (CDC), there are a few practices you should follow in order to lessen the chances of catching or spreading the virus.

- Wash your hands often

- Don’t touch your face

- Practice social distancing

Also, keep your car well-ventilated if you’re sharing the space with someone else.

According to the National Institutes of Health (NIH), the virus can survive on surfaces for an extended period of time. For instance, the coronavirus can survive:

- Up to 24 hours on cardboard surfaces (most packages)

- Up to two to three days on plastic and stainless steel surfaces (the interior trim of your vehicle)

This is important to remember if you’re delivering food or medicine during this time. Make sure to keep your hands washed or use hand sanitizer often to avoid cross-contamination.

This is a tough time for everyone, but relentless forward progress is the answer.

While you’re looking for ways to save money, you might want to check out our free tool below. You can get an insurance quote right now and hopefully save some money.

Frequently Asked Questions

Will I be getting a refund for driving less during the COVID-19 pandemic?

Several major insurers are following the recommendation by the CFA and offering refunds to customers due to decreased driving and accidents. Many more companies may follow suit, but insurers are still expected to have record-breaking profits during this time.

What are some ways to change my existing auto insurance policy to save money during the coronavirus pandemic?

You can consider updating your average commute length to reflect your decreased driving, which can potentially lower your rates. You may also review your coverage limits and consider reducing them if appropriate for your situation.

How can I make a payment during the COVID-19 pandemic?

Many auto insurance companies have shifted to remote work and offer various options for making payments, including online payment portals and mobile apps. You can still contact your representative for assistance with payments or claims.

What if I can’t afford to make a payment during the COVID-19 crisis?

Most major insurers have announced that they will not disconnect customers for non-payment or apply late fees during this time. However, the premiums owed will still be due at the end of the specified duration.

Should I cancel or pause my auto insurance during the coronavirus pandemic?

It is generally not recommended to cancel or pause your auto insurance, as it is a legal requirement in most states and provides essential coverage in case of accidents or unforeseen events. Dropping coverage can leave you financially vulnerable and expose you to risks.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.