Cheap Auto Insurance for Medicaid Recipients in 2026 (8 Most Affordable Companies)

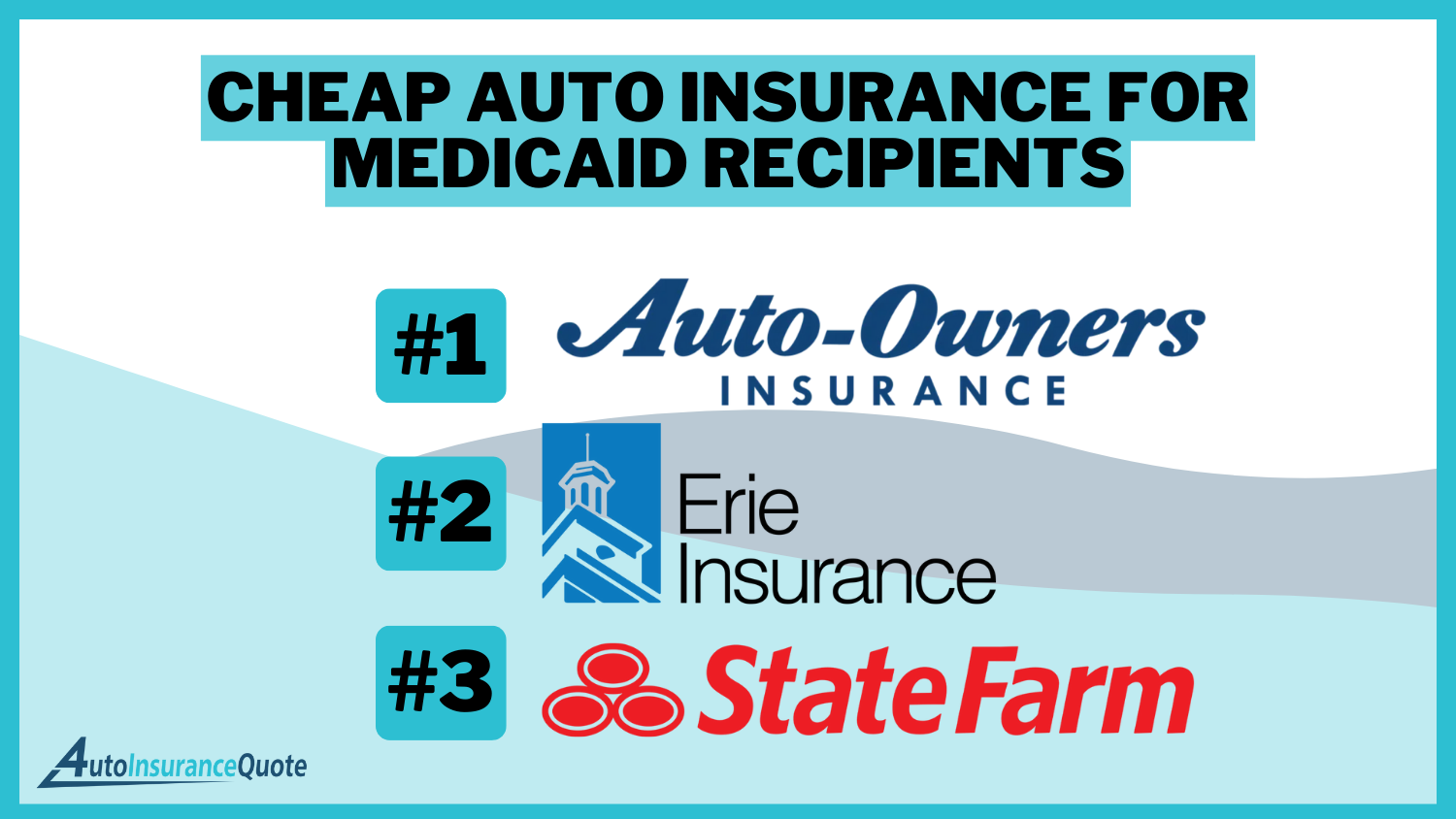

The cheap auto insurance for Medicaid recipients are offered by Auto-Owners, Erie, and State Farm offering tailored coverage and rates starting as low as $27 per month. These companies provide affordable coverage designed to meet the needs and financial capacity of Medicaid recipients.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage for Medicaid Recipients

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage for Medicaid Recipients

A.M. Best Rating

Complaint Level

The best cheap auto insurance for Medicaid recipients is offered by Auto-Owners, Erie, and State Farm. With rates starting as low as $27 per month, these companies provide affordable coverage tailored to meet the needs of Medicaid recipients.

Auto-Owners stands out as the top pick overall, offering competitive rates, auto insurance discounts, excellent customer service, and a range of coverage options. Whether you’re in California, New Jersey, or Hawaii, finding the right auto insurance coverage doesn’t have to break the bank.

Our Top 8 Company Picks: Cheap Auto Insurance for Medicaid Recipients

Company Rank Monthly Rates Safe Driver Discount Best For Jump to Pros/Cons

#1 $27 20% Personalized Service Auto-Owners

#2 $31 20% High Satisfaction Erie

#3 $33 15% Reliable Service State Farm

#4 $39 25% Regional Coverage American National

#5 $41 26% Budget-Friendly Geico

#6 $43 23% Tech-Savvy Drivers Travelers

#7 $46 15% Community Focused Farm Bureau

#8 $66 20% Flexible Policies Progressive

Compare quotes now and get the coverage you need at a price you can afford. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Auto-Owners offers the best rates providing excellent service

- Rates start as low as $27/month, making coverage affordable

- Auto-Owners offers cheap auto insurance for Medicaid recipients

#1 – Auto-Owners: Top Overall Pick

Pros

- Cheap Monthly Rates: Auto-Owners offers the lowest monthly rates among our top picks, making it an affordable option.

- Generous Safe Driver Discount: With a 20% safe driver discount, Auto-Owners rewards safe driving habits.

- Personalized Service: Auto-Owners auto insurance review is known for its exceptional customer service and personalized approach to insurance.

Cons

- Limited Availability: Auto-Owners operates in fewer states compared to some larger insurance providers.

- Online Presence: While Auto-Owners provides excellent personalized service, its online tools and mobile app may not be as robust as some competitors.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – Erie: Best for High Satisfaction

Pros

- Affordable Rates: Erie offers competitive monthly rates, making it an attractive option for budget-conscious consumers.

- Generous Safe Driver Discount: With a 20% safe driver discount, Erie rewards safe driving habits.

- High Customer Satisfaction: Erie auto insurance review is known for its excellent customer service and high customer satisfaction ratings.

Cons

- Limited Availability: Erie operates in a limited number of states, which may restrict its accessibility for some customers.

- Limited Discounts: While Erie offers a safe driver discount, its range of other discounts may be more limited compared to some competitors.

#3 – State Farm: Best for Reliable Service

Pros

- Wide Coverage Options: State Farm auto insurance review highlight offering a wide range of coverage options to meet various insurance needs.

- Safe Driver Discount: State Farm offers a 15% safe driver discount, helping customers save on their premiums.

- Reliable Customer Service: State Farm is known for its reliable customer service and ease of claims processing.

Cons

- Limited Multi-Policy Discount: State Farm’s multi-policy discount may not be as substantial as some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums may still be relatively higher for certain coverage levels.

#4 – American National: Best for Regional Coverage

Pros

- Competitive Rates: American National offers competitive monthly rates, making it an affordable option.

- Generous Safe Driver Discount: With a 25% good driver discount, American National rewards safe driving habits.

- Regional Coverage: American National provides coverage in specific regions, making it an excellent choice for local customers.

Cons

- Limited Availability: American National operates in a limited number of states, which may restrict its accessibility for some customers.

- Limited Online Tools: While American National provides personalized service, its online tools and mobile app may not be as robust as some competitors.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Geico: Best for Budget-Friendly Options

Pros

- Affordable Rates: Geico offers budget-friendly monthly rates, making it an attractive option for cost-conscious consumers.

- Generous Safe Driver Discount: With a 26% safe driver discount, Geico rewards safe driving habits.

- Online Tools and Mobile App: Geico auto insurance review boast on its user-friendly website and mobile app, making it easy for customers to manage their policies.

Cons

- Limited Personalized Service: Geico is known for its online and phone-based customer service, which may not be as personalized as some competitors.

- Limited Coverage Options: While Geico offers standard coverage options, it may not have as many additional coverage options as some competitors.

#6 – Travelers: Best for Tech-Savvy Drivers

Pros

- Competitive Rates: Travelers offers competitive monthly rates, making it an affordable option.

- Tech-Savvy Tools: Travelers provides innovative online tools and a mobile app, making it easy for tech-savvy drivers to manage their policies.

- Safe Driver Discount: Travelers auto insurance review reveal offering a 23% safe driver discount, helping customers save on their premiums.

Cons

- Limited Availability: Travelers operates in fewer states compared to some larger insurance providers.

- Limited Personalized Service: While Travelers offers excellent online tools, its personalized service may not be as strong as some competitors.

#7 – Farm Bureau: Best for Community Focused Service

Pros

- Community Involvement: Farm Bureau is deeply involved in the communities it serves, making it an excellent choice for customers who value community support.

- Affordable Rates: Farm Bureau offers affordable auto insurance rates, making it an attractive option for budget-conscious consumers.

- Safe Driver Discount: With a 15% safe driver discount, Farm Bureau rewards safe driving habits.

Cons

- Limited Availability: Farm Bureau operates primarily in rural areas, which may restrict its accessibility for some customers.

- Limited Online Tools: While Farm Bureau provides excellent personalized service, its online tools and mobile app may not be as robust as some competitors.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Progressive: Best for Flexible Policies

Pros

- Flexible Coverage Options: Progressive offers a wide range of coverage options, allowing customers to tailor their policies to their specific needs.

- Generous Safe Driver Discount: With a 20% safe driver discount, Progressive rewards safe driving habits.

- Name Your Price Tool: Progressive’s Name Your Price Tool allows customers to customize their coverage to fit their budget.

Cons

- Higher Premiums: While Progressive offers flexible policies, its premiums may be higher compared to some competitors.

- Limited Personalized Service: Progressive auto insurance review reveal that it is known for its online and phone-based customer service, which may not be as personalized as some competitors.

Understanding Auto Insurance for Medicaid Recipients by Coverage Level

Auto insurance is essential for Medicaid recipients, and understanding rates from different providers is crucial. There’s significant variation in monthly premiums for both minimum and full coverage plans. Factors like insurer policies, risk assessment models, and location contribute to these differences.

Auto Insurance for Medicaid Recipients: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

American National $39 $124

Auto-Owners $27 $89

Erie $31 $90

Farm Bureau $46 $161

Geico $41 $161

Progressive $66 $169

State Farm $33 $95

Travelers $43 $140

While Auto-Owners offers the lowest rates for minimum coverage, Progressive tops the list for full coverage. Recipients need to balance affordability with comprehensive coverage. The disparity in rates emphasizes the need for research and comparison shopping. Recipients must consider affordability, coverage extent, and insurer reputation.

Opting for minimum coverage may seem cost-effective but could lead to financial strain in accidents. Conversely, full coverage provides comprehensive protection but comes at higher premiums. By assessing their situation, recipients can make informed decisions about coverage. Regular reassessment of insurance needs is crucial, as circumstances change.

Exploring discounts and bundling options can help lower premiums without sacrificing coverage.

Ultimately, auto insurance is a vital financial safety net for Medicaid recipients, protecting assets and well-being on the road. Understanding premium factors and comparing rates ensures adequate protection at an affordable price.

Deciphering Medicaid Car Insurance

Is Medicaid auto insurance an option? Does Medicaid sell auto insurance? What is Medicaid dollar-a-day insurance? Read the next few sections to find out everything you need to know about Medicaid auto insurance options and whether you qualify.

Medicaid auto insurance doesn’t technically exist, but if you have Medicaid, it may help cover your medical costs if you’re in an accident. However, because it is a form of health insurance, not auto insurance, this coverage will not extend to anyone else in your vehicle, nor will it pay for any repairs on your vehicle.

Auto-Owners offers the best overall coverage for Medicaid recipients, with rates starting as low as $27 per month.

Jimmy McMillan Licensed Insurance Agent

According to the Medicaid website, Medicaid requires certain mandatory benefits to be provided, with optional benefits by state. But does having Medicaid qualify you for any type of auto insurance benefits? Depending on your state, you might be in luck.

Medicaid often doesn’t cover car accident injuries, so separate auto insurance is needed. Check the government Medicaid website or call (877) 267-2323 for state-specific auto insurance assistance and requirements.

Check out more details and compare “Auto Insurance Quotes by State“.

That’s required just about everywhere. You don’t normally have to have full coverage car insurance unless the lender you financed your vehicle from requires it.

You may need medical payment coverage on your auto insurance, but that is up to your state. Take a look at this table for a full list of the minimum insurance requirements by state, including those states that require MedPay coverage.

Auto Insurance Minimum Coverage Requirements by State| State | Requirements | Limits |

|---|---|---|

| Alabama | Bodily Injury and Property Damage Liability | 25/50/25 |

| Alaska | Bodily Injury and Property Damage Liability | 50/100/25 |

| Arizona | Bodily Injury and Property Damage Liability | 15/30/10 |

| Arkansas | Bodily Injury and Property Damage Liability, Personal Injury Protection | 25/50/25 |

| California | Bodily Injury and Property Damage Liability | 15/30/5 |

| Colorado | Bodily Injury and Property Damage Liability | 25/50/15 |

| Connecticut | Bodily Injury and Property Damage Liability, Uninsured Motorist, Underinsured Motorist | 25/50/20 |

| Delaware | Bodily Injury and Property Damage Liability, Personal Injury Protection | 25/50/10 |

| Florida | Property Damage Liability, Personal Injury Protection | 10/20/10 |

| Georgia | Bodily Injury and Property Damage Liability | 25/50/25 |

| Hawaii | Bodily Injury and Property Damage Liability, Personal Injury Protection | 20/40/10 |

| Idaho | Bodily Injury and Property Damage Liability | 25/50/15 |

| Illinois | Bodily Injury and Property Damage Liability, Uninsured Motorist, Underinsured Motorist | 25/50/20 |

| Indiana | Bodily Injury and Property Damage Liability | 25/50/25 |

| Iowa | Bodily Injury and Property Damage Liability | 20/40/15 |

| Kansas | Bodily Injury and Property Damage Liability, Personal Injury Protection | 25/50/25 |

| Kentucky | Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist, Underinsured Motorist | 25/50/25 |

| Louisiana | Bodily Injury and Property Damage Liability | 15/30/25 |

| Maine | Bodily Injury and Property Damage Liability, Uninsured Motorist, Underinsured Motorist, Medical Payments | 50/100/25 |

| Maryland | Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist, Underinsured Motorist | 30/60/15 |

| Massachusetts | Bodily Injury and Property Damage Liability, Personal Injury Protection | 20/40/5 |

| Michigan | Bodily Injury and Property Damage Liability, Personal Injury Protection | 20/40/10 |

| Minnesota | Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist, Underinsured Motorist | 30/60/10 |

| Mississippi | Bodily Injury and Property Damage Liability | 25/50/25 |

| Missouri | Bodily Injury and Property Damage Liability, Uninsured Motorist | 25/50/25 |

| Montana | Bodily Injury and Property Damage Liability | 25/50/20 |

| Nebraska | Bodily Injury and Property Damage Liability, Uninsured Motorist, Underinsured Motorist | 25/50/25 |

| Nevada | Bodily Injury and Property Damage Liability | 25/50/20 |

| New Hampshire | Financial Responsibility only | 25/50/25 |

| New Jersey | Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist, Underinsured Motorist | 15/30/5 |

| New Mexico | Bodily Injury and Property Damage Liability | 25/50/10 |

| New York | Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist, Underinsured Motorist | 25/50/10 |

| North Carolina | Bodily Injury and Property Damage Liability, Uninsured Motorist, Underinsured Motorist | 30/60/25 |

| North Dakota | Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist, Underinsured Motorist | 25/50/25 |

| Ohio | Bodily Injury and Property Damage Liability | 25/50/25 |

| Oklahoma | Bodily Injury and Property Damage Liability | 25/50/25 |

| Oregon | Bodily Injury and Property Damage Liability, Personal Injury Protection, Uninsured Motorist, Underinsured Motorist | 25/50/20 |

| Pennsylvania | Bodily Injury and Property Damage Liability, Personal Injury Protection | 15/30/5 |

| Rhode Island | Bodily Injury and Property Damage Liability | 25/50/25 |

| South Carolina | Bodily Injury and Property Damage Liability, Uninsured Motorist, Underinsured Motorist | 25/50/25 |

| South Dakota | Bodily Injury and Property Damage Liability, Uninsured Motorist, Underinsured Motorist | 25/50/25 |

| Tennessee | Bodily Injury and Property Damage Liability | 25/50/15 |

| Texas | Bodily Injury and Property Damage Liability, Personal Injury Protection | 30/60/25 |

| Utah | Bodily Injury and Property Damage Liability, Personal Injury Protection | 25/65/15 |

| Vermont | Bodily Injury and Property Damage Liability, Uninsured Motorist, Underinsured Motorist | 25/50/10 |

| Virginia | Bodily Injury and Property Damage Liability, Uninsured Motorist, Underinsured Motorist | 25/50/20 |

| Washington | Bodily Injury and Property Damage Liability | 25/50/10 |

| West Virginia | Bodily Injury and Property Damage Liability, Uninsured Motorist, Underinsured Motorist | 25/50/25 |

| Wisconsin | Bodily Injury and Property Damage Liability, Uninsured Motorist, Medical Payments | 25/50/10 |

| Wyoming | Bodily Injury and Property Damage Liability | 25/50/20 |

| Washington, D.C. | Bodily Injury and Property Damage Liability, Uninsured Motorist | 25/50/10 |

To better understand this table, we’ve summarized the acronyms and abbreviations here.

Liability Auto Insurance Minimum Coverage Abbreviations| Abbreviation | Auto Insurance Type |

|---|---|

| BI | Bodily Injury |

| PD | Property Damage Liability |

| PIP | Personal Injury Protection |

| UM | Uninsured Motorist |

| UIM | Underinsured Motorist |

For example, if your state requires 15/30 auto insurance, you’ll need $15,000 to cover bodily injury for one person and $30,000 for all persons in one accident.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

State-Sponsored Low-Income Auto Insurance Programs

While you already know that Medicaid auto insurance isn’t an option, in some states, your Medicaid will qualify you for public auto insurance. In January 2020, nearly 64 million individuals were enrolled in Medicaid. If your Medicaid policy does not cover automobile accident injuries, a good auto insurance policy will.

Unfortunately, many drivers throughout the country remain uninsured because they simply cannot afford it. Many states have set up low-cost car insurance programs for low income families (separate from Medicaid) and for those who qualify for it. Read through the next few sections to learn more about these programs.

California: Understanding Low-Cost Automobile Insurance Program

California, for example, has set up the California Low-Cost Automobile Insurance (CLCA) Program, which helps them to obtain affordable car insurance for low income families.

Unlike some of the other state-sponsored insurance programs, CLCA enables qualified drivers to purchase coverage that meets at least the minimum coverage required by the state, along with some optional coverages like uninsured motorist coverage.

Hawaii: How State-Sponsored Auto Insurance Functions

According to the Hawaii Government website, the state offers help on car insurance through Medicaid to the Aged, Blind, and Disabled (AABD) program with supplemental security income (SSI) insurance.

Individuals over the age of 65 and those who are blind or otherwise disabled may qualify for car insurance for SSI recipients offered by the state. You can reach out to your local government offices for qualification.

Check out our “Disabled Driver Auto Insurance Discount: Save on Auto Insurance” for more information.

Maryland: Unique Offering on Private Auto Insurance Option

Maryland has a private insurance option, known as Maryland Auto Insurance (formerly MAIF), which is not in any way government-sponsored, that provides specialty coverage. This provides auto liability insurance to residents of Maryland who aren’t able to get insurance the normal way.

Maryland drivers get at least 30/60/15 coverage, which breaks down to $30,000 in personal bodily liability per person, $60,000 in personal bodily liability per accident, and $15,000 in property damage liability. They also offer some limited optional coverage, including comprehensive and collision coverage. For information on Medicaid car insurance in New Jersey and other policies, read on.

New Jersey: Understanding Dollar-a-Day Auto Insurance Coverage

The Special Auto Insurance Policy (SAIP) for Medicaid car insurance NJ, allows drivers who are eligible for Medicaid and welfare to obtain auto insurance cheaply, but it’s medical-only liability coverage.

What are the requirements for this low-income dollar-a-day car insurance in NJ under SAIP? If you’re on Medicaid, you stand a good chance.

It’s best to contact your local government agency to see what the requirements are. You will have to provide your driver’s licenses and Medicaid cards for all drivers. It’s also important to note that if your driver’s license has been suspended or revoked, you won’t be eligible for coverage.

Gain more knowledge on our “Cheap New Jersey Auto Insurance“.

Whether you’re looking for dollar-a-day car insurance in East Orange, NJ or Newark, NJ, the SAIP policy may be able to help.

Understanding the Costs of New Jersey SAIP Auto Insurance

New Jersey SAIP insurance costs $365 per year, which works out to a dollar per day. You can pay in a single, annual payment, in which case you’ll save an additional $5, or you can pay half at the beginning of your policy term and the other half six months in.

This policy covers medical expenses from auto accidents, focusing on emergencies, critical brain and spinal injuries, and death benefits. Exclusions include property damage, bodily injury of others, and non-brain or spinal medical issues. It is not to be confused with liability insurance coverage, collision coverage, comprehensive coverage, or any other auto insurance coverage type.

Hacks for Low-Income Families to Secure Affordable Auto Insurance

What if you don’t qualify for low-income coverage options available in some states? There are some ways to lower your auto insurance rates to make them more affordable for your budget.

For example, you could take a defensive driving class, ask for a higher auto insurance deductible, ask your insurance agent about any money-saving options, and more.

Read on for more information on ways to save money. This is not a complete list, but in the next few sections, we’ve covered some ways to save on your insurance.

How to Find Discounts for Medicaid Car Insurance

Apart from government programs, there are many auto insurance discounts available through insurance providers. Here are some discounts provided by the major auto insurers in the country.

Auto Insurance Discounts Available by Provider| Discount | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Adaptive Headlights | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Anti-lock Brakes | 10% | NA | NA | 5% | 5% | 5% | NA | 5% | NA | NA |

| Anti-Theft | 10% | NA | NA | 23% | 20% | 25% | NA | 15% | NA | NA |

| Claim Free | 35% | NA | NA | 26% | NA | 10% | NA | 15% | 23% | 12% |

| Continuous Coverage | NA | NA | NA | NA | NA | NA | NA | NA | 15% | NA |

| Daytime Running Lights | 2% | NA | NA | 3% | 5% | 5% | NA | NA | NA | NA |

| Defensive Driver | 10% | 10% | NA | NA | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | NA | NA | NA | NA | 10% | NA | NA | 7% | NA |

| Driver's Ed | 10% | NA | NA | NA | 10% | NA | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | NA | NA | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | NA | NA | NA | NA | 8% | NA | NA | 10% | 12% |

| Electronic Stability Control | 2% | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Emergency Deployment | NA | NA | NA | 25% | NA | NA | NA | NA | NA | NA |

| Engaged Couple | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Family Legacy | NA | NA | NA | NA | NA | NA | NA | NA | NA | 10% |

| Family Plan | NA | NA | NA | NA | 25% | NA | NA | NA | NA | NA |

| Farm Vehicle | 10% | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Fast 5 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Federal Employee | NA | NA | NA | 12% | 10% | NA | NA | NA | NA | NA |

| Forward Collision Warning | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Full Payment | 10% | NA | NA | NA | $50 | NA | NA | NA | 8% | NA |

| Further Education | NA | NA | NA | NA | 10% | 15% | NA | NA | NA | NA |

| Garaging/Storing | NA | NA | NA | NA | NA | NA | NA | NA | NA | 90% |

| Good Credit | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Good Student | 20% | NA | NA | 15% | 23% | 10% | NA | 25% | 8% | 3% |

| Green Vehicle | 10% | NA | 5% | NA | 10% | NA | NA | NA | 10% | NA |

| Homeowner | NA | NA | NA | NA | 5% | NA | NA | 3% | 5% | NA |

| Lane Departure Warning | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Life Insurance | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Low Mileage | NA | NA | NA | NA | NA | NA | NA | 30% | NA | NA |

| Loyalty | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Married | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Membership/Group | NA | NA | NA | NA | 10% | 7% | NA | NA | NA | NA |

| Military | NA | NA | NA | 15% | 4% | NA | NA | NA | NA | NA |

| Military Garaging | NA | NA | NA | NA | NA | NA | NA | NA | NA | 15% |

| Multiple Drivers | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Multiple Policies | 10% | 29% | NA | 10% | 20% | 10% | 12% | 17% | 13% | NA |

| Multiple Vehicles | NA | NA | NA | 25% | 10% | 20% | 10% | 20% | 8% | NA |

| New Address | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| New Customer/New Plan | NA | NA | NA | NA | 10% | NA | NA | NA | NA | NA |

| New Graduate | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| New Vehicle | 30% | NA | NA | 15% | NA | NA | 40% | 10% | 12% | NA |

| Newly Licensed | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Newlyweds | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Non-Smoker/Non-Drinker | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Occasional Operator | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Occupation | NA | NA | NA | NA | 10% | 15% | NA | NA | NA | NA |

| On-Time Payments | 5 | |||||||||

| Online Shopper | NA | NA | NA | NA | NA | NA | 7% | NA | NA | NA |

| Paperless Documents | 10% | NA | NA | NA | NA | 5% | NA | NA | NA | NA |

| Paperless/Auto Billing | 5% | NA | NA | NA | NA | $30 | NA | $20 | 3% | 3% |

| Passive Restraint | 30% | 30% | NA | 40% | NA | 20% | NA | 40% | NA | NA |

| Recent Retirees | NA | NA | NA | NA | 4% | NA | NA | NA | NA | NA |

| Renter | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Roadside Assistance | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Safe Driver | 45% | NA | NA | 15% | NA | 35% | 31% | 15% | 23% | 12% |

| Seat Belt Use | NA | NA | NA | 15% | NA | NA | NA | NA | NA | NA |

| Senior Driver | 10% | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Stable Residence | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Students & Alumni | NA | NA | NA | NA | 10% | 7% | NA | NA | NA | NA |

| Switching Provider | NA | NA | NA | NA | 10% | NA | NA | NA | NA | NA |

| Utility Vehicle | 15% | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Vehicle Recovery | 10% | NA | NA | 15% | 35% | 25% | NA | 5% | NA | NA |

| VIN Etching | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Volunteer | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Young Driver | NA | NA | NA | NA | NA | NA | NA | NA | NA | $75 |

A lot of times, it just comes down to shopping around and doing your research. Inquire about any auto insurance discounts or special programs that are available. Often times, the insurance will be much cheaper than you expected.

Exploring the Benefits of Shopping Around for Auto Insurance

Shopping for insurance and comparing rates can have a significant effect on your auto insurance rates. We recommend getting quotes from at least three auto insurance companies so you can compare and find the best coverage at a rate you can afford.

Habits to Consider for Safer Driving

Reducing how much time you spend driving can mean getting a low-mileage discount. A proven track record for lower mileage can mean a readjustment in your rates because the less time you spend on the road, the lower risk you are to insure.

In addition, with low mileage, you may qualify for discounts based on your driving habits, which can further lower your rates. It is important to never let your auto insurance lapse. Getting stopped without insurance can result in high fines. Not to mention it is very dangerous to be driving without auto insurance.

How to Choose the Right Auto Insurance Coverage

How to get car insurance with Medicaid? As we noted earlier, every state in the country (except for Virginia and New Hampshire) requires a minimum amount of car insurance coverage, which varies by state.

This includes liability, collision, comprehensive, medical payments, personal injury protection, and uninsured/underinsured motorist coverage. While there’s no direct match between standard auto insurance and Medicaid auto insurance, Medpay is a close comparison. Yet, Medpay covers both you and passengers, unlike Medicaid, which covers only you.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Medicaid Car Insurance: The Bottom Line

Medicaid-enabled low-income auto insurance is only available for qualified Medicaid recipients and, in many cases, coverage is extremely limited. However, if you qualify, it may be worth considering if it makes the most financial sense.

California, New Jersey, and Hawaii are the only states that offer government-subsidized or government-aided auto insurance, but if you don’t live in one of those states or you don’t qualify, there are other ways you can lower your insurance rates. Shopping around, applying for discounts, and driving as little as possible are just a few to make your coverage as affordable as possible.

If you don’t qualify for state-sponsored or Medicaid auto insurance (and even if you do), take a few minutes to compare auto insurance quotes to see how affordable your rates can be. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

What is Medicaid car insurance?

Car insurance medicaid is not actual car insurance. It covers medical expenses for injuries resulting from accidents.

Can you get Medicaid car insurance?

No, Medicaid car insurance doesn’t exist. However, Medicaid may help cover your medical costs if you’re in an accident.

Prepare yourself by knowing more information on our “What should I do at the scene of an accident to prepare for an insurance claim?“.

Does Medicaid cover auto accidents?

In most states, Medicaid alone does not cover injuries from auto accidents. You will need an additional insurance policy for that.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Are there cheap auto insurance for low income families programs?

Some states offer low-cost car insurance for low income individuals programs who qualify, separate from Medicaid. It is recommended to check for low income auto insurance quotes to compare.

What are the requirements for New Jersey dollar-a-day auto insurance?

To qualify for Medicaid dollar a day car insurance in New Jersey, you need to be on Medicaid and meet specific requirements.

Gain more knowledge on our “What are the different types of auto insurance coverage?“.

Can you have 2 vehicles on Medicaid?

No, Medicaid does not regulate the number of vehicles an individual can own. Ownership of multiple vehicles is generally permissible for Medicaid recipients.

How does Medicaid impact auto insurance rates?

Medicaid itself does not directly impact auto insurance rates. However, some insurance companies may offer discounts or special programs for Medicaid recipients, so it’s worth exploring options with insurers.

Can Medicaid cover auto accident injuries?

Medicaid may cover medical costs resulting from auto accident injuries, depending on the state and the specific circumstances. However, it’s essential to have additional auto insurance coverage to ensure comprehensive protection.

Are there state-sponsored auto insurance programs for Medicaid recipients?

Yes, some states offer state-sponsored auto insurance programs specifically tailored for low-income individuals, including Medicaid recipients. These programs aim to provide affordable coverage options for those who qualify.

Get fast and cheap auto insurance coverage today with our quote comparison tool below.

What are the differences between Medicaid and traditional auto insurance coverage?

Medicaid primarily covers medical expenses resulting from accidents, whereas traditional auto insurance provides broader coverage, including liability, collision, and comprehensive protection for vehicles and drivers. It’s crucial to understand the distinctions between the two types of coverage to ensure comprehensive protection.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.