Best Roadside Assistance Coverage in 2026 (We Suggest These 10 Providers)

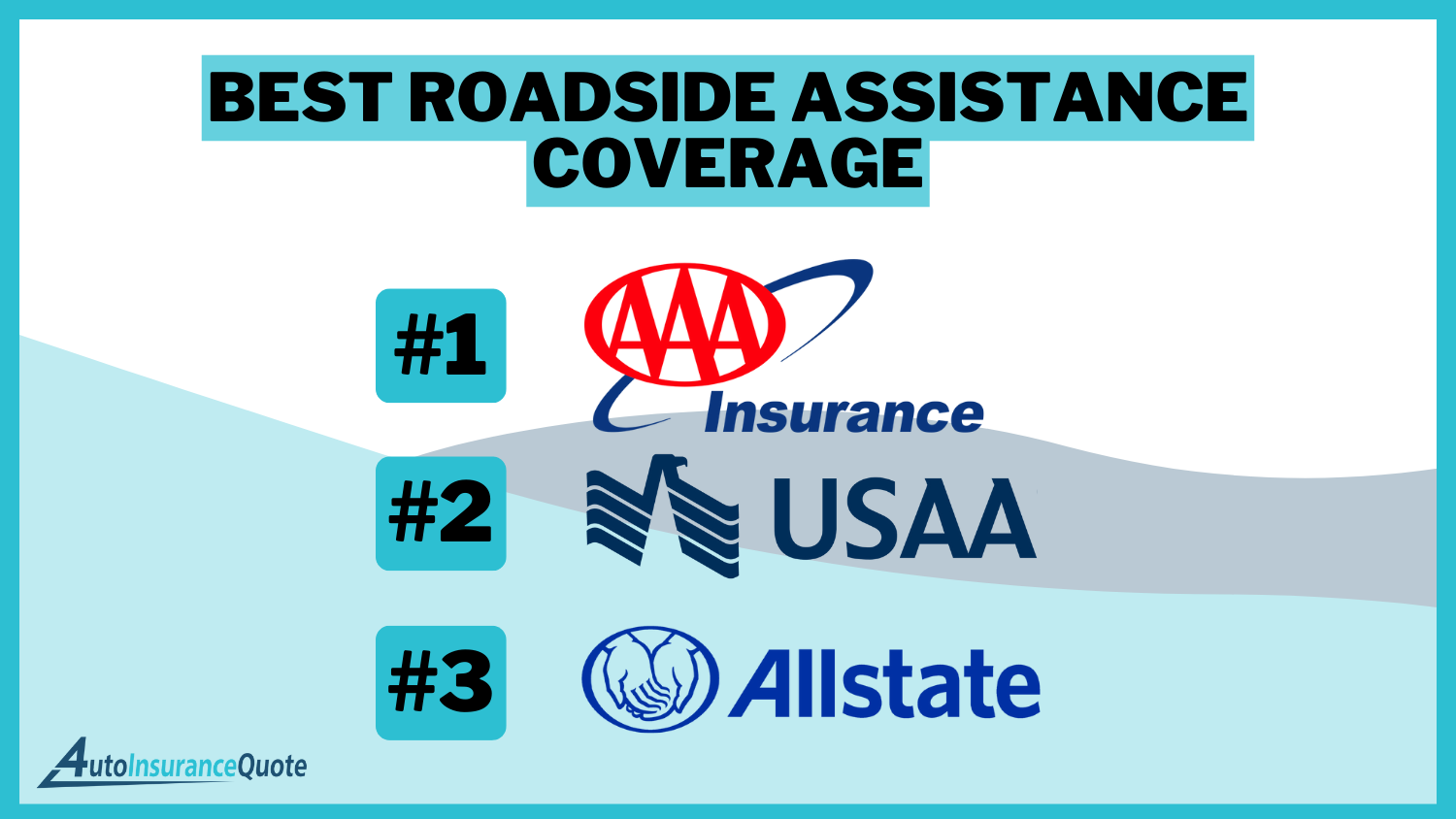

AAA, USAA, and Allstate have the best roadside assistance coverage, offering top-notch services at around $50 per month. These companies stand out for their comprehensive roadside assistance, excellent customer service, and a wide range of coverage options, ensuring drivers receive reliable support when needed.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: May 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Roadside Assistance

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Roadside Assistance

A.M. Best Rating

Complaint Level

Pros & Cons

AAA, USAA, and Allstate have the best roadside assistance coverage, offering top-tier services at competitive rates. With plans averaging around $50 per month, these providers stand out for their comprehensive coverage, reliable customer service, and additional benefits.

AAA is the top pick for its extensive network, affordable plans, and wide range of services. USAA excels in serving military members and their families with tailored roadside assistance. Allstate provides innovative solutions and flexible options for all drivers.

Our Top 10 Picks: Best Roadside Assistance Companies

Company Rank A.M. Best Multi-Policy Discount Best For Jump to Pros/Cons

#1 A 25% Roadside Assistance AAA

#2 A++ 8% Military Members USAA

#3 A+ 10% Innovative Solutions Allstate

#4 A++ 10% Customer Service State Farm

#5 A++ 10% Affordable Coverage Geico

#6 A+ 12% Variety of Coverage Progressive

#7 A 25% Customization Program Liberty Mutual

#8 A 10% Personalized Policies Farmers

#9 NR 5% RV Owners Good Sam

#10 A- 5% Environmentally Friendly Better World Club

Explore how these companies ensure peace of mind on the road with their exceptional roadside assistance programs. We often choose auto insurance policies based on liability auto insurance coverage, but what about auto insurance coverage types that protect you?

If you are ready to get a few quotes from insurance companies that offer programs like roadside assistance to their customers, enter your ZIP code into our FREE tool above.

- AAA is the top pick, providing extensive services and an affordable network

- Best roadside assistance companies offer thorough coverage and service

- Plans average $50 per month, ensuring peace of mind on the road

#1 – AAA: Top Overall Pick

Pros

- Comprehensive Coverage: Offers a wide range of services including towing, battery jump-starts, and lockout assistance.

- Multiple Membership Levels: AAA Auto insurance review provides flexible plans tailored to different needs and budgets.

- Extensive Network: Large network of service providers ensures quick response times.

Cons

- Higher Costs: Premium plans can be more expensive compared to other providers.

- Limited Digital Features: Fewer app-based features compared to some competitors.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Members

Pros

- Tailored for Military: Specialized services for active and retired military members and their families.

- Competitive Rates: Offers competitive pricing for a range of services. See more details on what information do I need to provide when filing an auto insurance claim with USAA.

- Excellent Customer Service: Highly rated for customer satisfaction and support.

Cons

- Limited Eligibility: Only available to military members and their families.

- Membership Fees: Some services may require additional membership fees.

#3 – Allstate: Best for Innovative Solutions

Pros

- Innovative Tools: Provides advanced tools and apps for roadside assistance tracking.

- Flexible Plans: Offers various plans to suit different customer needs. More information is available about this provider in our “Allstate vs. USAA: Which Offers More Affordable Auto Insurance Quotes.”

- Additional Discounts: Includes travel discounts and savings on car-related expenses.

Cons

- Mid-Range Pricing: Monthly rates are higher than some budget providers.

- Coverage Limitations: Certain services may have restrictions based on plan type.

#4 – State Farm: Best for Customer Service

Pros

- Bundling Policies: Significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Substantial discount for low-mileage usage. Learn more in our State Farm auto insurance review.

- Wide Coverage: Offers various coverage options tailored for different business needs.

Cons

- Limited Multi-Policy Discount: Multi-policy discount is not as high compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Geico: Best for Affordable Coverage

Pros

- Low Cost: Offers some of the lowest monthly rates for roadside assistance. See more details on our Geico auto insurance review.

- Easy Access: Convenient app-based access for roadside assistance.

- Comprehensive Services: Includes a wide range of roadside services at an affordable price.

Cons

- Basic Plans: Lower-cost plans may lack some advanced features.

- Limited Discounts: Smaller multi-policy discounts compared to competitors.

#6 – Progressive: Best for Variety of Coverage

Pros

- Extensive Coverage Options: Wide range of coverage plans to meet various needs. Read up on the Progressive auto insurance review for more information.

- Bundling Discounts: Offers discounts for bundling with other insurance products.

- User-Friendly App: Advanced app features for managing roadside assistance.

Cons

- Average Pricing: Monthly rates are mid-range, not the cheapest available.

- Service Availability: Availability of certain services may vary by region.

#7 – Liberty Mutual: Best for Customization Program

Pros

- Highly Customizable: Offers personalized policies to fit specific customer needs.

- Multi-Policy Discounts: Significant discounts for bundling multiple policies.

- Customer Support: Known for strong customer support and service. Check out insurance savings in our complete Liberty Mutual auto insurance review.

Cons

- Higher Costs: Customization can lead to higher premiums.

- Complex Plans: Customizable options may be overwhelming for some customers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Policies

Pros

- Personalized Service: Tailors policies to individual customer needs.

- Comprehensive Roadside Assistance: Offers a broad range of roadside services.

- Good Discounts: Provides decent multi-policy and other discounts. Discover more about offerings in our Farmers auto insurance review.

Cons

- Premium Prices: Higher monthly rates compared to some other providers.

- Limited Digital Tools: Fewer app-based features for roadside assistance.

#9 – Good Sam: Best for RV Owners

Pros

- Specialized RV Coverage: Excellent coverage options for RV and 5th wheel owners.

- Family Coverage: Covers spouse and dependent children at no extra cost. To gain more insights, check out this guide titled “Adding Your Spouse To Your Auto Insurance Policy“

- Travel Discounts: Offers discounts at various vacation destinations.

Cons

- Higher Costs for RV Plans: Premium rates for specialized plans.

- Limited to RV Owners: Less beneficial for those without RVs.

#10 – Better World Club: Best for Environmentally Friendly

Pros

- Eco-Friendly: Emphasizes sustainable and environmentally friendly practices.

- Comprehensive Coverage: Offers standard roadside assistance services.

- Competitive Pricing: Affordable plans with essential coverage.

Cons

- Basic Plans: Basic plan covers limited towing distance. Gain more knowledge by reading this guide titled “Does my auto insurance cover towing and roadside assistance?“

- Membership Requirement: Requires membership, which may add to overall cost.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Cost of Roadside Assistance Companies

When choosing a roadside assistance plan, it’s essential to consider the costs associated with both minimum and full coverage levels. Here’s a breakdown of the costs from some of the top providers:

Auto Insurance Monthly Rates for Roadside Assistance by Coverage Level & Provider| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $78 | $218 |

| Allstate | $70 | $205 |

| Better World Club | $68 | $200 |

| Farmers | $80 | $220 |

| Geico | $50 | $150 |

| Good Sam | $65 | $195 |

| Liberty Mutual | $75 | $215 |

| Progressive | $58 | $175 |

| State Farm | $60 | $180 |

| USAA | $55 | $170 |

Geico and USAA offer the most affordable options, with minimum coverage starting at $50 and $55 respectively, making them ideal for budget-conscious consumers. In contrast, AAA and Farmers provide extensive benefits and services, reflected in their higher costs, with full coverage priced at $218 and $220 respectively.

Mid-range options like Progressive and State Farm offer a good balance between cost and comprehensive services. Each provider caters to different needs, so selecting the right plan depends on your specific requirements and budget. Delve into our evaluation of “Affordable Full Coverage Auto Insurance.”

Insurance Company Roadside Assistance Plans

When wondering what is the best roadside assistance company or the best roadside assistance plan, many people don’t even consider looking into the options offered by their insurance company, which can be a big mistake.

Before you look into a car repair estimate, auto insurance with roadside assistance is often not too expensive of an update, so whether you are insured through Geico, Allstate, or Progressive roadside assistance service, the price may not be as much as you’d think. Cheap roadside assistance plans are out there.

Take a look at the table below to compare the insurance company roadside assistance plans:

Roadside Assistance Service Benefits by Provider| Roadside Benefit | AAA | Allstate | Geico | Nationwide | Progressive | State Farm | USAA |

|---|---|---|---|---|---|---|---|

| Battery Jump Start | Yes | Only lists generic "roadside services" | Yes | Yes | Yes | Yes | Yes |

| Flat Tire Change | Yes | Only lists generic "roadside services" | Yes | Yes | Yes | Yes | Yes |

| Fuel Delivery | Delivery is free, but you must pay for the gas | Only lists generic "roadside services" | Not listed | Yes | Yes | Yes | Yes |

| Maximum benefit | 4 uses/year | Not listed | Not listed | Not listed | Not listed | Not listed | Not listed |

| Towing | Nearest Facility or 3 Miles | Yes | Yes | Yes | Yes | Nearest repair location | Yes |

| Vehicle Lockout | Yes | Only lists generic "roadside services" | Up to $100 | Up to $100 | Yes | Up to 1 hour | Yes |

| Winching Service | 1 truck/30 minutes | Only lists generic "roadside services" | Not listed | Yes | Yes | Yes | Not listed |

Each company approaches roadside assistance differently. You will need to think about your situation and what might be most appropriate for you. What is the best towing service insurance? What other coverage do you need? Continue reading below to find out more about the roadside assistance options offered by some of the biggest insurance companies in the country.

AAA Roadside Assistance Explained

The American Automobile Association, or AAA, is one of the best-known roadside assistance programs in the country. Founded in 1902, AAA has 58 million members across the United States and Canada. AAA is the gold standard to many when it comes to roadside assistance benefits.

The company offers a AAA roadside assistance plan, automotive repair, travel assistance, and other services to members. If you are looking for an AAA roadside assistance review, our AAA auto insurance review shows that the AAA roadside assistance price varies as follows: The Basic plan is priced at just $48 per year, with a Premier plan starting at $109.

AAA also offers auto insurance, so combining your AAA membership with your auto insurance is possible.

According to Forbes magazine, more and more drivers have car battery problems. So, whether dealing with a dead battery, locked out of your vehicle or need a 100-mile tow, your AAA roadside assistance subscription can quickly pay for itself. AAA also has a specialized RV and motorcycle roadside assistance plan for $35 per year that covers things like winching, theft, towing, fuel delivery, trailer coverage, trip continuance, and auto insurance to cover a locksmith.

Is there a better service than AAA? Let’s take a look at some alternatives to AAA roadside assistance plans.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Allstate Roadside Assistance

Allstate is one of the largest auto insurance companies in the United States. However, you don’t have to be an Allstate insurance customer to sign up for Allstate Motor Club. Priced at $7 to $12 per month for the first year, Allstate Motor Club provides 24/7 roadside assistance for servings like towing and tire changes. Allstate roadside assistance plans seem affordable.

Members also get access to travel discounts, trip planning tools, and car buying savings.

Other benefits include guaranteed on-time services, making it easy to track your technician as he travels to your broken-down vehicle. Read thorough this comprehensive guide titled “Can you pause auto insurance while traveling”

Allstate Motor Club has two main subscription plans, including Roadside Advantage and Platinum Elite. Roadside Advantage offers 24/7 roadside assistance, travel savings, trip interruption coverage, and more. Platinum Elite has everything in the Roadside Advantage plan, motorcycle and RV coverage, a personal concierge, and other benefits.

Geico Roadside Assistance

Geico is one of the biggest insurance companies in the country, with more than 17 million active auto insurance policies that cover more than 28 million vehicles. The Geico roadside assistance price is a small fee of $14 per year, making this a very affordable alternative to some other roadside assistance plans.

The Geico roadside assistance plan is available as part of the downloadable Geico app for your smartphone. You can find it in the Google Play store, the AppStore on iPhone, or you can ROADSIDE to 43426 (Geico), and they will send you the link directly to your phone.

If you want to know what Geico roadside assistance package covers, their website says the service covers tow trucks, jump-starting a dead battery, lockout services, and changing a flat tire. Because the service is provided through a phone app, the company can use your GPS signal to help find you.

Learn more about Geico by visiting our Geico auto insurance review.

State Farm Roadside Assistance

Like most insurance companies, State Farm offers auto insurance with roadside assistance to their members for an additional fee. What does State Farm emergency roadside assistance cover? It covers the towing service, locksmith service, gas or oil delivery, changing a tire, and jumpstarting the battery.

If you have added the roadside assistance coverage to your plan, a dispatcher will be sent to help you, and you won’t be directly billed for the service. State Farm may charge you later for portions of the service calls that are not covered, such as the cost of gas or a new tire.

If you are a State Farm customer but have not elected this additional coverage, you can still use their roadside assistance services, but you will be billed a competitive rate for your service call. Is State Farm roadside assistance as good as AAA? They do provide most of the same services, but each individual person’s experience will vary. Check out our State Farm auto insurance review for more information.

Read more: Does auto insurance cover a locksmith?

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

USAA Roadside Assistance

USAA is an auto insurance company that only offers coverage to military members, both active and retired, and their families. The website shows that they do offer USAA roadside assistance, but the price is not listed.

If you are a current USAA member, contact the company to find out exactly how much it will cost to add roadside assistance coverage to your policy.

What is covered under the USAA roadside assistance plan? The USAA roadside assistance plan covers towing, locksmith services, changing your tire, jump-starting your battery, and fuel delivery. gather more information with our guide titled “Does auto insurance cover a dead battery?”

You can contact the company directly, or you can reach out to Agero, their roadside assistance partner, at 800-531-8555.

Progressive Roadside Assistance

Roadside assistance from Progressive comes with the most detailed plan of any of the other insurance companies on this list, including:

- Vehicle towing within a 15-mile radius

- Winching service

- Auto insurance coverage for a dead battery

- Fuel delivery

- Battery charge for electric cars

- Locksmith service

- Auto insurance covering flat tire

- On-scene labor

The company even offers additional roadside assistance packages, including motorcycle, boat, and RV roadside assistance packages. Their website makes it clear, however, that you may only have access to roadside assistance services with the purchase of certain types of coverage, so talk to the company about whether or not the roadside assistance package applies to you.

If you already have Progressive coverage and would like to add roadside assistance benefits, you can do so by logging into your account on their website, but they do not have a price listed, and coverage is not available for same-day service. Thinking about switching to Progressive? Read our Progressive auto insurance review first.

Nationwide Roadside Assistance

Nationwide does offer roadside assistance in addition to their insurance policies, but the descriptions on their website are very generic. They state their roadside assistance plan covers:

- Towing

- Jump-start

- Gas delivery

- Flat tire change

- Winching

They also state that they cover lockout services, but only if:

- The ignition key or fob is lost

- Key breaks off in the ignition, door, or trunk

- Keys are locked in the car

They also don’t list a price for services on their website, so if you are insured through Nationwide and are considering adding the benefit to your policy, contact the company or your agent for more details. To gain more insight, read our guide titled “Does auto insurance cover a flat tire?”

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Standalone Roadside Assistance Plans

The best companies for roadside assistance are not always going to be insurance companies. Sometimes the best roadside service company for you is specifically designed to meet your needs, such as a plan designed for senior citizens or a plan designed specifically for RV owners.

The top roadside assistance companies for you may not be the biggest names in the game.

If you’ve had a AAA policy and are looking for something different, there are plenty of options.

Considering that the roadside assistance market is supposed to reach 32 billion dollars in the next decade, it isn’t surprising there are plenty of stand-alone plan options. Read up on our comprehensive guide “What are the different types of auto insurance coverage?”

Before making a purchase, you should look at your state website and see if roadside assistance is offered by your state, as this plan from Massachusetts. If you are looking for some of the best companies that offer roadside assistance, continue reading below:

AARP Roadside Assistance

The American Association of Retired Persons (AARP) offers membership to anyone 50 years of age and older. You must be an AARP member to sign up for the organization’s popular roadside assistance membership. You can also get AARP auto insurance review as a member.

AARP is priced at $16 per year, while the roadside assistance programs start at $49 per year for the basic plan. If you are an AARP member and wonder who has the cheapest roadside assistance, this is likely your answer. It’s as close to free roadside assistance as you’ll find.

AARP offers four different roadside assistance plans. On the most basic plan, towing is restricted to five miles, with drivers paying any remaining towing expenses out of pocket.

The basic plan includes fuel delivery, dead battery service, and flat tire service. With the best AARP roadside assistance plan, you’ll receive coverage for up to 100 miles for towing trips. With the need for towing services on the rise, as reported by IBISWorld, having the service in your back pocket can come in handy. You can find AARP roadside assistance reviews on their website.

You can find AARP roadside assistance reviews on their website.

Good Sam Roadside Assistance

Good Sam roadside assistance plans are available for various vehicles, but their specialty is roadside services for RV and 5th wheel campers. Their plans run anywhere from $49.95 to $239.95 per year, depending on the number and type of vehicles you are adding to your plan.

In addition to roadside assistance coverage, your membership with Good Sam can provide discounts for certain vacation destinations for RV owners, fuel discounts, dump services, and propane discounts.

Their plan is also unique in that it doesn’t just cover you but also your spouse and dependent children free of charge. Good Sam roadside assistance reviews online tend to be very positive. For additional information, check out our guide “Can I remove my spouse from my auto insurance?”

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

What is Verizon roadside assistance?

Verizon may not be the first company you think of when you think about roadside assistance, but the cellular company has a roadside assistance plan available for their customers for an additional $3 per month per phone line. If you choose not to sign up for roadside assistance, you can still take advantage of the plan for a flat fee of $89.95 per use.

They also have the Verizon hum device, an intelligent driving technology powered by Google assistant. It can report crashes, help track a stolen vehicle, call for roadside assistance, etc. Check out this guide “What happens if stolen car is recovered after insurance company pays claim”

This is not the same as a basic roadside assistance plan, however, and it will come with monitoring technology many people are not comfortable with at this time. Make sure you understand exactly which program you are signing up for before choosing roadside assistance through Verizon.

Paragon Motor Club

Paragon Motor Club offers roadside assistance plans for individual vehicles, motorcycles, commercial/fleet vehicles, and RVs. Two emergency roadside assistance service plans are available, including the Classic Roadside and Advantage plans.

The Classic Roadside plan is similar to other providers listed here: Paragon charges $69.95 per year to cover basic roadside emergencies, including towing (up to 15 miles), flat tire assistance, dead battery service, and lockout service, and fuel delivery. Delve into our guide “Does auto insurance cover putting in the wrong fuel?”

Meanwhile, the Advantage plan is priced at $84.95 per year and provides towing up to 100 miles along with other premium features, including accident trip interruption, legal defense, and travel discounts. Paragon Motor Club covers drivers across Canada and the United States. However, if you’re a California resident, you cannot sign up for Paragon Motor Club.

National General Motor Club

Formerly known as GM Motor Club, the National General Insurance Motor Club offers roadside assistance to all drivers, regardless of whether or not you own a GM vehicle. Roadside assistance subscribers receive 24/7 service for fuel delivery, towing, jump-starting, and tire changes.

This roadside assistance program is one of the few to offer unlimited towing, which means you can have your car towed to the nearest service station for free, no matter where you are. Dive into this comprehensive guide titled “How to I Know if I Chose the Right Coverage”

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Better World Club

Better World Club roadside assistance is for individual drivers, ranging from $57 to $93 per year. The company also offers roadside assistance options for vehicle fleets, bicycles, and cars.

Better World Club aims to distinguish itself from the competition by emphasizing eco-friendly corporate practices. On the basic plan for $57 per year, drivers receive 24/7 roadside assistance anywhere in the United States, Canada, and Puerto Rico. Towing jobs, however, are covered up to just 5 miles.

On the $93 per year plan, towing costs are covered up to 100 miles. The premium plan comes with two free gallons of gas, although the basic plan lacks gas coverage. Better World Club is ideal for drivers looking for basic, inexpensive roadside assistance coverage from a company that emphasizes an eco-friendly attitude.

Read more: Get Affordable Puerto Rico Auto Insurance Quotes

OnStar Explained

OnStar is available on GM vehicles. If your GM vehicle is within the powertrain limited warranty period, you’re already covered by GM’s 24-Hour Roadside Assistance Program. Once outside that period, however, you may choose to subscribe to OnStar.

OnStar offers three plans, including the Protection plan ($19.99 per month or $199.90 per year), the Security plan ($24.99 per month or $249.90 per year), and the Guidance plan ($34.99 per month or $349.90 per year).

The cheapest plan gives you 24/7 roadside assistance and automatic crash response, emergency services, crisis assist, remote access, OnStar Smart Driver, and OnStar AtYourService. The two more expensive plans include bonuses like theft alarm notification, stolen vehicle slowdown, turn-by-turn navigation, and hands-free calling, among other features.

The Best Insurance Companies With Roadside Assistance

Many insurance companies offer roadside assistance, though usually at an additional fee. If you’ve ever wondered whether or not your auto insurance would cover a flat tire, now you know that this would be covered under the roadside assistance portion of your policy.

Choosing an insurance company with the best roadside assistance programs will be based on your specific needs, but the companies listed above, including Geico, Progressive, State Farm, Allstate, and USAA, all offer a comprehensive roadside assistance program.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Obtaining Online Quotes for Auto Insurance Roadside Assistance

Obtaining online quotes for auto insurance roadside assistance is easy and convenient. Here are the steps to efficiently gather and compare quotes:

- Use Comparison Tools: Websites like 4AutoInsuranceQuote.com let you compare quotes from multiple insurance companies by entering your ZIP code.

- Visit Provider Websites: Many insurance companies, such as Geico, Progressive, and State Farm, offer online quote tools for personalized quotes.

- Enter Accurate Information: Provide precise details about your vehicle, driving history, and desired coverage to get accurate quotes.

- Compare Coverage Options: Review what each roadside assistance plan includes, such as towing, battery jump-starts, lockout assistance, and fuel delivery.

- Read Reviews and Ratings: Look for customer reviews and industry ratings to gauge reliability and customer service quality.

- Check for Discounts: Some providers offer discounts for bundling roadside assistance with other insurance policies.

By following these steps, you can efficiently gather and compare online quotes for auto insurance roadside assistance. This approach ensures you find a plan that fits your needs and budget while providing peace of mind on the road.

Taking the time to compare options can lead to significant savings and better coverage, making your driving experience safer and more secure. Check out this guide “Affordable Instant Auto Insurance Quotes”

Case Studies: Best Roadside Assistance Companies

Exploring real-life experiences can provide valuable insights into how different roadside assistance plans work in practice. Here are three case studies highlighting various scenarios where roadside assistance made a significant difference.

- Case Study #1– A Lifesaver on a Family Road Trip: The Smith family’s car broke down on a remote highway during a summer road trip. Stranded with two kids, they called AAA. Within 30 minutes, a tow truck arrived and took them to a nearby mechanic, who quickly fixed the issue. AAA’s prompt response saved their vacation.

- Case Study #2– Support for a Military Family: The Johnson family faced a late-night flat tire while moving to a new base. They contacted USAA roadside assistance. A service provider arrived within 45 minutes, replaced the tire, and ensured they could continue their journey. USAA’s support was crucial.

- Case Study #3– Essential Aid for RV Owners: Retirees Mark and Susan’s RV broke down far from major cities. They called Good Sam roadside assistance. A specialist arrived, performed on-site repairs, and ensured their journey continued. Good Sam’s support turned a potential disaster into a minor inconvenience.

This demonstrate the critical role roadside assistance services play in providing security, convenience, and peace of mind. Whether traveling with family, moving due to military duty, or exploring the country in an RV, having a reliable roadside assistance plan can turn potential disasters into manageable inconveniences. To find out more, explore our guide titled “Auto Insurance Quotes by Vehicle.”

AAA is the top choice for comprehensive and reliable roadside assistance.

Chris Abrams Licensed Insurance Agent

Choosing the right plan tailored to your specific needs ensures you are prepared for any road emergency. Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Frequently Asked Questions

Are there any insurance company roadside assistance plans?

Yes, many insurance companies offer roadside assistance plans as an additional service to their customers. Some of the notable insurance companies with roadside assistance programs include Allstate, Geico, State Farm, and Progressive.

Access comprehensive insights into our guide titled “Auto Insurance Discounts for Affordable Coverage.”

What is AAA roadside assistance?

AAA (American Automobile Association) is a well-known roadside assistance program in the United States. They offer a range of services including towing, lockout assistance, battery jump-starts, fuel delivery, and more. AAA has different membership levels with varying benefits and pricing options.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

What is Allstate roadside assistance?

Allstate offers its own roadside assistance program called Allstate Motor Club. This program provides 24/7 roadside assistance services such as towing, tire changes, fuel delivery, and lockout assistance.

What is Geico roadside assistance?

Geico, a major insurance company, offers a roadside assistance program to its customers. Geico’s roadside assistance plan covers services like towing, battery jump-starts, lockout assistance, and tire changes.

What is State Farm roadside assistance?

State Farm, another well-known insurance company, offers roadside assistance as an optional coverage for its policyholders. Their roadside assistance plan includes services such as towing, locksmith services, tire changes, jump-starts, and fuel delivery.

Learn more by reading our guide titled “How to File an Auto Insurance Claim.”

What is USAA roadside assistance?

USAA offers roadside assistance to its members, who are primarily military personnel and their families. Their plan covers towing, locksmith services, tire changes, battery jump-starts, and fuel delivery.

What is Good Sam roadside assistance?

Good Sam provides specialized roadside assistance for RV owners and other vehicles. Their plans cover towing, tire changes, battery jump-starts, lockout services, and more, with a focus on RV-specific needs.

What is Progressive roadside assistance?

Progressive offers a detailed roadside assistance plan that includes towing, battery jump-starts, tire changes, lockout services, fuel delivery, and additional coverage options for motorcycles, boats, and RVs.

Access comprehensive insights into our guide titled “Average Cost of Auto Insurance: Find Affordable Quotes.”

How much does roadside assistance typically cost?

The cost of roadside assistance varies by provider and plan. Basic plans can start as low as $14 per year with Geico, while more comprehensive plans like those from AAA or Good Sam can range from $50 to over $100 per year.

Can I get roadside assistance if I’m not insured with the company?

Yes, some companies like Allstate and Good Sam offer roadside assistance memberships independently of their insurance policies. This means you can sign up for their roadside assistance services without having their auto insurance.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.