Progressive Auto Insurance Review (2026)

Progressive auto insurance reviews find the company with an "A-" rating from the BBB and a financial standing of "A+" with A.M.Best. Progressive car insurance rates average $165 per month for a married 60-year-old female driver. The Progressive Snapshot app, a usage-based insurance program, can help safe drivers save an average of $146 per year.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jun 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

| Progressive Overview | Progressive Stats |

|---|---|

| Year Founded | 1937 |

| Slug Executives | Tricia Griffith, CEO & President John Barbagallo Commercial Lines President |

| Total Sales | $10 billion USD per year |

| Headquarters | 6300 Wilson Mills Rd. Mayfield Village, Ohio 44143 |

| Phone Number | 1 (800) 776-4737 (Customer Service) |

| Company Website | https://www.progressive.com/ |

| Premiums Written | $27,058,768,000 |

| Loss Ratio | 62 |

| Best For | Auto Insurance |

If you’ve browsed our state and city guides, you might have noticed mentions of some of the most budget-friendly rates available in your area. Progressive stands out among insurance providers, offering competitive rates and various discounts, which can significantly reduce the overall annual insurance expenses.

This makes Progressive a preferred choice for individuals aiming to lower their insurance costs. Additionally, those seeking Progressive Insurance levels and Progressive Insurance locations nearby can easily find suitable options through our platform. If you want to compare quotes from different quotes right away, enter your ZIP code in the free quote box above. For more information about Progressive car insurance, continue through the guide.

Cheap Progressive Car Insurance Rates

This section of the guide delves into the car insurance premium that a potential customer, as a policyholder, is likely to pay. Car insurance premiums, also known as rates, can vary based on different factors such as age, gender, marital status, type of vehicle, commuting rates, coverage level, credit history, and driving history. These factors are in line with the principles upheld by Progressive insurance management and the Progressive insurance motto of providing personalized coverage.

In addition to these factors, annual premiums are different for each state. We’ll cover each of these factors and analyze the data so you can review which rates are the cheapest. Learn the top 10 secrets for getting cheap auto insurance.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Progressive Availability and Rates by State

According to our internal data, Progressive operates in every state across the United States. Each state has its own average annual insurance rate across all providers, while Progressive maintains its unique average annual rate. Within this section, we will analyze the state averages for car insurance alongside Progressive’s specific average rates for each state. If you need assistance or have inquiries about Progressive insurance, you can reach out to their customer service by calling the Progressive number provided, or you can visit a local Progressive office for personalized assistance.

We do this for each of our company guides to show how much more or less car insurance is in each state. Let’s begin by looking at the data. Use the search bar on the upper right corner to find your state.

Average Annual Auto Insurance Rates by State| State | Average Annual Auto Insurance Rates |

|---|---|

| Hawaii | $2,555.64 |

| North Carolina | $3,393.11 |

| Iowa | $2,981.28 |

| Virginia | $2,357.87 |

| New Hampshire | $3,151.77 |

| California | $3,688.93 |

| Alaska | $3,421.51 |

| New Mexico | $3,463.64 |

| Wisconsin | $3,606.06 |

| Washington | $3,059.32 |

| Missouri | $3,328.93 |

| Ohio | $2,709.71 |

| Illinois | $3,305.48 |

| Arizona | $3,770.97 |

| North Dakota | $4,165.84 |

| Oregon | $3,467.77 |

| Maine | $2,953.28 |

| Tennessee | $3,660.89 |

| South Dakota | $3,982.27 |

| Nebraska | $3,283.68 |

| New York | $4,958.88 |

| Utah | $3,611.89 |

| Massachusetts | $2,678.85 |

| Indiana | $3,414.97 |

| Median | $3,660.89 |

| New Jersey | $5,515.21 |

| Nevada | $4,861.70 |

| Maryland | $4,582.70 |

| Kansas | $3,279.62 |

| Delaware | $5,986.32 |

| Colorado | $3,876.39 |

| Mississippi | $3,664.57 |

| Montana | $3,220.84 |

| Wyoming | $3,200.08 |

| Alabama | $3,566.96 |

| Pennsylvania | $4,034.50 |

| Georgia | $4,966.83 |

| South Carolina | $3,781.14 |

| Texas | $4,043.28 |

| Oklahoma | $4,142.33 |

| Connecticut | $4,618.92 |

| District of Columbia | $4,439.24 |

| Vermont | $3,234.13 |

| Rhode Island | $5,003.36 |

| Arkansas | $4,124.98 |

| Michigan | $4,362 |

| Kentucky | $5,195.40 |

| Florida | $4,680.46 |

| Louisiana | $5,711.34 |

| West Virginia | $2,595.36 |

| Idaho | $2,979.09 |

| Minnesota | $4,403.25 |

If you click on the up-triangle, you’ll be able to sort the table from lowest to highest. Idaho, Minnesota, and West Virginia don’t have any data. If you live in one of those three states, contact a local Progressive agent in those areas about car insurance rates.

For some states that do have values, car insurance from Progressive is much more expensive per year. For example, in Florida, Progressive is $903 more than the Florida average rate. The percentage listed is the difference between Florida’s average annual rate and Florida’s Progressive average annual rate.

How do the top 10 companies compare by market share?

Where does Progressive stand in market share? We talked about the rankings before and how they are determined by market share. Progressive has earned its spot among the top insurance companies, but how does the company compare to its competitors? Let’s look at how Progressive compares to the other major companies in the country.

Top U.S. Auto Insurance Companies by Market Share| Top Auto Insurance Companies | Average Annual Premiums | Market Share |

|---|---|---|

| State Farm | $2,731.48 | 17.01% |

| Geico | $3,073.66 | 13.41% |

| Progressive | $3,935.36 | 10.97% |

| Allstate | $4,532.96 | 9.19% |

| USAA | $2,489.49 | 5.87% |

| Liberty Mutual | $5,295.55 | 4.77% |

| Farmers | $3,907.99 | 4.26% |

| Nationwide | $3,187.20 | 2.73% |

| Travelers | $3,729.32 | 1.9% |

| American Family | $3,698.77 | 1.9% |

Progressive has the third-largest market share when compared to the other car insurance companies in the country.

What are the average Progressive male vs. female car insurance rates?

When you’re shopping for car insurance, you should know that car insurance companies base your premiums on several factors. Some of the factors that affect the average cost of auto insurance include your age, gender, and marital status. As of Aug. 1, 2019, California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and parts of Michigan have outlawed car insurance companies from using age, gender, and marital status to determine car insurance rates.

For the states that still follow this car insurance factor, there are annual rates that come with it. We’ve collected some data, which is presented in the table below.

| Demographics (Age, Gender & Marital Status) | Progressive Annual Rates Based on Demographics |

|---|---|

| Single 17-year-old female | $8,689.95 |

| Single 17-year-old male | $9,625.49 |

| Single 25-year-old female | $2,697.73 |

| Single 25-year-old male | $2,758.66 |

| Married 35-year-old female | $2,296.90 |

| Married 35-year-old male | $2,175.27 |

| Married 60-year-old female | $1,991.49 |

| Married 60-year-old male | $2,048.63 |

The average cost of Progressive car insurance for teen drivers is nearly $10,000 per year. Progressive does have discount options to curve the price a little more, but the annual rate for teen drivers is more expensive than any other demographic. Older, married drivers pay significantly less than single and younger drivers. How come?

Data indicates that younger individuals behind the wheel tend to engage in riskier driving behaviors. Particularly, young male drivers exhibit a propensity for even greater risk-taking. As a result, insurers like Progressive analyze crash statistics to evaluate the level of risk involved. This assessment is crucial when considering factors such as the installation of Progressive’s plug-in device and obtaining a price quote from Progressive.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

What are the average Progressive rates by make and model?

Have you ever noticed how car insurance rates vary by vehicle make and model? Older vehicles tend to have cheaper annual rates. The values of the vehicles often reflect the car insurance rates. Therefore, new make and model vehicles will cost more to insure. Here’s a table that shows how much Progressive may issue for car insurance based on the make and model of a vehicle.

| Make and Model of a Vehicle | Progressive Annual Rates based on Make and Model |

|---|---|

| 2015 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,914.05 |

| 2015 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $4,429.56 |

| 2015 Toyota RAV4: XLE | $3,647.22 |

| 2018 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,962.58 |

| 2018 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | $4,528.90 |

| 2018 Toyota RAV4: XLE | $3,730.78 |

Let’s examine the car insurance premiums for the Toyota RAV4 XLE from Progressive and compare them. The most recent model incurs a higher annual rate, nearly $100 more. This pattern is likely to hold true for many vehicles you inquire about when obtaining insurance from car insurance companies. Additionally, if you’re interested in getting a Progressive quote in Spanish or need to look up a Progressive quote number, we can assist you with that as well.

What are average Progressive commute rates?

Commute rates are determined by the mileage a policyholder travels per year. Car insurance companies estimate mileage based on how you’ll use your vehicle. if you plan on using your vehicle for school or work commutes, you’ll likely pay more money. If the vehicle you drive is a vehicle you only take out for special occasions, you’ll probably pay the minimum commute rate.

So what are the commute rates for Progressive? Let’s examine them.

| Commute Mileage Summary | Progressive Annual Rates Based on Commute Mileage |

|---|---|

| 10-mile commute, 6,000 annual miles | $4,030.02 |

| 25-mile commute, 12,000 annual miles | $4,041.01 |

Progressive reviews indicate that there isn’t a significant variance in commute rates offered by Progressive. However, policyholders have the opportunity to save through various discounts available. It’s advisable to consult with a Progressive agent regarding potential discounts on commute mileage rates. Additionally, Progressive provides a senior discount option, and its Snapshot program assesses driving behavior to potentially adjust insurance rates.

What are average Progressive coverage level rates?

Coverage level rates are determined by the minimum coverage requirements set by each state, typically consisting of liability car insurance. This type of insurance encompasses various coverage limits, also referred to as coverage rules, each with its own set limit. These limits vary across different levels and play a crucial role in determining the average annual rate for insurance premiums. Additionally, it’s worth noting that factors like Progressive Snapshot hacks, information available on progressivedirect.com, and reviews on Progressive auto insurance can further inform decisions regarding coverage and rates.

Liability coverage pays for a driver’s or no-fault driver’s bodily injury and property damage. Coverage limits are the dollar amount which a car insurance company will pay.

A low coverage level is the base car insurance coverage, which is the minimum requirement for each state. Medium and high coverage levels are more expensive but have higher coverage limits.

For instance, if a driver gets into an accident and has a coverage limit that’s lower than the actual cost of bodily injury and property damage, their policy would be considered underinsured.

To avoid being underinsured, car insurance companies will suggest you get a higher coverage limit. This is particularly helpful for states with low coverage limits.

Each coverage limit has its average annual rate, which we’ve listed for you in the table below.

| Coverage Level | Progressive Annual Rates Based on Coverage Level |

|---|---|

| Low | $3,737.13 |

| Medium | $4,018.46 |

| High | $4,350.96 |

The higher the coverage limit, the more money a policyholder will pay per year. If you live in a city where the average value of a vehicle is over $10,000, it’ll be more cost-efficient to get medium to high coverage. Most of the higher-than-average rates are decreased due to discounts.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

What are average Progressive credit history rates?

Car insurance companies, including Progressive, will look at your credit history when you enroll in a policy. Credit history is an indicator that reveals your financial ability to pay the premiums for your policy. When car insurance companies look at your credit history, it’s not supposed to affect your credit rating.

Why do car insurance companies look at credit history?

Credit experts say that there’s a correlation between a person’s credit history and risk, and companies often assess whether a person is a risk based on credit history.

Does Progressive follow this trend? We can view their risk assessment as to how they issue car insurance premiums per year based on credit history. Let’s have a look.

| Credit History | Progressive Annual Rates Based on Credit History |

|---|---|

| Poor | $4,737.64 |

| Fair | $3,956.31 |

| Good | $3,628.85 |

Based on the table, Progressive does correlate credit history with risk. Those who have poor credit are likely to pay more money for car insurance than those who have fair or good credit. The national average annual rate is $3,661.

Without discounts, Progressive policyholders with poor credit will likely pay $1,100 more than the average for car insurance. If you’re in the poor credit status, ask Progressive agents for discounts to get the rate decreased.

What are average Progressive driving record rates?

One of the most important factors of car insurance is your driving record. Accidents, speeding violations, traffic violations, and DUI convictions can increase your car insurance dramatically once they’re on your record. A person’s driving record could place them in the high-risk pool, and they’ll need SR-22 insurance to get insured.

SR-22 insurance is insurance for high-risk drivers who can’t find insurance through the voluntary market.

The voluntary market is where a potential customer of car insurance can select the company they want to get insurance. For high-risk drivers, however, their options are limited, so they must go to the DMV or other agencies that will help them acquire car insurance. The rates are generally much higher for high-risk drivers.

Drivers with a clean driving record will pay the least and receive a discount for it. There’s even some leniency for accidents through accident forgiveness programs, which Progressive has for loyal policyholders and policyholders who purchase accident forgiveness.

Let’s examine Progressive’s average annual rates based on driving record

| Driving Record Summary | Progressive Annual Rates Based on Driving Record |

|---|---|

| Clean record | $3,393.09 |

| With 1 DUI | $3,969.65 |

| With 1 speeding violation | $4,002.28 |

| With 1 accident | $4,777.04 |

Progressive issues more expensive increases on a person’s record for accidents and speeding violations than DUI convictions. This is helpful for people in states where DUI convictions stay on their driving record for life. For those under SR-22 insurance, Progressive is likely to issue a higher-than-average rate.

What coverage is offered?

As you’re shopping for car insurance, you’ll want to know what coverages will be available to you. The main parts of car insurance coverage are bodily injury and property damage. A lot of other car insurance coverage options do more. We’ll talk about those options from Progressive in this section as well as the essentials for car insurance coverage.

Types of Coverages Offered

Progressive has a variety of coverages: liability auto insurance coverage, collision coverage, and comprehensive auto insurance coverage. Progressive also has uninsured coverage, underinsured coverage, medical payments (often referred to as MedPay). Ask the Progressive insurance agent about Personal Injury Protection or PIP. PIP is required in some states, and you may see it attached to your policy.

The most important car insurance coverage offered is liability. Liability coverage is what all U.S. states and car insurers require for car insurance. It covers bodily injury and property damage.

Liability coverage carries a coverage limit, which determines how much your car insurance will cover in case you’re in a car accident. You can ask Progressive for a higher coverage limit if you think the minimum coverage limit isn’t enough to cover the cost of an accident.

What about full coverage?

Progressive experts say full coverage is a myth.

Full coverage is commonly known as the combination of liability coverage, collision coverage, and comprehensive coverage. When you’re financing or leasing a vehicle, the lender will ask you about full coverage, which is the combination of the three insurance coverages.

Comprehensive coverage provides protection in case your vehicle is damaged through unexpected events such as a fire, theft, vandalism, hitting an animal, glass breakage, or weather and acts of nature. You may have to pay a deductible.

A deductible is the amount of money you’ll pay out of pocket before your insurer pays the remaining balance.

Collision coverage pays for the cost of damage when your vehicle collides with another object such as a curb, trees, or another vehicle. If you have collision coverage with Progressive, they will pay veterinarian bills in case your pet is injured.

Uninsured and underinsured coverage is compensation after an accident with an at-fault driver who doesn’t have insurance or has coverage limits that don’t cover the cost of bodily injury or property damage.

Medical payment coverage is additional coverage for injuries regardless of who is at fault. It covers your family members and passengers in your vehicle. It also applies to you and family members who may be passengers in another vehicle or who are in an accident while they are walking or riding a bicycle.

What additional coverages does Progressive provide?

- Roadside assistance — This coverage helps a policyholder in case their vehicle breaks down. Roadside assistance will get your car towed to your home or an auto repair shop of your choice.

- Loan/lease payoff — Whenever your vehicle is a total loss after a car accident, Progressive will pay off the remaining balance of your loan or lease.

- Rental car reimbursement — If you get into an accident and need a rental car to commute, Progressive will compensate you for any rental car fees and payments while your car is getting repaired.

- Custom parts and equipment value — Cars that are customized with parts different from the original manufacturer can be insured with this coverage. Contact a Progressive agent to let them know which parts of your vehicle are customized, so they may add it to your policy.

- Rideshare coverage — With ridesharing becoming popular, Progressive has adapted to this trend and offers ride sharers with insurance. If you’re in a car accident, and you have sufficient coverage, Progressive will pay for a rental car (up to $30 to $50 per day) while your vehicle is being repaired (does not include routine maintenance).

- Deductible savings — Concerned about deductibles? Progressive allows its policyholders to deposit money into a deductible savings account. This will allow policyholders to use their savings whenever they need to repair a windshield or whenever a deductible is required.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

What are Progressive bundling options?

On the Progressive homepage, you can get a quote for auto and home insurance, auto and renters insurance, and auto and condo insurance. Progressive has a lot more items you can insure for your convenience, and policyholders can receive discounts for bundling insurance policies together.

What are Progressive insurance discounts?

As you’ve seen from the Progressive commercials, Progressive promotes their savings. Their savings stem from the auto insurance discounts policyholders and potential customers can receive under their policies.

What discounts are available at Progressive car insurance? We’ve seen the affordable rates based on driving record, coverage level, and commute mileage. Let’s take a look at more discounts that are available for Progressive policyholders.

Loyalty-Based Discounts

Policyholders who use Progressive services for car insurance and home insurance can receive a 5 percent or higher discount. Bundling your car insurance with another type of insurance at Progressive is one way to save money on your premium. Also, if you have multiple cars on one policy, Progressive will give you a 12 percent discount.

For those who continuously use Progressive as their insurance provider, Progressive will give them a discount. Progressive says that a policyholder’s discount for consistently insuring with Progressive depends on how long they’ve been insured with them without any gaps or cancellations.

Driver-Based Discounts

Teenage drivers who are 18 years old or younger are expensive to insure for car insurance. Progressive will help decrease teen driver insurance rates to help parents save money. The discount rate varies, so talk to a Progressive agent about eligibility.

If you’re a college student who wants to save money on car insurance, earning a B average or better could help you get a good grade auto insurance discount and save you money with Progressive. This discount is also available to parents who have college students on their policy.

Like teen driver discounts, the good student auto insurance discount rate varies. Students who live farther than 100 miles from their permanent residence are eligible for Progressive’s driver-based discount. Students who are 22 years old or younger are eligible, also.

What if a college student is on your policy and they don’t have a car while they’re in college? In that case, the policyholder would still be eligible for a distant student auto insurance discount as long as the students are over 100 miles away from their permanent residence.

Speaking of residence, policyholders can receive up to 10 percent off their premiums if they have homeowners insurance, even if the home insurance provider isn’t with Progressive or their affiliates.

Discounts for How You Quote and Buy

Get a 4 percent discount if you purchase your policy using Progressive’s online quote generator. Progressive gives you further discounts when you go paperless (discount varies) and use the signup online feature (8.5 percent off). To get these discounts, you must e-sign (electronically sign) the necessary documents.

Progressive will give discounts to people who want to pay their premiums in full. The rate of this discount varies. Discounts are also given to people who set up automatic payments. Consult a Progressive agent on the discount rates, which could be different for each state, city, or county.

What are Progressive insurance programs?

Progressive Advantage ® Business Program gives businesses access to different types of insurance products that typical small business owners need most. Progressive’s team of licensed agents can offer business owners policies, contractors liability, professional liability, cyber insurance and workers’ compensation underwritten by carriers selected by Progressive.

A program that relates to car insurance can save you money. Progressive has a usage-based insurance program called Snapshot®. The Snapshot® program tracks your driving performance and determines your premium rate based on how safe you drive. The safer you drive, the more money you’ll save.

Free Auto Insurance Comparison

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

What are Progressive insurance reviews and consumer reports?

Before we move on to the annual rates for Progressive car insurance, let’s discuss how Progressive is rated by financial and credit agencies. Each agency has its own rating system.

Some groups don’t have a rating, but they use consumer feedback to judge whether the company or product is performing well for consumers.

Here are the ratings for Progressive from the top financial strength and credit rating agencies in the world.

Progressive Ratings by the Top Financial Strength and Credit Agency| Ratings Agency | Rating |

|---|---|

| A.M. Best | A+ |

| Better Business Bureau | A+ |

| Consumer Reports | 87 |

| J.D. Power | Claims Satisfaction 3/5 Shopping Study 3/5 |

| Moody's | Aa |

| NAIC Complaint Index | 0.42 (2018) |

| S&P | AA |

It appears that Progressive has good ratings from different agencies, but how do we know that for sure? This section will go into detail on what each grade means and explain where Progressive stands as a company based on the opinion of each major agency.

A.M. Best

A.M. Best is an international financial and credit rating agency that focuses on the insurance industry. A.M. Best’s credit ratings are an indicator of an insurance company’s financial strength and credit worth.

A.M. Best uses the Best Financial Strength Ratings, which is an independent opinion about an insurance company’s financial strength. In addition to the company’s financial strength and creditworthiness, A. M. Best judges an insurance company’s ability to meet policy and contract obligations.

| Rating Categories | Rating Symbols | Rating Notches | Category Definitions |

|---|---|---|---|

| Superior | A+ | A++ | Assigned to insurance companies that have a superior ability to meet their ongoing insurance obligations |

| Excellent | A | A- | Assigned to insurance companies that have an excellent ability to meet their ongoing insurance obligations |

| Good | B+ | B++ | Assigned to insurance companies that have a good ability to meet their ongoing insurance obligations |

| Fair | B | B- | Assigned to insurance companies that have a fair ability to meet their ongoing insurance obligations. Financial strength is vulnerable to adverse changes in underwriting and economic conditions. |

| Marginal | C+ | C++ | Assigned to insurance companies that have a marginal ability to meet their ongoing insurance obligations. Financial strength is vulnerable to adverse changes in underwriting and economic conditions. |

| Weak | C | C- | Assigned to insurance companies that have a weak ability to meet their ongoing insurance obligations. Financial strength is very vulnerable to adverse changes in underwriting and economic conditions. |

| Poor | D | - | Assigned to insurance companies that have a poor ability to meet their ongoing insurance obligations. Financial strength is extremely vulnerable to adverse changes in underwriting and economic conditions. |

A.M. Best rates Progressive Corporation and its national affiliates with an A+ rating, which means Progressive has a superior ability to meet their ongoing insurance obligations to their policyholders.

Better Business Bureau

The Better Business Bureau (BBB) grades the financial strength of a company, and they allow consumers to leave reviews about products and services. The BBB has a rating system also. The agency bases its grading on these factors:

- Advertising issues

- Business’s complaint history

- Failure to honor commitments

- Licensing and government actions

- Type of business and time in business

- Transparent business practices

What’s the BBB rating for companies? This table summarizes the grading system shown below and will explain how the BBB scores or rate each company.

| BBB Score | BBB Letter Rating |

|---|---|

| 97-100 | A+ |

| 94-96.99 | A |

| 90-93.99 | A- |

| 87-89.99 | B+ |

| 84-86.99 | B |

| 80-83.99 | B- |

| 77-79.99 | C+ |

| 74-76.99 | C |

| 70-73.99 | C- |

| 67-69.99 | D+ |

| 64-66.99 | D |

| 60-63.99 | D- |

| 0-59.99 | F |

Progressive’s score is in the lower 90s and has a letter grade of A-, which is one of the highest ratings on the BBB grade scale. The customer ratings for Progressive, however, were low. Over 300 customer reviews gave Progressive a one-star rating.

Let’s continue through the guide to see ratings and customer reviews from other groups and agencies.

Moody’s Rating

Moody’s analyzes global capital markets and grades them based on their financial strength, performance, and credit worth. They provide credit ratings, research, tools, and analysis to financial markets.

Moody’s is one of the top credit-rating agencies. This agency tracks credit ratings of companies in 135 countries. Their rating system is much different from its competitors, which we will show here:

| Moody's Grading Scale | Moody's Grading Summary |

|---|---|

| Aaa | Obligations are judged to be of the highest quality, subject to the lowest level of credit risk. |

| Aa | Obligations are judged to be of high quality and are subject to very low credit risk. |

| A | Obligations are judged to be upper-medium grade and are subject to low credit risk. |

| Baa | Obligations are judged to be medium-grade and subject to moderate credit risk and as such may possess certain speculative characteristics. |

| Ba | Obligations are judged to be speculative and are subject to substantial credit risk. |

| B | Obligations are considered speculative and are subject to high credit risk. |

| Caa | Obligations are judged to be speculative of poor standing and are subject to very high credit risk. |

| Ca | Obligations are highly speculative and are likely in, or very near, default, with some prospect of recovery of principal and interest. |

| C | Obligations are the lowest rated and are typically in default, with little prospect for recovery of principal or interest. |

Moody’s rating of Progressive is AA, which says that Progressive handled their obligations with high quality and was subject to very low credit risk.

S&P Rating

Standard and Poor’s is another international financial strength rating and credit rating agency that promotes transparency and business growth. S&P reports credit ratings, critical insights, and risk research that are essential to interpreting complexity into clear reports to help consumers make decisions.

S&P helps consumers through their rating system. Here are the grades they use to rate companies around the world and give consumers a clear view of who provides the best products and services.

| Investment Grade | Invest Grade Summary |

|---|---|

| AAA | Extremely strong capacity to meet financial commitments |

| AA | Very strong capacity to meet financial commitments |

| A | Strong capacity to meet financial commitments, but somewhat susceptible to economic conditions and changes in circumstances |

| BBB | Adequate capacity to meet financial commitments, but more subject to adverse economic conditions |

| BB | Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions |

| B | More vulnerable to adverse business, financial and economic conditions but currently has the capacity to meet financial commitments |

| CCC | Slugly vulnerable and dependent on favorable business, financial and economic conditions to meet financial commitments |

| CC | Highly vulnerable; default has not yet occurred but is expected to be a virtual certainty |

| C | Slugly highly vulnerable to non-payment, and ultimate recovery is expected to be lower than that of higher-rated obligations |

| D | Payment default on a financial commitment or breach of an imputed promise and also used when a bankruptcy petition has been filed |

According to S&P, Progressive has a very strong capacity to meet financial obligations to its policyholders, giving the insurance company a grade of AA.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) reviews complaints from car insurance policyholders and reports the total number of complaints, premiums written and earned, and loss ratio to consumers as a way to promote transparency.

Consumer feedback is vital to any company’s success. Ratings from financial and credit rating agencies come from consumer feedback.

| Progressive Report Criteria | Complaint Ratio |

|---|---|

| Annual national Median complaint ratio | 1.00 |

| Progressive Insurance Corporation annual median complaint ratio | 0.36 |

This report is from NAIC’s 2018 report of Progressive. It compares the national average complaint ratio with Progressive’s annual average of complaint ratio. Based on the averages, Progressive’s complaint ratio was 0.64 less than the national average.

What’s the complaint forecast for private passengers?

Private passengers are customers who insure their privately owned vehicles with a designated car insurance company.

The private passenger category is the voluntary insurance market where all policyholders take part in. The data in the table below describe Progressive’s complaint ratio and total complaints in the private passenger category.

| Policy Type | Private Passenger |

|---|---|

| Complaint year | 2018 |

| Complaint index | 0.42 |

| National median complaint index | 1.16 |

| Complaint share | 0.003 |

| Total complaints | 46 |

| U.S. market share | 0.71% |

| Total premiums | $1,748,548,733 |

The complaint index for Progressive’s private passenger sector was 0.42. The national average complaint index for private passenger insurance was 1.16. Throughout 2018, Progressive only had 46 complaints in their private passenger department.

J.D. Power

J.D. Power reviews all companies based on a combination of financial strength and overall customer satisfaction review in a study called the U.S. Auto Claims Satisfaction Study. This financial strength and credit agency uses something called the Power Circle Ratings and the customer satisfaction index. J.D. Power reviews companies by surveying customers of a company or product to rate various aspects of their service.

J.D. Power experts say, “All ratings are based on the opinions of consumers who have actually used or owned the product or service being rated.”

J.D. Power collects consumer feedback and releases it in its research reports. This research is called the Customer Satisfaction Index Ranking. The rankings are measured on a 1,000 point scale. The Power Circle Ratings are measured from:

- Five out of five circle rating: Among the best

- Four out of five circle rating: Better than most

- Three out of five circle rating: About average

- Two out of five circle rating: The rest

J.D. Power rates companies by region through independent studies conducted annually. For your convenience, we’ve listed each rating for Progressive in each region. Here are the results.

| Region | Customer Satisfaction (out of 1,000) | J.D. Power Circle Ranking | J.D. Power Circle Rating |

|---|---|---|---|

| California | 821 | About average | ooo |

| Central | 823 | About average | ooo |

| Florida | 809 | The rest | oo |

| Mid-Atlantic | 828 | The rest | ooo |

| New England | 825 | About average | ooo |

| New York | 815 | The rest | oo |

| North Central | 828 | About average | ooo |

| Northwest | 797 | The rest | oo |

| Southeast | 824 | The rest | oo |

| Southwest | 807 | The rest | oo |

| Texas | 816 | The rest | oo |

J.D. Power rates Progressive in the upper 700s and mid 800s. Under the Power Circle Ratings, Progressive rates below average. As mentioned above, J.D. Power’s opinion is measured by customer satisfaction. Progressive appears to struggle between average to below-average in terms of customer satisfaction.

Consumer Reports

Consumer Report uses customer feedback to determine what company is right for the customer. If you’ve ever wondered about how other customers feel about a particular company, you can always search for Consumer Reports online. Consumer Reports tells you about such factors as the consumer experience with a company, customer service, and agent response time.

Here’s what we found out about Consumer Reports’ opinions of Progressive car insurance.

| Progressive Insurance Group | Consumer Report Stats |

|---|---|

| Reader Score | 87 |

| Reaching an Agent | Very Good |

| Simplicity of the Process | Very Good |

| Promptness of Response | Very Good |

| Damage Amount | Very Good |

| Agent Courtesy | Very Good |

| Timely Payment | Excellent |

| Freedom to Select Repair Shop | Very Good |

| Being Kept Informed of Claim Status | Very Good |

Consumer Reports’ opinion differs from J.D. Power’s opinion greatly. Instead of the average and below-average evaluation, Consumer Report gives Progressive an excellent or very good rating. The reader’s score for Progressive is 87.

What is the history of the company?

Progressive was established in 1937 by Joseph Lewis and Jack Green. They launched the Progressive Mutual Insurance Company to provide affordable auto insurance to all vehicle owners. Progressive encourages innovation and reinforces their drive to provide insurance protection at affordable prices.

Fifty years ago, Progressive was the first car insurance company that allowed policyholders to pay their car insurance premiums in installments.

Today, Progressive is one of the top 10 car insurance companies in the United States that not only provides car insurance, but also home insurance, renters insurance, and other services to policyholders. In recent years, they’ve seen an increase in company development.

What is Progressive’s market share?

Progressive’s total sales have earned a spot on the top 10 list of the best car insurance companies in the United States.

But where do they rank among the top 10 insurance companies? We’ve provided a summary of Progressive’s rank from 2015 to 2018. Here are the results:

| Year | Progressive Rank | Progressive Market Share |

|---|---|---|

| 2015 | 4 | 8.7% |

| 2016 | 4 | 9.15% |

| 2017 | 3 | 9.84% |

| 2018 | 3 | 10.97% |

In 2015 and 2016, Progressive was ranked in fourth place, but in 2017 to 2018, they moved up to third. The market share for Progressive has gradually increased over four years.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

What is Progressive’s position for the future?

Based on the market share of Progressive, we see an increase in rank from 2015 to 2018. Could this increase continue? It depends on the company’s performance. Perhaps Progressive’s marketing and consumer strategies have improved the company’s policyholder acquisition rate. For now, it’s difficult to tell which direction Progressive will go.

How could that possible with Progressive earning higher profits each year? Even though Progressive has done well with premiums written, they advance more slowly than the competitors ranked above them. So far, Progressive has maintained a steady increase.

What is Progressive’s online presence?

Progressive has a steady online presence. About 994,000 people follow them on Facebook, and they have 63,800 followers on Twitter. Progressive also has 25,300 subscribers on YouTube, while their Instagram account has 38,500 followers.

How are Progressive’s commercials?

Progressive uses humor, celebrities, and other witty displays to promote their company. Here are two commercials from Progressive that do just that. Most of the commercials appear to be geared more toward younger adults.

Progressive appears to be targeting college students and younger adults who are searching for car insurance.

Progressive continues to encourage young adults to abandon their parents’ car insurance policy and join Progressive to save money.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Is Progressive active in the community?

The Keys to Progress ® Program honors veterans with vehicle donations to members of the U.S. Armed Forces. Progressive has donated more than 700 vehicles to veterans and veteran organizations since 2013. The one-day vehicle giveaway occurs every November.

Progressive employees across the country volunteer to find vehicles to donate, organize fundraising activities to collect money or goods for families, and plan memorable vehicle giveaway events for veterans.

STEM Progress ® Program stands for science, technology, engineering, and math education programs. Progressive employees contribute to the causes they care about through the Progressive Insurance Foundation, which was established in 2001. The foundation gives back to communities by supporting charities.

Progressive considers any qualified civic, cultural, educational, environmental, health care, human services, or religious 501(c)(3) public, tax-exempt charitable organization as eligible under the STEM Progress ® program.

The Progressive Corporation contributes to the Progressive Insurance Foundation every year. When an employee gives any amount from $20 to $3,000 to a qualified 501(c)(3) charity and requests a matching gift, the foundation matches the employee’s dollars up to 100 percent, depending on the number of requests and the company’s performance.

Who are Progressive’s employees?

Progressive’s employee experience is rated as one of the highest among insurance companies. In 2019, Progressive was ranked fifth in Financial Services & Insurance™ Best Workplaces, and it ranked 76th in the Fortune 100 Best Companies to Work For®.

According to Great Place to Work, the overall employee experience at Progressive has a 92 percent approval rating. Great Place to Work is a nonprofit group that allows current and former employees to anonymously rate their workplace. The group analyzes each factor of a company. For Progressive, five areas were praised by employees.

| Great Place to Work Review - Progressive Insurance | Employee Satisfaction Score |

|---|---|

| Overall employee experience | 92% |

| Welcoming newcomers | 97% |

| Honest & ethical management | 94% |

| Professional executive staff | 93% |

| Resources | 93% |

| Proud to work for the company | 93% |

Ninety-seven percent of employees felt welcome when they joined, while 94 percent praised the honesty and ethics of management. Executives, resources, and pride about the job were given a 93 percent approval rating.

What’s the average age of employees at Progressive?

The largest age group at Progressive are millennials (born between 1981 and 1997), which make up 47 percent of employees. Thirty-nine percent of employees are Gen-X’ers (born between 1965 and 1980), and the remaining 13 percent are baby boomers (born between 1945 and 1964).

Can you cancel Progressive car insurance anytime?

If you want to cancel your policy with Progressive, there are few things you should know. This section of the Progressive guide will explain how to cancel your car insurance policy and set up another insurance so your car can remain insured.

Does Progressive charge a cancellation fee?

Some states have laws that require car insurance companies to issue a cancellation fee whenever a policyholder cancels their insurance policy. Car insurance companies will normally ask for the remaining balance on your policy before you cancel.

Is there a refund?

Policyholders who have prepaid their car insurance will be issued a refund for car insurance services not used.

How to Cancel Progressive Car Insurance

For Progressive policyholders to cancel their policy, they’ll have to contact a Progressive associate, which can be done through their toll-free number at 1 (866) 416-2003. Be sure to have your policy number close by. They’ll want to ask a few questions on why you want to cancel. Associates will evaluate whether you’re eligible for other discounts, and they’ll ask about the next car insurance company you’ll be insured with.

Policyholders may be able to cancel their policies on the website when they log in to their account, but it’s safer to cancel with a Progressive associate.

When can I cancel?

You can cancel anytime you see fit. It’s better to cancel once you have another car insurance policy ready to use.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How do you make a claim?

If you’re already a Progressive policyholder, you can make a claim by calling Progressive’s toll-free service, submitting it online or using the Progressive mobile app.

There are two options for making a claim. One of them is reporting vehicle damage, and the other is reporting windshield and glass damage.

When you make a claim, be sure to have your account/policy number ready. Keep a physical copy of your Progressive information in your vehicle and an electronic copy on your smartphone.

Once you’ve submitted your claim, Progressive associates will inspect the damage and give you repair options. They’ll help schedule repairs as well. When the repairs are complete, your claim will be resolved.

Claims for windshield and glass repair follow the same procedure.

Ease of Making a Claim

Using the toll-free service or the Progressive mobile app is the easiest way to make a claim. It may be inconvenient for policyholders to log in to make a claim, especially if they haven’t logged in through the website before.

Read more:

- Affordable Full Glass Auto Insurance Coverage

- Does Progressive auto insurance cover windshield replacement?

What are the direct premiums written?

Premiums written represent the total premiums written in a company within a period. This could be from the company itself or any other affiliated companies. The main factor for a car insurance company’s direct premium success is when new policies are written.

| Year | Progressive Rank | Progressive Direct Premiums Written |

|---|---|---|

| 2015 | 4 | $16,566,932 |

| 2016 | 4 | $19,634,834 |

| 2017 | 3 | $22,786,034 |

| 2018 | 3 | $27,058,768 |

Progressive’s direct premiums written increased from 2015 to 2018, which increased their ranking among the major insurance companies in the United States. Since 2015, Progressive has increased its direct premiums written by about $11 million.

What is the loss ratio?

The loss ratio represents the number of claims paid out versus the number of premiums received from policyholders.

The loss ratio is money being paid out in claims from a car insurance company and the money they earned from policyholders.

If a car insurance company, for example, has a loss ratio of 71.21, it means the company spent $71.21 for every $100 they made.

Loss ratios that are too low indicate a car insurance company that doesn’t pay out claims effectively, and loss ratios that are too high or exceed 100 indicate a car insurance company that isn’t earning money.

| Year | Progressive Rank | Progressive Loss Ratio |

|---|---|---|

| 2015 | 4 | 64.23 |

| 2016 | 4 | 66.74 |

| 2017 | 3 | 63.32 |

| 2018 | 3 | 62 |

The loss ratio for Progressive stayed around 65 from 2015 to 2016. By 2017, the loss ratio saw its first decrease, and in 2018, the loss ratio dropped to 62. When we average all the loss ratios in the four-year trend, we’ll see that Progressive had an average loss ratio of 64.07.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How can you get a Progressive insurance quote online?

Now that you’ve seen what the average annual rates are like for Progressive, you’re probably wondering what it would be like for you. You can a direct quote from Progressive through their website. In this section, we’ll give you some a step-by-step guide on how you can do that.

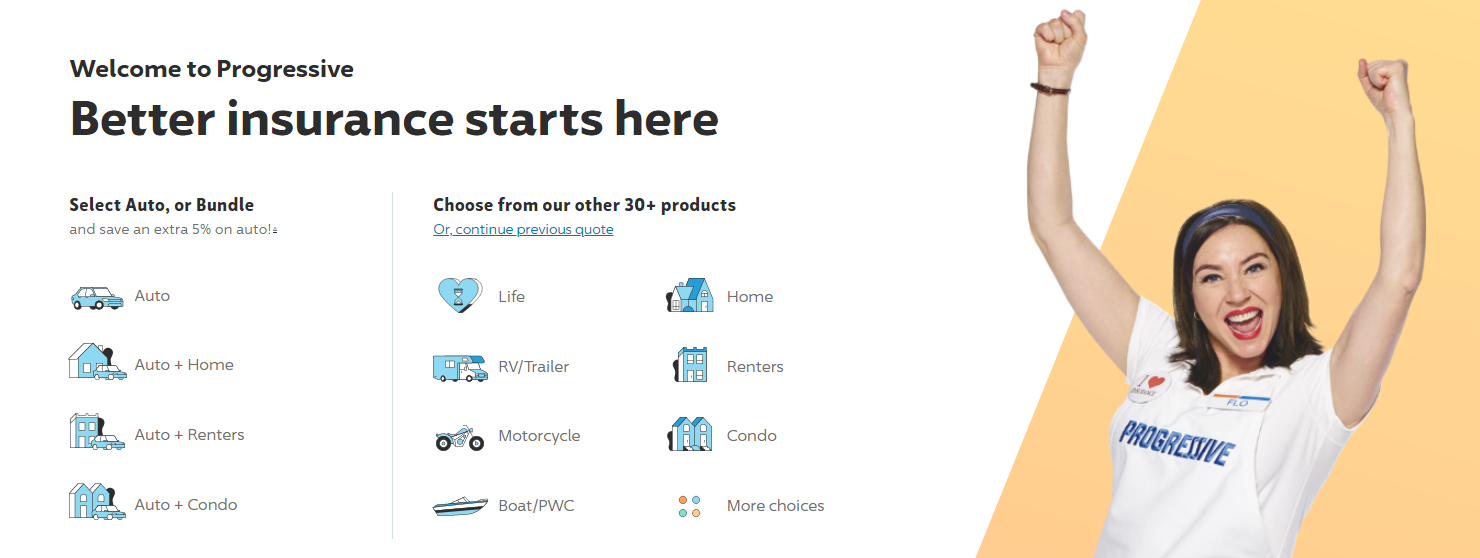

To get started, click on the car icon under “Better insurance starts here.”

Step 1: Choose Your Insurance Option

You’re welcome to bundle your insurance, but for this example, we’ll stick with auto.

Enter your ZIP code and click the “Get a Quote” button to continue.

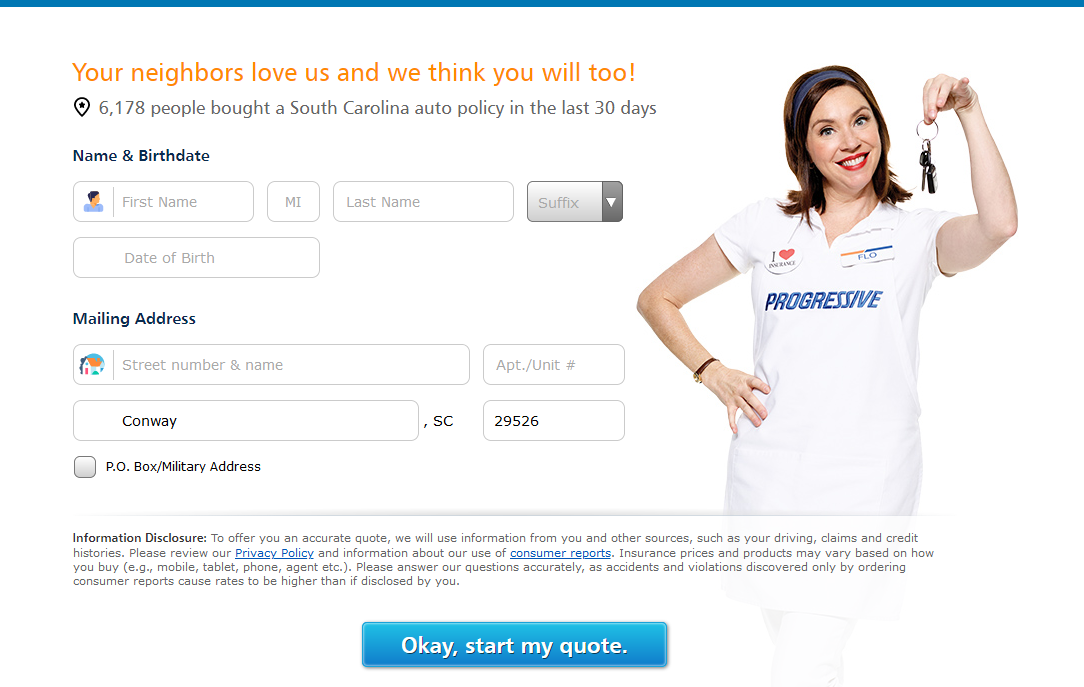

Step 2: Enter Name, Birthdate & Address

Progressive will need to know some information about you before you can move on.

Enter your name, date of birth, and mailing address. When you’re done, click “Okay, start my quote” to continue.

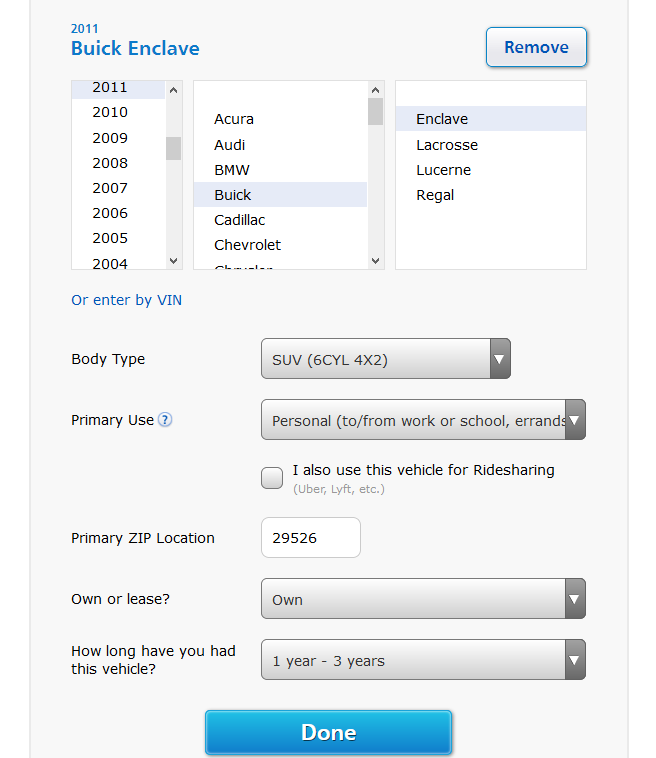

Step 3: Enter Information About Your Vehicle

The next step is entering your vehicle information. Progressive will ask about the make, model, and body type of the vehicle.

In addition to technical vehicle details, the site will ask you how you’ll use the vehicle, and if you own or lease the vehicle. Finally, the section will ask how long you’ve driven the vehicle.

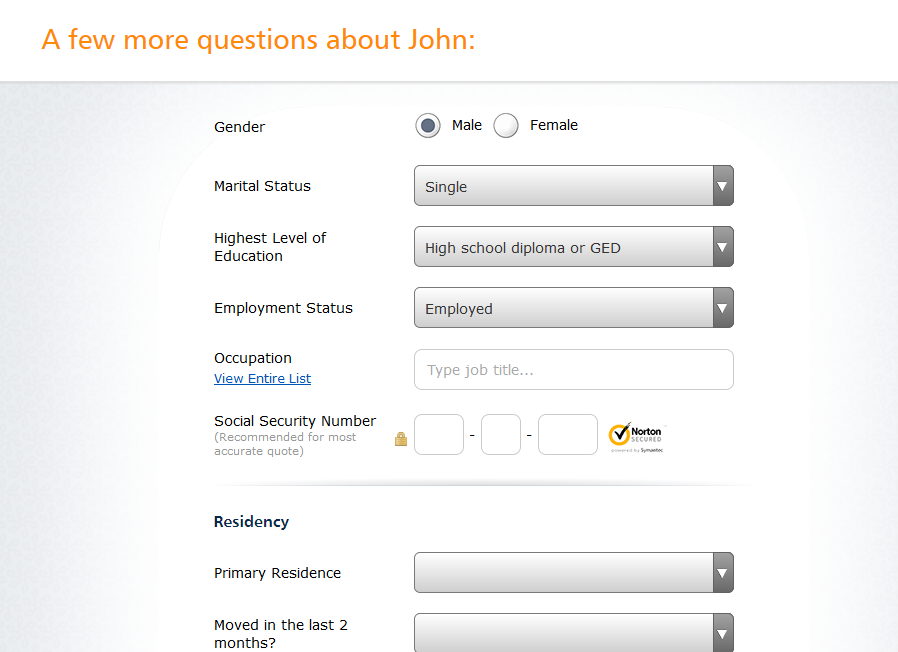

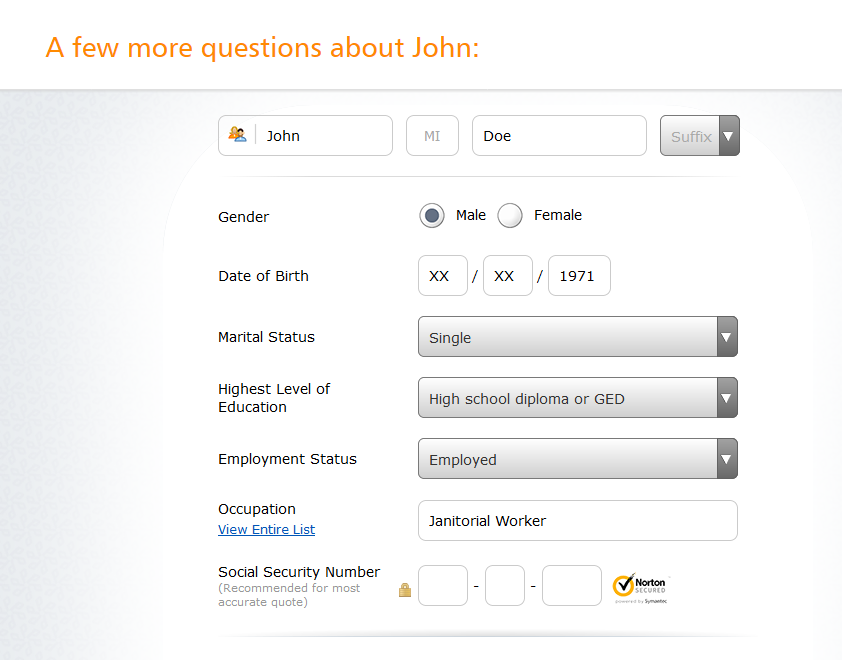

Step 4: Enter Information Driver Information

The next section of the quote process is entering your driver information. This will give Progressive more information about your gender, education level, and occupation.

You don’t have to use your Social Security number (SSN). We didn’t enter an SSN for this step and we were able to proceed to the next step.

You’ll have to respond to a few more items in the quote process, which is relevant to how much your quote will be.

Double-check your information before you move on to the other responses.

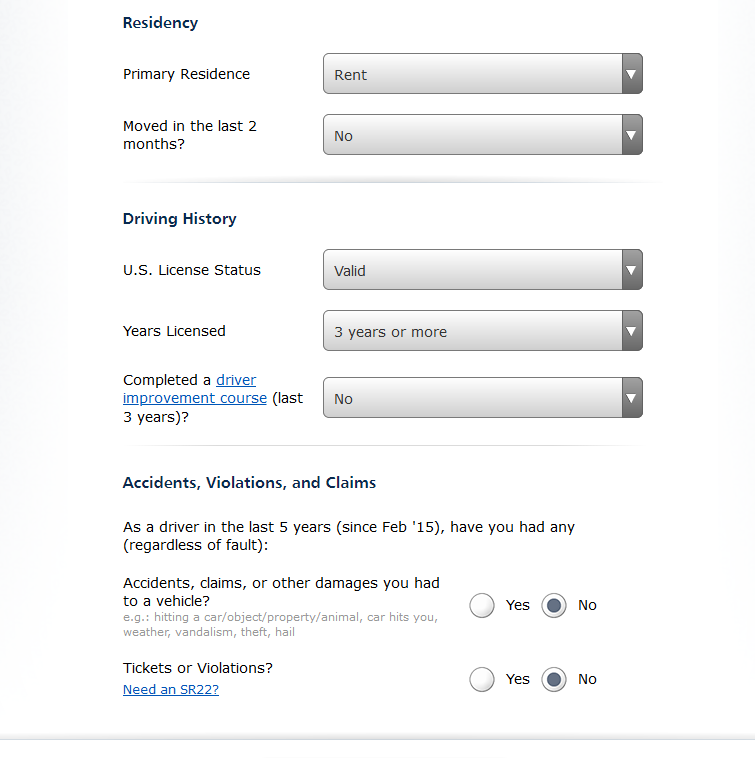

Progressive will ask about whether you own or rent your residence, and they’ll want to know about your driving history.

Answer each dialog box and bullet point accurately. It could be a problem later in your policy if you didn’t answer one of the questions accurately.

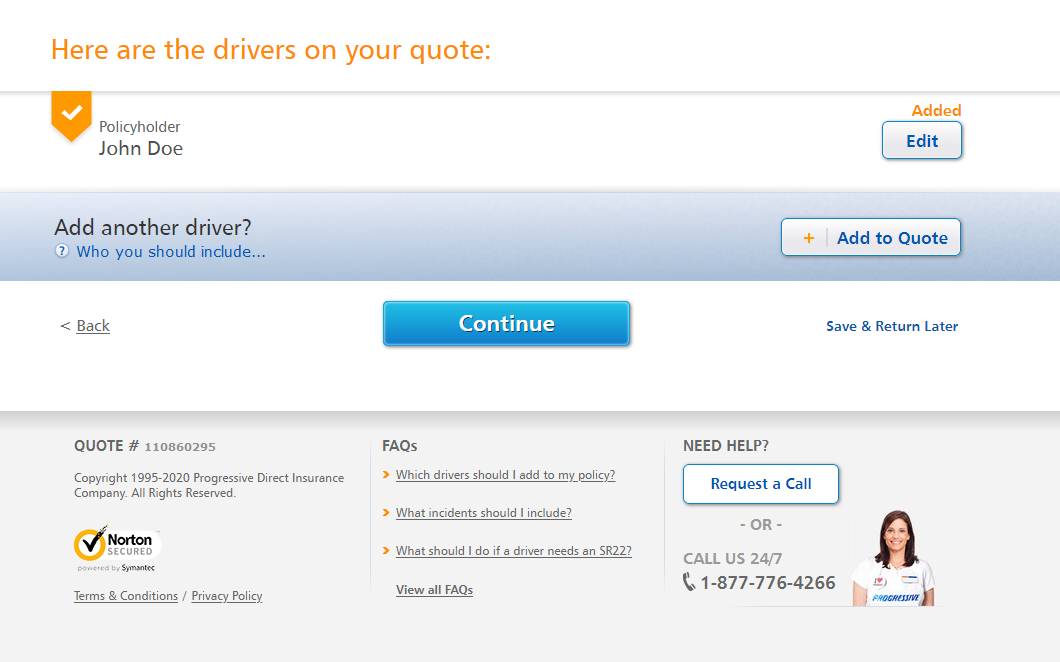

Continue to follow the responses and prompt until you get to this screen.

Once you’ve completed all the information required, click “Continue.”

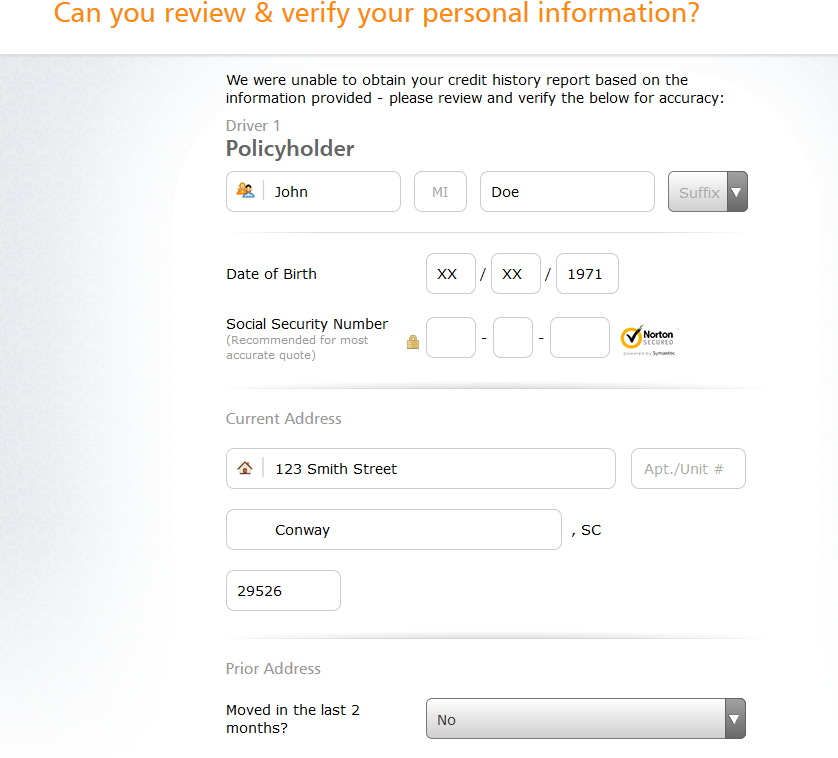

Step 5: Verify Additional Personal Information

Progressive’s quote responses will double-check your information to make sure it’s accurate.

Look through the information to see if anything is missing. If everything is accurate, continue through the Progressive quote process.

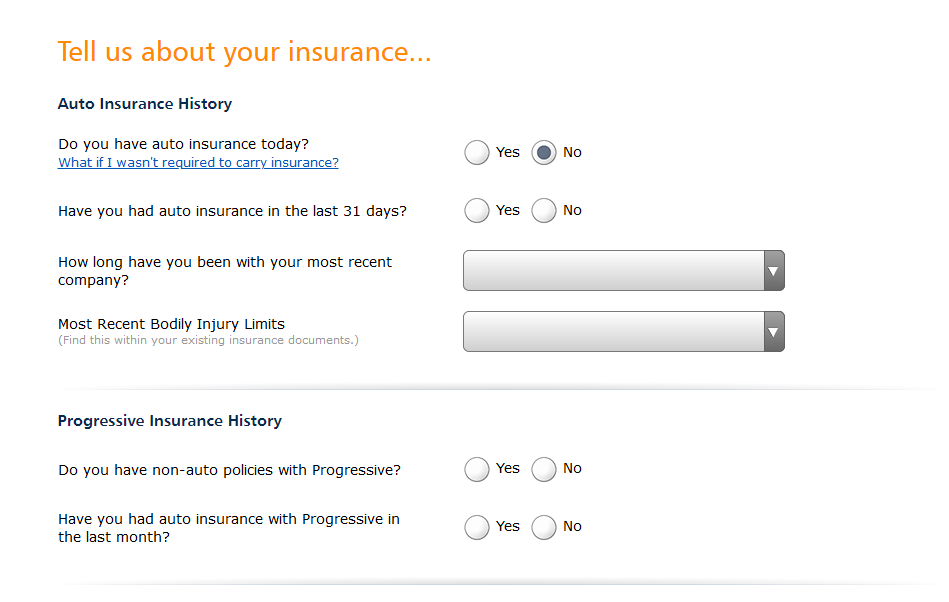

Step 6: Report Insurance History

You’ll need to provide Progressive with information about your insurance history and e-mail address.

When you’ve completed this section, click continue.

If you scroll down, you’ll see more information that’s required.

Enter your primary email address and how many people live with you in the household, then click “Continue.”

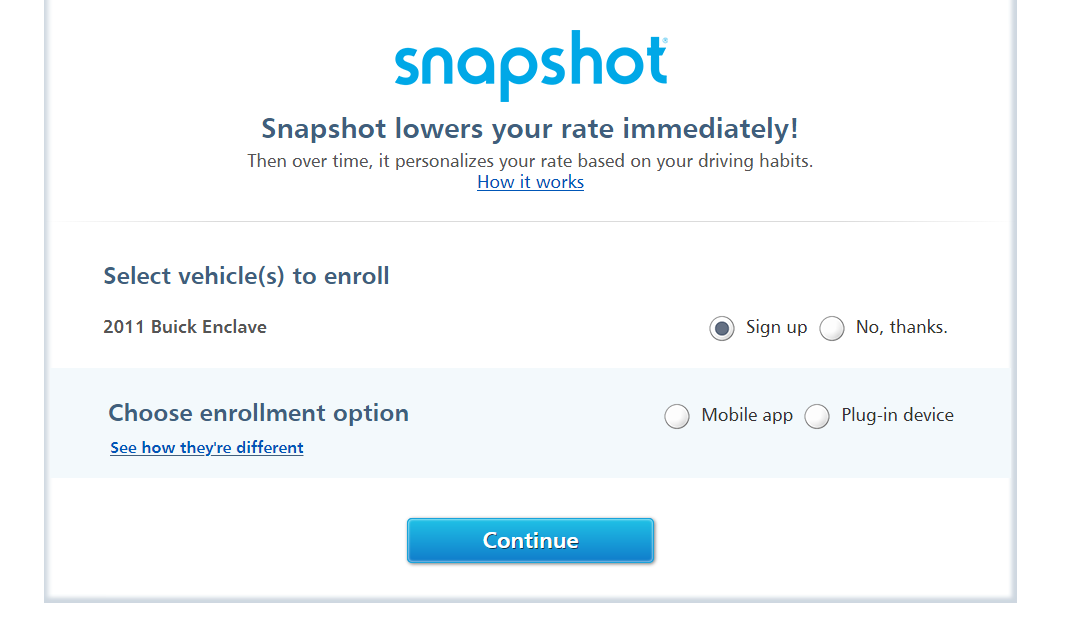

Step 7: Choose to Enroll in Additional Services

Before you move on to your quote, Progressive will ask if you want to sign up with Snapshot ®.

It’s optional, so you can simply click continue and skip the signup process.

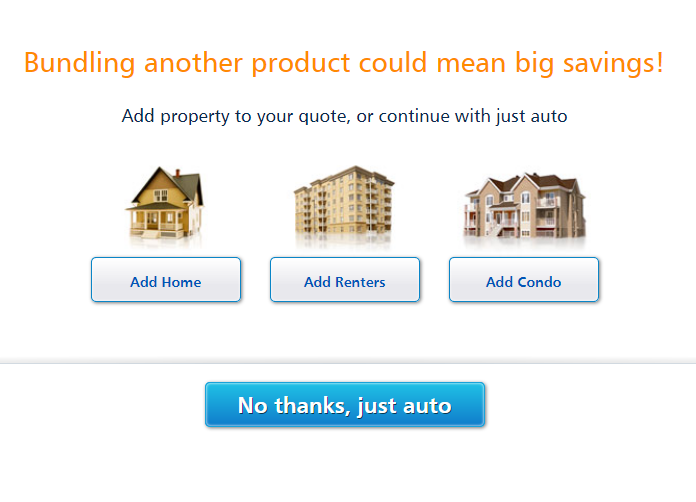

Step 8: Choose to Bundle with Another Insurance

After the Snapshot ® sign-up screen, you’ll have another chance to bundle your auto insurance with other insurance that Progressive offers.

We’ve decided to skip the bundle option for this step-by-step guide.

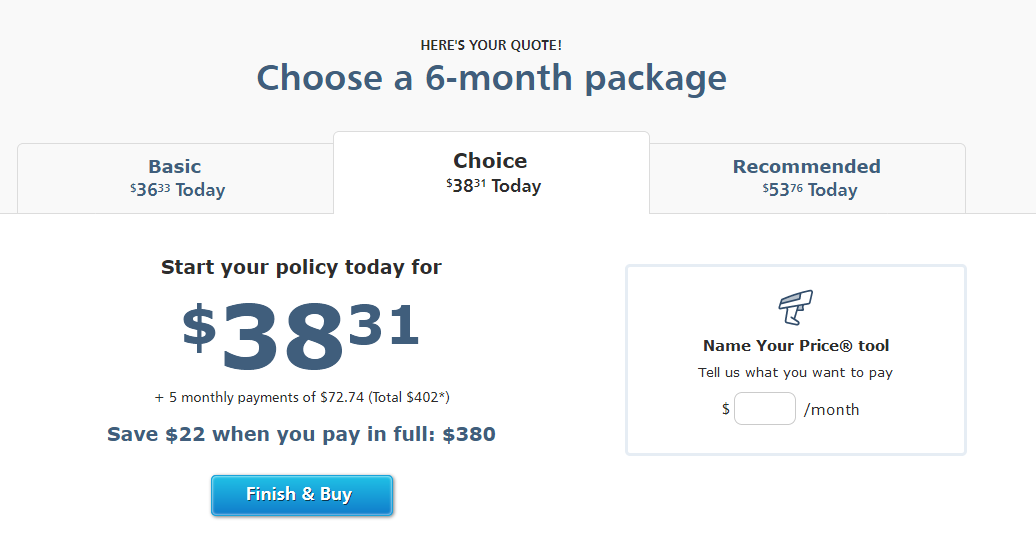

Step 9: Select Your Auto insurance quote from Progressive

Finally, the last part is your quote. You’ll see three selections you can choose from.

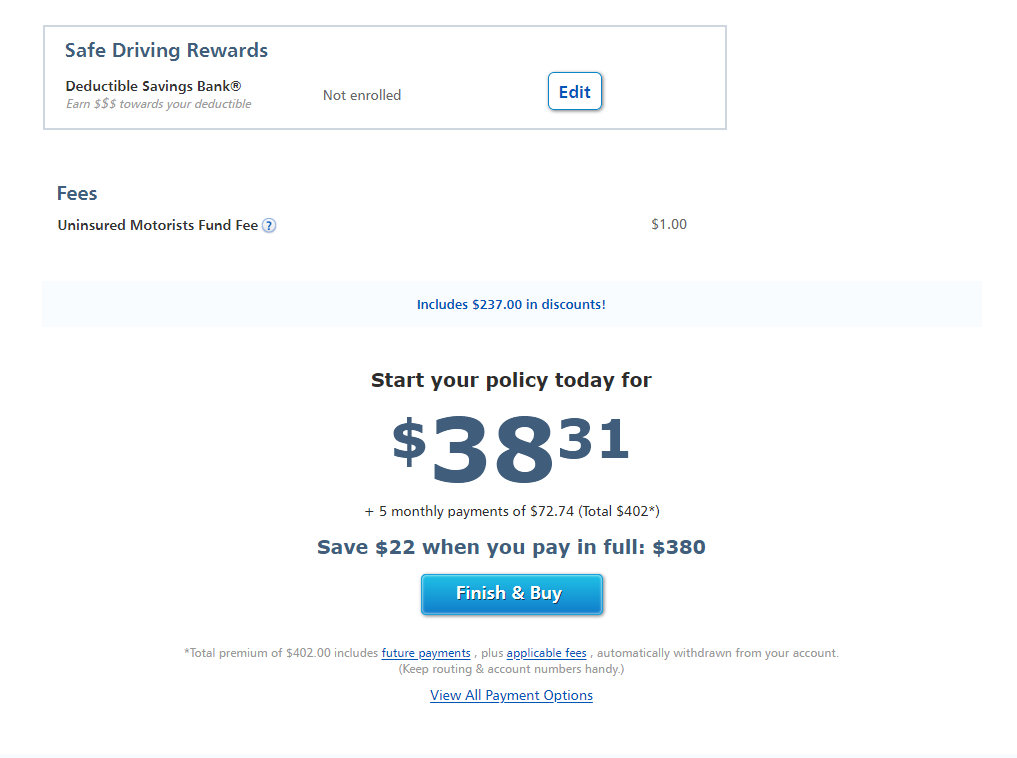

Below the “Start your policy today for”, you’ll see how much you’ll pay in the next five months with the total in parentheses.

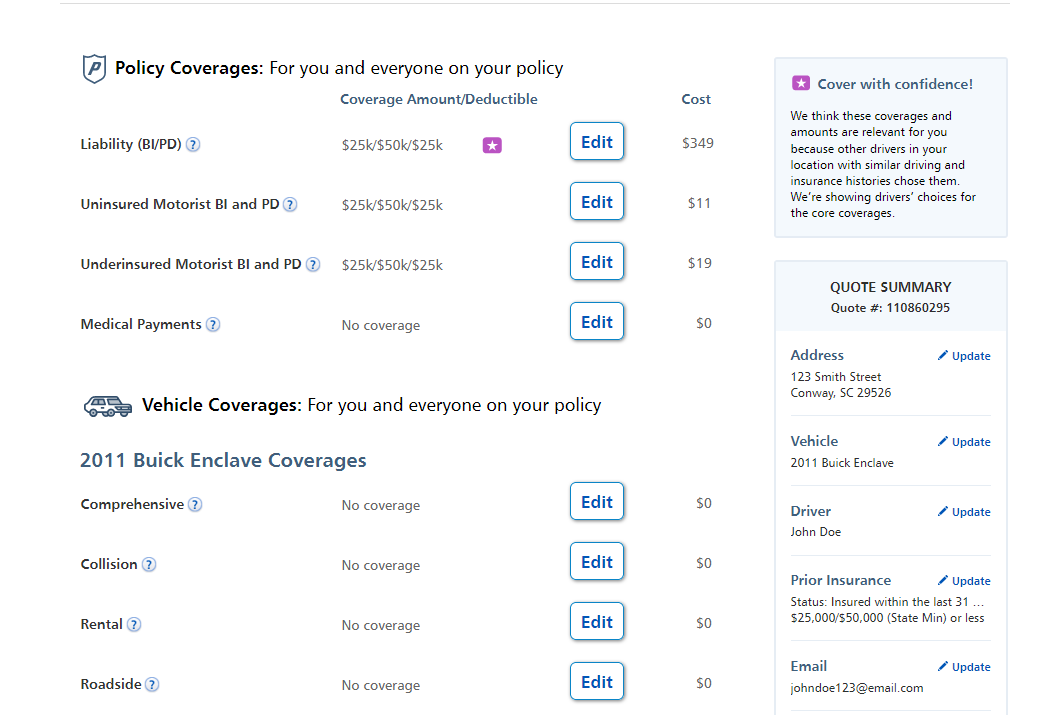

As you scroll through the quote webpage, you’ll see options to edit the type of coverages you need.

The information you entered the previous steps will be listed on the right.

If you’re satisfied with what you see, you can submit your information and click the “Finish & Buy” button at the bottom.

Progressive holds up to its promise of providing cheap car insurance rates as seen in the quoted price.

What’s the design of the website and app?

Website design can be a deterrent for customers. Slow wait times, too much text, and over-the-top interactivity on icons and text can frustrate web surfers, especially those who are searching for information.

Where does Progressive stand on website design? Before we talk about it, let’s take another look at Progressive’s introduction webpage.

Some answers can be difficult to find despite having an answers tab at the top of the webpage. The Progressive website has some complexity to it, which might deter or distract a visitor. For example, the search box is close to the bottom of the homepage. So finding an answer could be frustrating.

Is the design a plus or minus?

There are certain areas on the website that take you directly to what you’re looking for. The design may be user-friendly to some, but may not be to others. Giving users or visitors options to choose their specifics is helpful, but it would be equally helpful if they didn’t have to scroll through the page to locate the search bar.

How’s the mobile app?

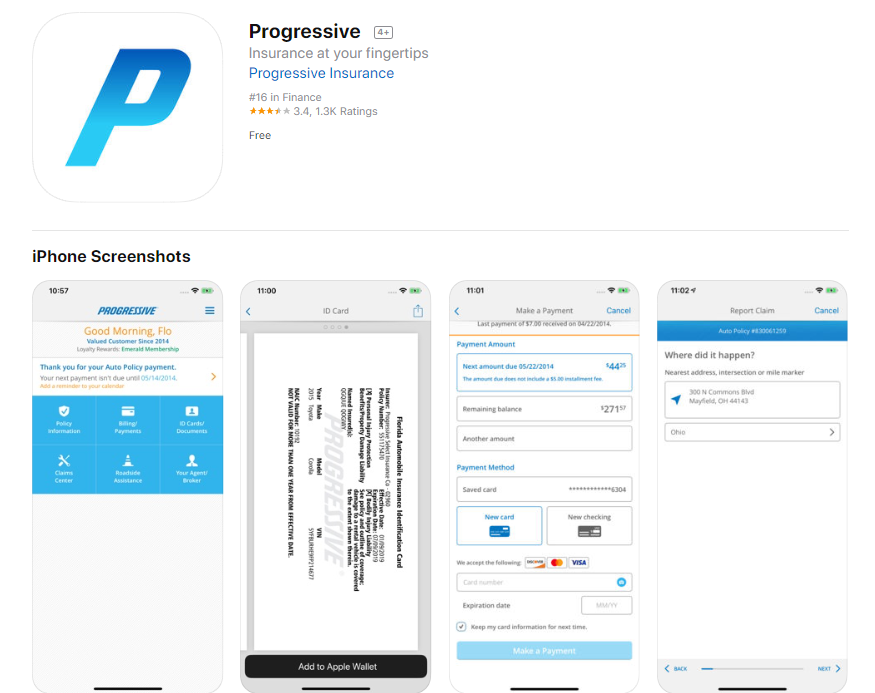

What’s it like for those who use Progressive’s mobile app? Here’s a screenshot of Progressive’s mobile app download and screenshots of the Progressive app on the iPhone.

How easily can you manage your account using just the app?

Mobile apps are built for the user’s convenience. Everything a policyholder could do on the internet can be done on the mobile app. You can make payments, make claims, and check your car insurance information.

Is the design a plus or minus?

The design is a plus for policyholders. Access to their policy information and payment information will allow them to view anything they need right away.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

What are Progressive car insurance pros and cons?

To be truly objective in our analysis of Progressive car insurance, we have to look at the pros and cons of the company. Customer reviews are subjective, and they vary for each individual.

Let’s review the pros and cons of Progressive based on facts we’ve seen thus far and what available for policyholders and potential customers.

| Progressive Car Insurance Pros | Progressive Car Insurance Cons |

|---|---|

| Discounts for teen and college student drivers | All states don't receive the same discounts |

| Policyholders have 24/7 access to customer service and claims | Higher than average rates for policyholders with poor or fair credit |

| Accurate quote processing | Below Average and Average J.D. Power ratings |

| Additional car insurance coverage for any situation | Snapshot app can increase rates if your driving is habits are risky. |

Although Progressive has several discounts that are helpful to its policyholders, they don’t offer discounts in all states. The discounts that are available to policyholders help save thousands per year. Progressive has below average to average ratings from financial and credit rating agencies, but they make up for it in there 24/7 claim service, which shows the company’s eagerness to improve in areas where they lack.

What’s the bottom line?

Progressive has earned its place among the top 10 insurance providers. Although the rates are more expensive than some car insurance companies, Progressive makes up for it through discounts and policy flexibility. We see that in the increasing premiums written and market share. The company’s commitment to customers and employees has given them a major boost.

Frequently Asked Questions

What is accident forgiveness? Does Progressive offer accident forgiveness?

Accident forgiveness is a feature where a car insurance company, such as Progressive, chooses not to raise rates after a policyholder has an accident. For policyholders in New Jersey, Progressive offers this option through their 135 Drive program. It provides a discount to those who have been with the company for over a year. To learn more or sign up, you can contact the 800 number for Progressive Insurance.

What is personal injury protection? Does Progressive provide it?

Personal injury protection (PIP) offers additional medical compensation following an accident. What sets PIP apart is its coverage of lost wages, mental health expenses, and other related medical costs. Progressive includes PIP in its offerings. Note that in some states, PIP is mandatory. For more details, contact American Strategic Insurance at 8664162003.

How long does high-risk driver status last?

Some high-risk drivers must obtain SR-22 car insurance, typically required for up to three years. Once this period ends, car insurance companies may no longer classify you as a high-risk driver, allowing you to re-enter the voluntary market. However, the decision to categorize you as high-risk rests with the insurance company. When looking for the best bundled insurance for seniors or the best motorhome insurance, ensure you review these classifications carefully.

How good is Progressive auto insurance?

Progressive is regarded as one of the leading auto insurance providers in the U.S., noted for its competitive rates, extensive coverage options, and numerous discounts. They offer innovative tools such as the Name Your Price tool and the Snapshot program, which can help customers manage and potentially lower their premiums. Customer service reviews are mixed, with some praising their claims process and others mentioning issues with customer support. For more details or to get a quote, call Progressive auto insurance. To explore options, visit the car insurance Progressive section on their website.

How long do accidents stay on your insurance?

Accidents usually stay on your insurance record for approximately three to five years, although this timeframe can differ depending on state regulations and the specific policies of the insurance company. With Progressive, most accidents typically affect your rate for about three years. If you need assistance or have any concerns regarding accidents on your record, it’s advisable to reach out to Progressive insurance company directly. Additionally, if you have any complaints against Progressive insurance, it’s important to address them directly with the company for resolution.

How much does defensive driving lower insurance with Progressive?

Considering defensive driving courses can lead to reduced insurance premiums. The exact discount varies by state and individual policy, typically falling between 5-10%. For specific information on discounts available in your area, it’s best to call Progressive car insurance directly. Additionally, while discussing your options, you can inquire about car insurance quotes from Progressive.

Do insurance companies drop you after a claim?

t’s uncommon for insurance providers to terminate policies after a single claim, yet the likelihood of non-renewal rises with multiple claims in a brief timeframe. Insurers like Progressive evaluate the comprehensive risk posed by a policyholder before deciding on renewal. Additionally, when obtaining a full coverage quote, Progressive’s Deductible Savings Bank may be considered, allowing policyholders to lower their deductible over time.

Does Progressive cover rental cars?

Yes, General Auto Insurance through Progressive includes an optional add-on for rental car reimbursement coverage. This feature assists in covering the expenses of a rental car during the repair period of your vehicle following a covered accident. For more information on this coverage and to obtain insurance quotes from Progressive, feel free to reach out.

Does Progressive have local agents?

Yes, Progressive partners with a network of local agents across the country. These independent agents can assist you in purchasing a policy, making changes, and answering questions about your coverage. If you’re interested in the Progressive 6-month package or need assistance with your policy, these agents are available to help. Additionally, if you require the Progressive address, they can provide you with that information as well.

Does the Progressive Snapshot monitor speed?

Yes, the Progressive Snapshot device and app can monitor your speed, along with other driving behaviors such as braking, acceleration, and time of day you drive. These metrics help determine your driving habits and can potentially lower your insurance rates if you demonstrate safe driving.

Does using roadside assistance increase premium with Progressive?

Using roadside assistance typically does not increase your premium with Progressive. However, excessive use of roadside assistance services may lead to a review of your policy and could potentially impact your rates.

Is Progressive Deductible Savings Bank worth it?

The Progressive Deductible Savings Bank can be worth it if you’re looking to lower your deductible over time. For each policy period you go without a claim, Progressive adds $50 to your Deductible Savings Bank, which can reduce your deductible amount in the event of a claim.

Is Progressive Direct legit?

Yes, Progressive Direct is a legitimate way to purchase insurance directly from Progressive, bypassing an agent. This can sometimes result in lower premiums due to reduced administrative costs.

Is Progressive home insurance good?

Progressive offers competitive home insurance policies with various coverage options. They are known for bundling discounts when you purchase both auto and home insurance. Customer reviews are mixed, so it’s a good idea to compare with other insurers and read specific reviews.

What does a Progressive policy number look like?

A Progressive policy number typically consists of a series of digits, sometimes separated by hyphens, and may include both numbers and letters. It usually looks something like this: 12345678-123456.

What is Progressive car insurance phone number?

The main customer service phone number for Progressive car insurance is 1-888-671-4405.

What is the 1-800 number to Progressive insurance?

The 1-800 number for Progressive insurance is 1-800-PROGRESSIVE (1-800-776-4737).

What is the address for Progressive auto insurance headquarters?

The headquarters for Progressive auto insurance is located at: 6300 Wilson Mills Road Mayfield Village, OH 44143

How does State Farm home insurance compare to Progressive home insurance?

When comparing State Farm and Progressive home insurance:

- State Farm: Known for excellent customer service and a wide range of coverage options. State Farm often receives high marks for customer satisfaction and financial stability.

- Progressive: Offers competitive rates and discounts, especially when bundling with auto insurance. Progressive may rely on third-party underwriters for some policies, which can affect service consistency.

Jabunn1987

Progressive refuses to change

KLA-169

You may not get your full refund.

Bio Or

progressive insurance review

fedoria7

DO NOT HONOR CLAIMS WILL DENY YOU INSTANTLY

FlyntRock78

Horrible customer service

Leah_p

The worst

RFK

Get lost Flo

Ace_1

This insurance [REDACTED WORD]

KobuSosho

Random charge after I already paid premium in full

Suegoo

Worst insurance company and customer service.