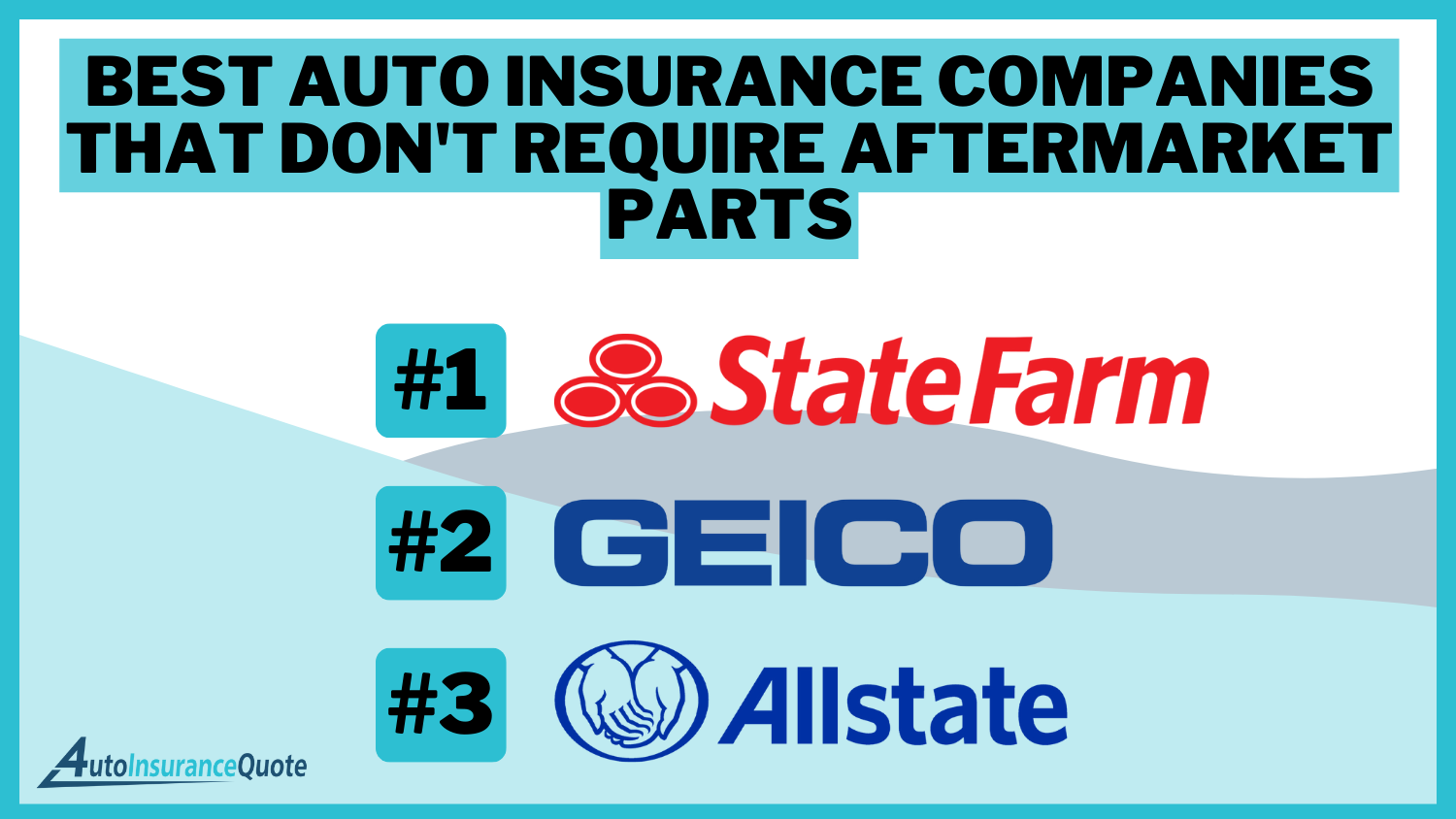

Best Auto Insurance Companies That Don’t Require Aftermarket Parts in 2026 (Top 10 Providers)

State Farm, Geico, and Allstate are the best auto insurance companies that don’t require aftermarket parts, offering comprehensive coverage with monthly rates starting at $66. These companies excel in customer satisfaction and provide OEM parts, ensuring your vehicle's performance and safety are maintained.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage Without Aftermarket Parts

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage Without Aftermarket Parts

A.M. Best Rating

Complaint Level

Pros & Cons

The best auto insurance companies that don’t require aftermarket parts are State Farm, Geico, and Allstate. These providers offer comprehensive coverage options, ensuring your vehicle is repaired with high-quality OEM parts.

Vehicle accidents are on the rise. If you’re in one and your car’s badly damaged, reach out to your auto insurer. They’ll assess the damage and give you a repair estimate.

Our Top 10 Picks: Best Auto Insurance Companies That Don’t Require Aftermarket Parts

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A++ Many Discounts State Farm

#2 15% A++ Cheap Rates Geico

#3 5% A+ Add-on Coverages Allstate

#4 10% A+ Online Convenience Progressive

#5 10% A+ Usage Discount Nationwide

#6 12% A Customizable Polices Liberty Mutual

#7 10% A++ Military Savings USAA

#8 7% A Local Agents Farmers

#9 8% A++ Accident Forgiveness Travelers

#10 10% A Student Savings American Family

Insurance providers cover losses and damages, but often limit costs through various methods. Your insurance provider can use aftermarket parts to repair your vehicle as one of these methods.

To avoid disappointment with non-OEM parts, learn about different types, check your insurance for OEM coverage, and choose insurers flexible with part selection.

- State Farm is the top pick for its broad range of discounts and coverage

- Focuses on companies providing OEM parts instead of aftermarket parts

- Highlights insurers like Geico and Allstate for specific coverage benefits

Auto Insurance Monthly Rates by Coverage Level & Providers That Don’t Require Aftermarket Parts

Insurance Company Minimum Coverage Full Coverage

Allstate $79 $198

American Family $74 $189

Farmers $78 $179

Geico $85 $176

Liberty Mutual $78 $205

Nationwide $90 $220

Progressive $66 $158

State Farm $86 $151

Travelers $75 $171

USAA $82 $215

For those seeking minimal coverage, Progressive offers the most affordable rate at $66, while Nationwide presents the highest at $90.

On the other hand, full coverage rates range significantly with State Farm offering the most economical option at $151, and Nationwide again on the higher end at $220.

This variance underscores the importance of considering both coverage needs and budget when selecting an auto insurance provider, especially for those prioritizing original equipment manufacturer (OEM) parts over aftermarket alternatives. See more details on our “Affordable Full Coverage Auto Insurance.”

More About Refurbished Parts for Auto Claims

Refurbished parts are one of the most popular car parts that insurance companies use for auto claims. These are previously used parts that have been reconditioned, renovated, and refined. Since they are the ones returned to their manufacturers, they undergo rigorous testing, repairs, and a certification process before being sold for use again.

Every manufacturer of car parts has its own refurbishment criteria for these parts. They ensure that the refurbished parts adhere to those criteria and can be used reliably in cars with auto insurance claims.

Refurbished parts are classified into three grades, even though they are reliable. Grade A consists of parts that look new and show no significant signs of wear. Grade B has parts that show signs of use, but they are minimal. However, Grade C parts display obvious signs of rough use. These grades determine the cost of the refurbished parts categorized under them.

Learn more: Can my auto insurance company use aftermarket parts to repair my vehicle?

OEM Parts for Vehicle Repair

Most policyholders prefer using Original Equipment Manufacturer (OEM) parts produced by automobile manufacturers for specific vehicles. Since OEM parts are replicas of the original parts of your car used during its assembly, they fit perfectly. See more details on How to insure aftermarket parts on your vehicle.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Car Insurance Companies That Cover OEM Parts

Not all car insurance companies offer coverage for OEM parts. A significant portion of them only cover refurbished parts or aftermarket parts.

Alternatively, some insurance companies may cover the cost of OEM parts only if the part is available in the different categories. Learn more on how to insure aftermarket parts on your vehicle.

Best Auto Insurance Companies That Don’t Force You to Use Refurbished Parts

While several auto insurance companies may offer OEM parts coverage as an add-on, here are the best auto insurance companies that don’t force you to use refurbished parts.

Allstate Insurance Company

Allstate Insurance Company allows its policyholders to choose between using aftermarket parts or OEM parts, according to the customer’s requirement. The company also charges no additional cost for the use of OEM products as part of its “customer choice” policy.

American Family Insurance

This insurance company provides OEM coverage as an add-on option. Having car insurance with American Family Insurance can help you get original parts for covered repairs in case of a car accident.

Geico

Geico is one of the companies with a separate and unique policy for OEM parts. The company claims that it will cover up to 80% of the cost of the OEM parts required to repair your car post-accident. However, as the policyholder, you are required to pay the difference.

Liberty Mutual Insurance

Liberty Mutual Insurance provides optional coverage to its policy customers, allowing them to replace damaged vehicle parts with ones that meet the highest quality requirements, including OEM parts.

However, if OEM parts are not available, the company provides you with an estimate for using aftermarket or refurbished parts.

Amica Mutual Insurance

If you have an auto insurance policy with Amica Mutual Insurance, they will automatically put you in touch with appraisers and affiliated auto repair shops. They can then potentially include OEM parts in your car repair as required.

Berkshire Hathaway Automotive

This company provides comprehensive coverage for OEM parts as it maintains a detailed inventory of high-quality and genuine OEM parts. You can contact their staff for further inquiries depending on your requirements.

State Farm Auto Insurance

If a car accident occurs, your insured vehicle may require parts replacement. If you have a policy with State Farm, they use non-original equipment manufactured (non-OEM) parts. However, they also use recycled, new, and OEM Surplus parts whenever needed.

State Farm offers a somewhat inclusive coverage for OEM surplus and recycled parts for vehicles. In addition, it offers coverage for non-OEM parts and also includes new aftermarket parts that are properly certified and meet the required standards approved by State Farm.

Apart from these companies, several others also provide coverage for OEM parts, refurbished, and aftermarket parts. Depending on your vehicle’s potential requirement, it gives you a wide range of policy options and does not force you to get refurbished parts for your car. However, if you exclusively want OEM parts, you need to be willing to pay additional costs. Unlock details in our “Best Affordable Auto Insurance Companies.”

Insurance Companies and Aftermarket Parts

As you take your car to the body shop to get it repaired after an accident, you need to ask your auto insurance company for fair compensation for repairs and replacement. Many policyholders do not know if their company uses OEM or aftermarket parts.

In some cases, once you submit your information to the company, you even lose control over all matters regarding repairs. Therefore, it is essential to know your insurance company’s process to request OEM parts.

Here are a few essential things you should know:

Company Responsibilities

There are no specific laws in several states that make it obligatory for insurance companies to use OEM parts during vehicle repairs. In 31 states, insurers must provide disclosures to customers regarding repair estimates and the use of aftermarket parts. Thirteen states require the quality of the aftermarket parts to be on par with OEM parts. The other six states require the vehicle owner’s consent for using non-OEM replacement parts.

Know Your Rights

If you do not want the mechanic to use aftermarket parts for your vehicle repair, you have the right to ask your insurance provider to use OEM parts. The parameters for sanctioning the use of OEM parts vary from company to company. If your insurance company deems the cost and use of OEM parts to be unreasonable, they might deny your claim. However, if the damage is significant and the part is critical, they might accept your request.

Learn more by reading our guide titled “Affordable Auto Insurance Companies With Great Customer Service.”

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Difference Between OEM Parts and Refurbished Parts

Repairing your vehicle after an accident is a challenge. No other parts can beat the performance and appeal of the original parts fitted during your car’s assembly. However, though several types of parts are used for repairs, some are preferred over others.

People mainly prefer using OEM parts to refurbished and aftermarket parts due to the following key reasons:

Impact on Vehicle Performance

Since aftermarket parts are made to fit every vehicle, they may not always be designed to fit your vehicle precisely and hence, may impact your vehicle’s performance. OEM parts are designed specifically to align with your vehicle’s performance and improve the efficiency of the car significantly.

Difference in Quality

The quality of aftermarket parts is comparatively lower than other parts as the original manufacturer does not make them. This will lead to greater wear and tear and more frequent replacement in the future.

Warranty

Aftermarket parts come without a warranty, similar to recycled and refurbished ones. On the other hand, OEM parts have the original warranty provided by manufacturers.

Check out insurance savings in our complete “Affordable Auto Insurance Companies That Don’t Lobby.”

The Final Word

As a car owner, you do not know when an accident may occur. Therefore, it is best to be prepared and choose from the best auto insurance companies one that will offer the best protection and coverage for your car. It is also advisable to conduct thorough research before purchasing insurance and choose one that provides extensive coverage for all different types of parts and does not force you to buy aftermarket parts.

Conclusion: Evaluating Insurance Options for Optimal Vehicle Repair and Satisfaction

When considering auto insurance options, particularly those prioritizing OEM parts over aftermarket alternatives, it is crucial to evaluate insurers carefully. Companies like State Farm, Geico, and Allstate lead the pack by offering comprehensive policies that accommodate the use of OEM parts, ensuring that repairs maintain the integrity and performance of your vehicle.

As vehicle owners, understanding the nuances of your insurance policy’s parts coverage can significantly impact both the quality of repairs and overall satisfaction with the service. Therefore, taking the time to compare various insurance providers, as well as the specifics of their coverage, can lead to substantial savings and better coverage outcomes.

Learn more: Can I choose where to get my vehicle repaired after an accident?

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

What are refurbished parts?

Refurbished parts are previously used car parts that have undergone reconditioning, repairs, and certification before being sold for use again. They are classified into grades based on their condition, ranging from Grade A (looking new with no significant signs of wear) to Grade C (displaying obvious signs of rough use).

For additional details, explore our comprehensive resource titled “Auto Insurance Discounts for Affordable Coverage.”

Do all car insurance companies cover OEM parts?

No, not all car insurance companies offer coverage for OEM parts. Some only cover refurbished or aftermarket parts. However, some insurance companies may provide coverage for OEM parts if they are available in their network.

Which auto insurance companies don’t force you to use refurbished parts?

Here are some of the best auto insurance companies that don’t force you to use refurbished parts:

- Allstate Insurance Company: Allows policyholders to choose between aftermarket parts and OEM parts at no additional cost.

- American Family Insurance: Offers OEM coverage as an add-on option.

- Geico: Covers up to 80% of the cost of OEM parts, with the policyholder responsible for the difference.

- Liberty Mutual Insurance: Provides optional coverage for OEM parts and offers estimates for aftermarket or refurbished parts if OEM parts are unavailable.

- Amica Mutual Insurance: Connects policyholders with appraisers and repair shops that can include OEM parts in the car repair process.

Selecting an auto insurance provider that offers flexibility in parts replacement can be crucial for maintaining your vehicle’s integrity and performance.

Can I request OEM parts from my insurance company?

Yes, as a car owner, you have the right to request OEM parts for your vehicle repairs. However, insurance companies may assess the cost and reasonableness of using OEM parts before approving the request. They might also consider the availability of OEM parts for specific vehicles.

What is the difference between OEM parts and refurbished parts?

OEM parts are original, and made by car manufacturers for your vehicle, ensuring a perfect fit. Refurbished parts, however, are used items that have been repaired. OEM parts are higher quality with a warranty, while refurbished parts vary in condition and may show wear.

To find out more, explore our guide titled “Auto Insurance Quotes by Vehicle.”

What is Geico’s OEM parts policy?

Geico’s OEM parts policy covers up to 80% of the cost for OEM parts needed in repairs, with the car owner responsible for the remaining cost.

Which insurance companies cover OEM parts?

Companies like State Farm, Allstate, and Geico offer policies that cover OEM parts, often as an optional add-on or under certain conditions.

What is Allstate’s OEM parts policy?

Allstate offers extensive add-on coverages that include the use of OEM parts, allowing customers to choose OEM over aftermarket parts for their vehicle repairs.

Does State Farm cover OEM parts?

Yes, State Farm provides coverage for OEM parts, integrating them as part of their policy options to meet the high standards and specifications of original vehicle manufacturing.

To learn more, explore our comprehensive resource on “How Vehicle Make and Model Affects Your Auto Insurance Rates.”

Can insurance force you to use used parts?

Insurance companies cannot force you to use used parts if you specify and pay for a policy that covers new or OEM parts, but standard policies might include clauses allowing the use of refurbished or aftermarket parts to manage repair costs.

Can an insurance company put used parts in my car?

Yes, an insurance company can use used parts for repairs unless your policy specifies that only new or OEM parts must be used.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

What services does A Affordable Auto Repair offer?

A Affordable Auto Repair offers a wide range of services including routine maintenance, major repairs, and diagnostics for all types of vehicles.

What can I expect from Affiliated Auto Salvage?

Affiliated Auto Salvage specializes in providing high-quality used auto parts from a vast inventory of salvaged vehicles, offering cost-effective solutions for car repairs.

Learn more by reading our guide titled “Understanding How Auto Insurance Works.”

Is Affordable Auto Body known for good service?

Affordable Auto Body is recognized for providing high-quality body repairs at competitive prices, focusing on excellent craftsmanship and customer satisfaction.

What makes an auto insurance policy affordable?

Affordable auto insurance typically includes competitive rates, multiple discount options, and flexible coverage plans that align with the driver’s budget and coverage needs.

Which is the best auto insurance out there?

Travelers is the best car insurance company for most drivers in 2024, based on extensive research from the MarketWatch Guides team. State Farm, which was this year’s runner-up, stands out for its exceptional customer service. Erie, which ranked third, offers the best liability coverage.

Who typically has the cheapest insurance?

The cheapest car insurance rate is $38 a month from Geico according to our research team’s cost analysis of national average prices for minimum coverage. The top 10 cheapest car insurance companies are Nationwide, Geico, State Farm, Travelers, Progressive, AAA, Allstate, Chubb, Farmers, and USAA.

Access comprehensive insights into our guide titled “Average Cost of Auto Insurance: Find Affordable Quotes.”

What is the most basic car insurance coverage?

Basic car insurance is a policy that only includes liability coverage. It helps cover the damage you may cause to other people and their property. That can include medical bills, repair or replacement of property, and legal fallout. Almost every state has minimum basic auto insurance limits for their drivers.

What is the most popular type of insurance?

The most common type of insurance is Auto Insurance. Auto insurance is designed to help protect you financially against vehicle damage and injury, depending on your coverage.

What month is insurance the cheapest?

The best time to get car insurance quotes is 20 to 26 days before you need the policy to start. Your renewal notice from your insurer will show the new price for next year (and the price you paid last year).

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.