Cheap Dodge Auto Insurance in 2025 (Lower Your Rates With These 10 Top Companies!)

Erie, American Family, and State Farm all offer cheap Dodge auto insurance. Our top pick, Erie, provides rates starting as low as $50 per month. Discover affordable Dodge auto insurance options that not only provide full coverage but also come with excellent benefits tailored for your Dodge below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

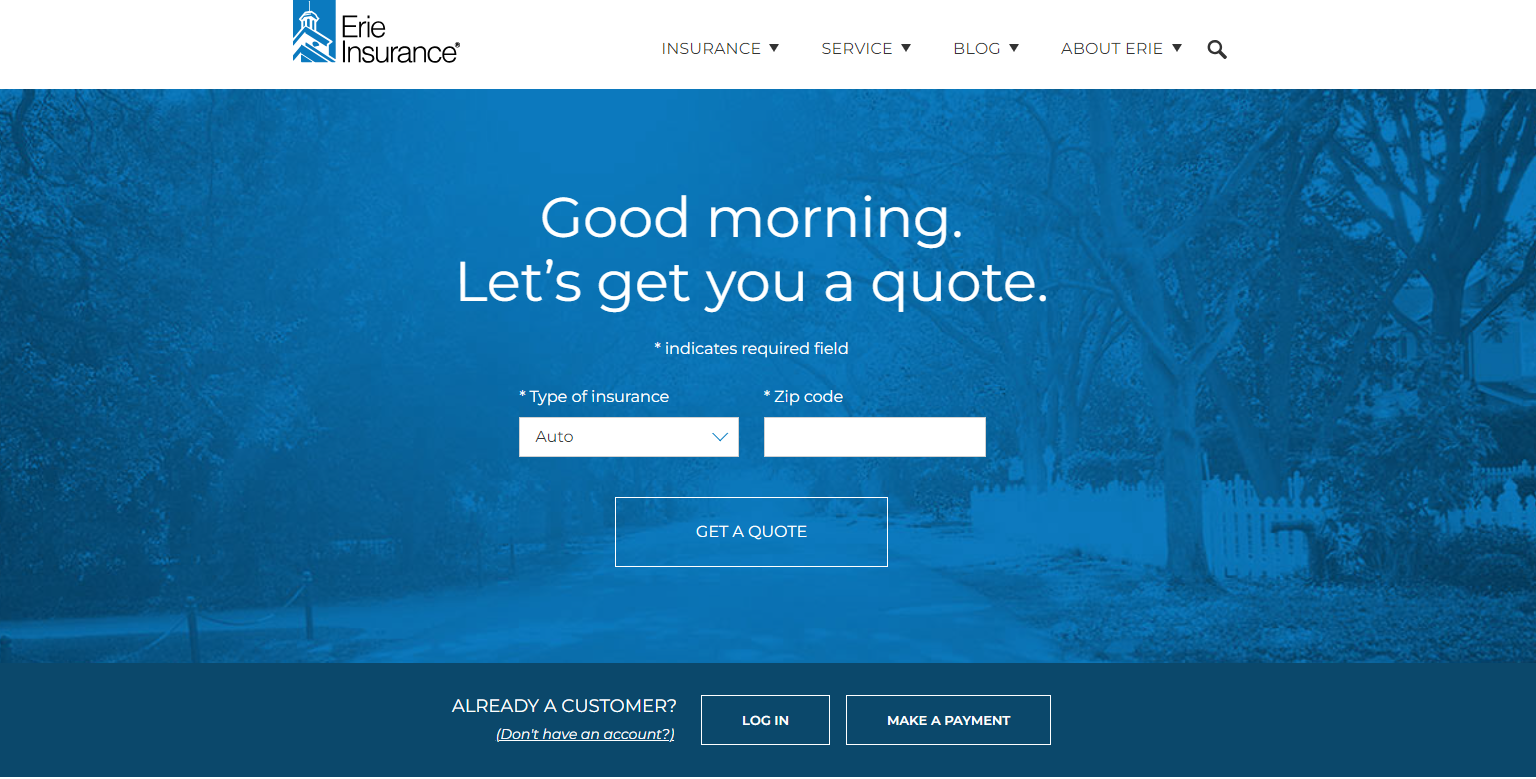

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage for Dodge

A.M. Best Rating

Complaint Level

Company Facts

Min. Coverage for Dodge

A.M. Best Rating

Complaint Level

Erie, American Family, and State Farm offer cheap Dodge auto insurance. On average, Dodge auto insurance typically costs around $1,956 annually or $163 each month.

When you find and compare Dodge quotes online, you’ll learn which companies offer the coverage you want at an affordable price. Doing so can help you avoid paying too much in monthly or annual auto insurance rates for Dodge insurance.

Our Top 10 Company Picks: Cheap Dodge Auto Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $50 A+ Affordable Rates Erie

#2 $55 A Discount Options American Family

#3 $58 B Consistent Savings State Farm

#4 $60 A+ Competitive Pricing Nationwide

#5 $62 A+ Usage-Based Discounts Progressive

#6 $65 A+ Extensive Discounts Allstate

#7 $67 A Flexible Plans Liberty Mutual

#8 $69 A++ Comprehensive Coverage Travelers

#9 $70 A Bundle Savings Farmers

#10 $73 A High-Risk Friendly The General

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code above to find the most affordable instant auto insurance quotes in your area.

#1 – Erie: Top Pick Overall

Pros

- Affordable Rates: Erie is known for offering competitive pricing. Dive into our in-depth Erie auto insurance review to find the best policy for your needs.

- New Car Replacement: Erie offers a replacement with the same make and model within the first two years if your new car is totaled.

- Rate Lock: Helps you budget more predictably by locking in your rate, which doesn’t change unless you add or remove a vehicle or driver from your policy.

Cons

- High Rates for Bad Credit: Drivers with poor credit scores may find Erie’s rates higher than average.

- No Usage-Based Insurance: Erie does not offer a pay-as-you-drive option, limiting flexibility for low-mileage drivers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#2 – American Family: Best for Discount Options

Pros

- Extensive Discount Opportunities: American Family provides more discounts than many other insurers. Find out more about American Family in our American Family review.

- Telematics Program Options: Offers two telematics programs for those looking to reduce costs through safe driving.

- Rideshare Coverage Available: Lyft and Uber drivers can secure rideshare insurance for added protection.

Cons

- Low Customer Ratings: Poor customer reviews on BBB and Trustpilot indicate dissatisfaction with service.

- Average Collision Repair Score: Received only a C+ from collision repair professionals.

#3 – State Farm: Best for Consistent Savings

Pros

- Consistent Savings: State Farm offers a range of discounts and savings opportunities.

- High Customer Satisfaction: Consistently top-rated for buying auto insurance, according to J.D. Power. Wondering about their level of customer service? Find out in our State Farm Company Review.

- Generous Rental Coverage: Comprehensive rental car and travel expense coverage included.

Cons

- No Gap Insurance: State Farm does not offer gap insurance, which is essential for covering the difference between your car’s value and loan balance if totaled.

- No Accident Forgiveness: State Farm does not provide accident forgiveness.

#4 – Nationwide: Best for Competitive Pricing

Pros

- Competitive Pricing: Nationwide offers affordable rates and various discounts. Explore more discount options in our Nationwide auto insurance review.

- Competitive Rates for Risky Drivers: Provides affordable options for motorists with less-than-perfect driving records.

- Diverse Product Options: There is an Extensive selection of policies, allowing customers to bundle multiple products and enjoy comprehensive coverage from a single provider.

Cons

- Low Customer Satisfaction: Nationwide’s auto insurance has below-average satisfaction scores in recent J.D. Power studies, indicating room for improvement.

- Higher Premiums: Nationwide’s insurance rates tend to be above the industry average, making it less affordable for some drivers.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#5 – Progressive: Best for User-Based Discounts

Pros

- Usage-Based Discounts: Progressive offers significant savings through their Snapshot program, which rewards safe driving habits with lower premiums.

- Vanishing Deductibles: Deductibles decrease over time with safe driving, potentially saving you money on future claims. Our complete Progressive auto insurance review goes over this in more detail.

- Rideshare Coverage: Progressive provides coverage for rideshare drivers, protecting them while they work for companies like Uber or Lyft.

Cons

- High Rates for Some Drivers: Rates for senior drivers and adding teens to a policy are only average.

- Below Average Satisfaction: Received low ratings for car insurance shopping and claims satisfaction from J.D. Power.

#6 – Allstate: Best for Extensive Discounts

Pros

- Extensive Discounts: Allstate offers a wide range of discounts.

- Rideshare Insurance: Allstate provides coverage for drivers who work for services like Uber and Lyft.

- Usage-Based Insurance: Allstate offers flexible options with usage-based and pay-per-mile insurance programs to help you save. Read more about this provider in our Allstate auto insurance review.

Cons

- Below Average Customer Satisfaction: Allstate’s customer ratings for auto insurance shopping satisfaction are lower than those of many competitors.

- Costly for High-Mileage Drivers: Allstate’s premiums tend to be higher for those who drive a lot, making it expensive for high-mileage drivers.

#7 – Liberty Mutual: Best for Flexible Plans

Pros

- Flexible Plans: Liberty Mutual offers customizable insurance plans. To see monthly premiums and honest rankings, read our Liberty Mutual auto insurance review.

- Excellent BBB Ratings: Liberty Mutual has high ratings from the Better Business Bureau.

- Numerous Discounts Available: Provides a wide range of discounts.

Cons

- Average Customer Satisfaction: Liberty Mutual’s customer satisfaction ratings are average compared to other insurers.

- Middling Claims Process: The claims process has received mixed reviews.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

#8 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Travelers provides extensive coverage options, including accident forgiveness and new car replacement.

- Multiple Discounts: Several discounts are available for good students and responsible drivers.

- Roadside Assistance: Offers roadside assistance coverage for emergencies. Read more in our detailed Travelers auto insurance review.

Cons

- Higher Premiums: Travelers often has higher premiums compared to other insurers.

- Mixed Customer Reviews: The company has received lower-than-average ratings from customers on platforms like the BBB.

#9 – Farmers: Best for Bundle Savings

Pros

- Bundle Savings: Farmers offers substantial discounts for customers who bundle their auto insurance with other policies, such as home or life insurance.

- Online Policy Management: You can easily purchase policies and file claims online for convenience. Take a look at our Farmers auto insurance review to learn more.

- Highly-Rated Mobile App: The Farmers mobile app is well-reviewed, offering a user-friendly experience for managing insurance needs.

Cons

- Limited Digital Service: Farmers scores lower than average for digital services, impacting online customer experience.

- Higher Premiums: Premium costs can be higher than the national average in several states.

#10 – The General: High-Risk Friendly

Pros

- Accepts High-Risk Drivers: The General specializes in providing coverage for drivers with poor records or high-risk profiles.

- Discount Opportunities: Offers multiple discounts, including for safe driving, multi-vehicle policies, and homeowners.

- Flexible Coverage Options: Provides various coverage options tailored to meet diverse needs and requirements.

Cons

- Slow Claims Process: Policyholders often report delays and inefficiencies when filing and processing claims.

- Limited Policy Communication: Customers frequently experience poor communication regarding policy details and claim statuses.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Types of Auto Insurance for Dodges

What type of auto insurance do I need for my Dodge? All states except New Hampshire and Virginia require Dodge owners to purchase the following liability auto insurance:

- Property Damage Liability: Property damage liability insurance covers you if you cause an accident and damage someone’s vehicle or other personal property. Most states require property damage liability.

- Bodily Injury Liability: Bodily injury liability covers you if you cause an accident and one or more people are injured. Most states require bodily injury liability coverage.

Your state mandates how much liability coverage you need. In addition, some states require more auto insurance coverage, such as:

- Uninsured/Underinsured Motorist Coverage: If another driver causes an accident but does not carry proper insurance, uninsured/underinsured motorist coverage allows your insurance company to pay for the damage someone else caused to your vehicle.

- Medical Payments (MedPay): MedPay helps with medical bills like visits to the doctor and hospital stays.

- Personal Injury Protection: PIP coverage helps with medical bills, lost wages, and funeral costs associated with a covered accident.

If you drive a Dodge, you need auto insurance. The type of auto insurance coverage you need for your Dodge depends on where you live.

Dodge Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $65 $160

American Family $55 $140

Erie $50 $130

Farmers $70 $170

Liberty Mutual $67 $160

Nationwide $60 $150

Progressive $62 $150

State Farm $58 $140

The General $73 $170

Travelers $69 $160

Check with your state’s Department of Motor Vehicles (DMV) to learn more about the types and amounts of auto insurance coverage you need for your Dodge.

Getting Full Coverage for Your Dodge

Along with minimum coverage or liability-only policy, Dodge drivers can purchase additional coverage to create a full coverage policy.

With full coverage auto insurance, your Dodge has coverage even if you cause an accident.Jeff Root Licensed Insurance Agent

For a full coverage policy, you will need the following insurance:

- Collision: Collision insurance pays for damage to your vehicle if you cause an accident. Collision will cover your Dodge up to its actual cash value (ACV).

- Comprehensive: Comprehensive insurance pays for damage to your vehicle caused by theft, vandalism, wild animals, or inclement weather.

You may need full coverage if your Dodge is new or an expensive model, or if you owe money on a loan or lease. In addition, full coverage can help with peace of mind whenever you’re on the road. You can learn more about what is included with full coverage car insurance here.

Finding the Best Dodge Auto Insurance

How can I find the best auto insurance coverage for my Dodge? Your auto insurance rates for a Dodge will depend on several variables. One important factor is the model of Dodge you drive.

The average insurance cost for a Dodge Ram is $1,928 annually or $161 each month. On the other hand, Dodge Durango auto insurance costs around $1,509 annually or $126 per month. If you drive a Dodge Challenger, your insurance will cost around $1,567 annually or $131 per month, and Dodge Charger insurance costs are typically around $2,077 annually or $173 each month.

This table compares auto insurance rates for various Dodge models, such as the Charger, Ram 3500, and Viper. Analyzing this data provides valuable insights into comparative insurance costs for Dodge owners and potential buyers.

Dodge Auto Insurance Cost by Model| Auto Insurance Rates for Your Dodge Model |

|---|

| Dodge Charger |

| Dodge Ram 3500 |

| Dodge Viper |

Auto insurance rates for your Dodge model can vary significantly based on the specific model you own. Factors such as the car’s safety features, engine size, and repair costs are crucial in determining your auto insurance premiums.

Discounts on Dodge Auto Insurance

You may qualify for auto insurance discounts. Some of the most popular auto insurance discounts include:

- Good student

- Defensive driver

- Safety features

- New car

- Affiliations

- Paid-in-full

- Multi-car

- Multi-policy

Check out this table highlighting the discounts offered by our top auto insurance companies.

Speak with a representative from any company you’re considering to learn whether you qualify for discounts on your Dodge auto insurance. Discounts on auto insurance can help you save up to 25% on your monthly or annual rates.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

How to Save on Dodge Auto Insurance

How can I save money on Dodge Auto insurance? Aside from pursuing discounts, you may be able to save money on your Dodge auto insurance by doing the following:

- Combine insurance policies to save money on Dodge auto insurance rates

- Increase your Dodge auto insurance deductible

- Keep a clean driving record

- Maintain a low annual mileage

As you search for the best auto insurance policy, don’t forget to find and compare auto insurance quotes for Dodge auto insurance.

Although you can shop for insurance by yourself, having an expert on your side provides you with:

· Personalized service

· Options

· The knowledge of an industry pro

· Someone who looks out for your best interests—and your budget pic.twitter.com/Nma9DYdppz— Erie Insurance (@erie_insurance) December 8, 2023

Comparing quotes can help you save money as you learn more about the companies that offer the coverage you want at the right price. In addition, comparing quotes can help you avoid overpaying for monthly or annual auto insurance rates.

Instantly Buy Affordable Dodge Car Insurance Coverage Near You

Owning and driving a Dodge means you need auto insurance. You can purchase minimum coverage or pursue full coverage for additional protection when you’re on the road. You may have to purchase full coverage if you have a loan or lease on your Dodge.

Dodge auto insurance rates vary for many reasons. One major factor in determining auto insurance rates is the model of Dodge you drive.

Remember to research cheap Dodge auto insurance rates for your model and year to determine what you’ll likely pay for your coverage.

You can pursue discounts, bundle your policies, and increase your deductible to save money on your Dodge auto insurance coverage. Remember to compare Dodge auto insurance quotes from several insurance companies to avoid paying too much for your Dodge coverage. Use our free comparison tool below to see what auto insurance quotes look like in your area.

Frequently Asked Questions

How much does insurance for a Dodge Ram 1500 cost?

A 2019 Dodge Ram 1500 costs around $126 per month to insure. If you own an older model, your monthly or annual rates will likely be lower. Learn how to find your car make and model in our guide.

Are Dodges expensive to insure?

Dodge auto insurance typically costs around $1,956 annually or $163 each month on average. Still, if you’re shopping for auto insurance for a Dodge, your rates will vary based on age, gender, marital status, ZIP code, driving history, credit score, and more.

Will it be expensive to insure a Dodge Ram?

The average insurance cost for a Dodge Ram is $1,928 annually or $161 each month. You can find auto insurance quotes online, compare rates, and discover the most affordable coverage in your area.

Am I going to pay a lot for insurance on a Dodge Charger?

A Dodge Charger is one of the more expensive Dodge models to insure. Dodge Charger insurance typically costs around ranges from $12 to $116 each month.

How can I save money on Dodge auto insurance?

You can save money on Dodge auto insurance by pursuing discounts offered by insurance companies, bundling your policies, increasing your deductible, and comparing quotes from multiple providers.

Are dodge challengers expensive to insure?

Yes, Dodge Challenger insurance rates are typically higher than average. This is due to the car’s high performance and higher risk of theft and accidents.

Why is auto insurance so high for a Dodge Challenger?

Because Dodge Challengers are one of the more expensive Dodges to buy, Dodge insurance companies would have to pay more in claims for repairs or replacement. Read more: How do auto insurance claims work?

What is the average insurance cost for Dodge Charger?

The average insurance cost for a Dodge Charger ranges from $12 to $116 per month. This can vary based on factors such as driving history, location, and coverage options. For the best rate, compare quotes from multiple providers.

What is the average Dodge Durango insurance cost?

The average Dodge Durango insurance rates are $139 per month. This gives an annual cost of approximately $1,668.

How much does it cost to insure a Dodge Challenger?

The Dodge Challenger average insurance cost is $270 per month. This rate can vary based on your location and driving record. To find the best rate, comparing quotes from multiple insurers is advisable.

How much is insurance on a Dodge Viper?

The average Dodge Viper insurance cost is $170 a month, or $2040 a year. Rates can vary based on factors such as your driving record, location, and coverage options. Comparing quotes from different providers can help you find the best rate for your Dodge Viper. Find out how your driving experience affects auto insurance rates.

Is a Dodge Charger expensive to insure?

Yes, a Dodge Charger can be expensive to insure due to its high performance and powerful engine. The dodge insurance cost varies based on factors like the driver’s age and driving history. Typically, sports cars like the Dodge Charger have higher insurance rates compared to sedans and SUVs.

What is the average insurance for Dodge Ram 1500?

The average dodge ram 1500 insurance cost is about $1,743 per year, which breaks down to approximately $145 per month. Comparing quotes from different providers can help you find the best deal. Make sure you choose adequate coverage to meet your needs.

Which insurance company offers the cheapest insurance for Dodge Charger?

The cheapest dodge charger insurance is around $2,555 per year, which averages to approximately $213 per month. This is the lowest rate found among major insurers.

How much does Dodge Challenger insurance cost monthly?

The Dodge Challenger monthly insurance cost averages $270. This makes the Dodge Challenger one of the most expensive vehicles to insure. If you want detailed information on Dodge Challenger monthly insurance, consult various insurers for precise quotes.

Which company offers the cheapest Dodge car insurance?

Erie, American Family, and State Farm are known for offering the cheapest Dodge auto insurance. They provide competitive rates for Dodge vehicles. Check with these companies for the best deals on Dodge auto insurance.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.